Project Development Stage

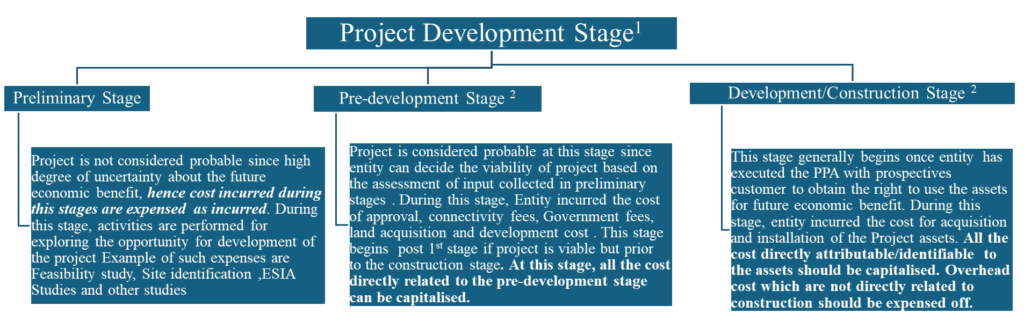

Usually, the project development activities pass through the three stages. During this period cost is incurred for construction or development of power plant. The following is the summary of all the three stage and treatment of cost incurred under each stage

1.Refer the appendices for illustrative list of expenses and its treatment during all the three stage of project life cycle.

2.All the General and administrative cost and overhead cost should be expenses off unless specifically identified and deemed necessary for completion of the project regardless of those incurred internally or outsourced to a third parties. Those cost include all costs (including payroll and payroll benefit cost) of support functions, which include executive management, corporate accounting, administrative, marketing, HR and information systems.

Capitalisation Policy

The capitalisation for projects assets basically outlies the criteria for determining the project cost that can be capitalised , rather than expensed immediately. The projects assets of power generation companies mainly include the Power plant, transmission line, substation, electrical installation , land and building. The below is the policy pertaining to capitalisation of each cost.

A. Direct Costs: These are the costs which are directly attributable to the project assets such as material and supplies cost, erection/commissioning cost, transportation, engineering cost, development cost, approval cost, GO cost and other overhead cost directly related to the project will be capitalised which subject to adherence to applicable Accounting Standard ( Refer appendices for Accounting Standard)

B. Indirect Costs: These are the general overhead and administrative cost will be expensed as incurred unless specifically identified and deemed necessary for the projects` completion. Further, employee cost of the groups which is directly pertaining to the specific projects will be capitlised.

C. Interest cost: Theses are the costs incurred during the construction or development of a project may be capitalised if they meet the specific criteria specified in applicable Accounting Standard. (Refer appendices for Accounting Standard)

Note: Cost incurred during operating phase of asset for replacement of PPE or enhancement of PPE can be capitalised when they increase the life of assets or increase the economic benefit or efficiency of the asset, otherwise, they should be expensed as incurred.

Impairment of Project during construction

During the pre-development or development stage, if project is no longer probable, the capitalized cost related to project should be impaired or write off and entity need to determine whether the asset will be sold, abandoned or held and used.

The impairment is equal to fair market value minus cost of assets.

Usually, fair value of cost incurred before construction or development stage is Zero except for Land and Plant machinery.

Capitalization Period

The capitalization of project cost start post completion of the preliminary stage once there is a probability1 that project will be constructed and ceased to be capitalized when the project is ready for its intended use(i.e till the date of commissioning for its intended use)

At preliminary stage, the project is not considered probable of being constructed. Accordingly, given the high degree of uncertainty about the future economic benefits, costs incurred during this stage are expensed as incurred.

During the preliminary stage, activities are performed exploring the opportunities for acquisition or construction of property, plant, and equipment. An entity may conduct feasibility studies and other activities related to asset selection. Some examples of other costs that may be incurred during this stage include those related to surveying, engineering studies, design layouts, WRA and ESIA studies, and obtaining management’s approval to move forward with a particular capital project.

Note: In assessing probability, the entity should consider whether (1) management, having the requisite authority, has implicitly or explicitly authorized and committed to funding the acquisition or construction of a specific asset, (2) the financial resources are available consistent with such authorization, and (3) the ability exists to meet the necessary local and other governmental regulations.

Extract of Accounting Standard on PPE ( IND AS 16/IAS 16)

An item of property, plant and equipment that qualifies for recognition1 as an asset shall be measured at its cost.

The cost of an item of property, plant and equipment comprises:

(a) its purchase price, including import duties and non-refundable purchase taxes, after deducting trade discounts and rebates.

(b) any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

(c) the initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located, the obligation for which an entity incurs either when the item is acquired or as a consequence of having used the item during a particular period for purposes other than to produce inventories during that period.

•Examples of directly attributable costs are:

(a) costs of employee benefits (as defined in Ind AS 19 Employee Benefits) arising directly from the construction or acquisition of the item of property, plant and equipment;

(b) costs of site preparation;

(c) initial delivery and handling costs;

(d) installation and assembly costs;

(e) costs of testing whether the asset is functioning properly, after deducting the net proceeds from selling any items produced while bringing the asset to that location and condition (such as samples produced when testing equipment); and

(f) professional fees.

Note: The cost of an item of property, plant and equipment shall be recognized as an asset if, and only if:

(a) it is probable that future economic benefits associated with the item will flow to the entity; and

(b) the cost of the item can be measured reliably.

Extract of Accounting Standard on Borrowing cost Capitalization( IND AS 23)

•Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset1 should be capitalized as part of the cost of that asset. The amount of borrowing costs eligible for capitalization should be determined in accordance with this Standard. Other borrowing costs should be recognized as an expense in the period in which they are incurred.

The capitalization of borrowing costs as part of the cost of a qualifying asset should commence when all the following conditions are satisfied:

(a)expenditure for the acquisition, construction or production of a qualifying asset is being incurred;

(b) borrowing costs are being incurred; and

(c) activities that are necessary to prepare the asset for its intended use or sale are in progress.

Capitalization of borrowing costs should cease when substantially all the activities necessary to prepare the qualifying asset for its intended use or sale are complete.

As per Para 20 of IND AS, an entity shall suspend capitalization of borrowing cost during extended period in which it suspends active development of a qualifying assets.

Note: A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its intended use.

Illustrative List of expenses and its treatment during project life cycle

| Type of cost | Preliminary | Pre-Development | Development | Remarks/Comment/Consideration |

| Construction labor and other direct costs of construction | Expense | Capitalize | Capitalize | Labor and related direct costs should be expensed until the project is probable. |

| Consulting fees | Expense | It depends | It depends | Fees should be expensed until the project is probable. Once the project is probable, directly identifiable costs should be capitalized. The amount capitalized is limited to those amounts directly related to the site and project selected (e.g., costs related to evaluation of potential projects or locations should be expensed). |

| Feasibility studies/Due dilligence fees | Expense | It depends | It depends | See discussion under “Consulting fees.” |

| Legal fees | Expense | It depends | It depends | See discussion under “Consulting fees.” |

| Engineering, procurement, and construction contract costs | Expense | Capitalize | Capitalize | Direct costs of construction should be capitalized. Other costs should also be capitalized as part of the direct costs of construction if the amounts are considered an incremental direct cost. |

| Interest/Finance costs | Expense | It dependes | Capitalize | Interest costs should be capitalized in accordance with IND AS 23 |

| Land | Capitalize | Capitalize | Capitalize | Capitalised since separate identifiable assets |

| Materials and supplies | It depends | Capitalize | Capitalize | Materials and supplies should be expensed during the preliminary stage unless they have an alternative use |

| Operating contract negotiation (e.g., fuel supply agreements, power sales agreements, operating and maintenance agreements) | Expense | Expense | Expense | Contract negotiation costs should be expensed. Although the project may not be viable without operating contracts (e.g., a signed power sales agreement is a prerequisite for financing), these contracts are not directly related to or necessary for construction of the asset itself. |

| Overhead, including rent, depreciation, and support functions (executive management, accounting, purchasing, corporate legal, human resources, and information systems) | Expense | Expense | Generally expense | General and administrative and overhead costs should be charged to expense as incurred,unless specifically identified and deemed necessary for the projects` completion. |

| Outsourced administrative functions (e.g., accounting, purchases, and payables) | Expense | Expense | Generally expense | General and administrative and overhead costs should be charged to expense as incurred, even if the costs are incurred by a third party on behalf of the reporting entity. |

| Recruitment and training cost | Expense | Expense | Expense | |

| Salaries—developers, legal counsel, and other personnel working directly on the project | Expense | It depends | It depends | All payroll and payroll-related costs should be expensed until the project is probable. Once the project is probable, directly identifiable payroll and payroll-related costs should be capitalized. The amount capitalized should be limited to those amounts directly related to the site and project selected (e.g., costs related to evaluation of potential projects or locations should be expensed). |

| Salaries—support functions | Expense | Expense | Generally expense | General and administrative costs should be expensed as incurred, unless specifically identified and deemed necessary for the projects` completion. |

| Site permit and license fees | Expense | Capitalize | Capitalize | Site permit and related fees are a direct cost of construction and should be capitalized once construction is probable. |

| Site security costs | Expense | Capitalize | Capitalize | Site security costs are a direct cost of construction and should be capitalized once construction is probable. Amounts capitalized should be limited to incremental security costs. |

| Travel expenses—internal and third party | Expense | It depends | It depends | Cost should be expensed until the project is probable. Once the project is probable, directly identifiable costs should be capitalized. |