Monthly GST & Income-Tax Due Dates Calendar (India Compliance Calendar)

Last updated: Automatically refreshed for latest statutory deadlines

Never miss an important tax deadline again. This Indian Tax Due Dates Calendar brings all major compliance dates together in one place, including GST returns, Income-tax filings, TDS payments, advance tax instalments, PF and ESIC obligations. Instead of checking multiple portals or notifications, you can quickly view upcoming statutory due dates month-wise and plan your compliance work in advance. The calendar helps professionals, businesses, accountants and students stay organised and avoid interest, late fees and penalties caused by missed filings. Use it as a daily reference during return season or as a monthly planner for regular compliance tracking. The list is structured for quick scanning so you can immediately know what is due next. Keeping track of deadlines becomes simple, predictable and stress-free, ensuring you remain compliant throughout the financial year without last-minute rush or confusion.

When you’re done, explore our free tax tools, read practical articles & guides, and bookmark the resources hub for checklists and templates.

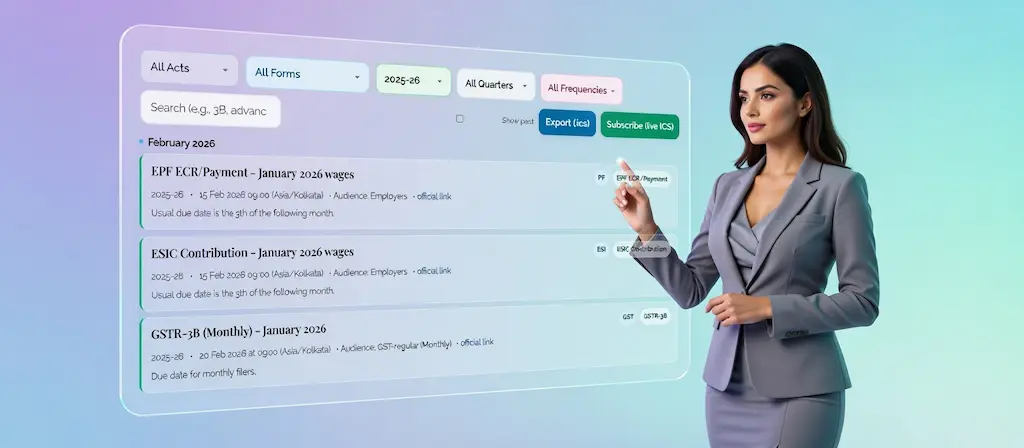

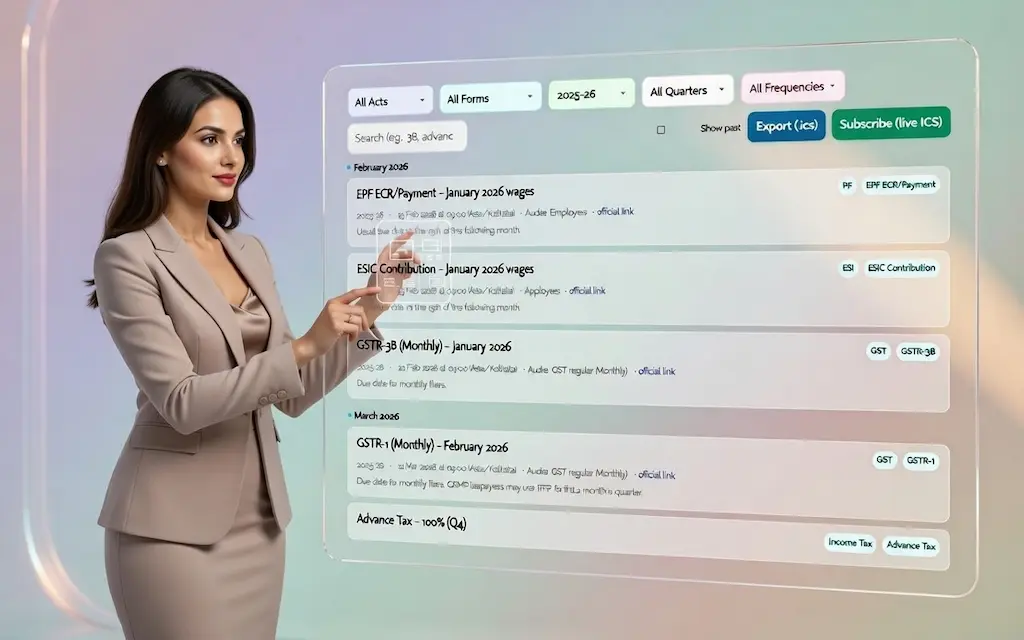

Tip: Filter the list above (e.g., GST only) and click Subscribe (live ICS) to get a personalised feed that auto-updates.

Disclaimer: Dates may shift via official notifications; please verify on GST/IT portals.

How to Use the Tax Due Dates Calendar

- Filter smartly: Choose the Act (GST, Income-tax, PF, ESIC) and Form (e.g., GSTR-3B, GSTR-1, 27EQ).

- Search faster: Type terms like “advance tax”, “GSTR-1”, “TDS return”, or “PF contribution”.

- Switch FY or quarter: View a full financial year or narrow to a quarter when planning workloads.

- Show past (optional): Turn it on for audit/closure work; keep it off to focus on what’s next.

- Add reminders: Click Export (.ics) for a one-time import, or Subscribe (live ICS) to auto-update in Google, Apple or Outlook.

- Open official links: Where provided, click the “official link” on an item to verify the date and fine print.

What’s Covered: GST Due Dates & Income-Tax Due Dates

GST

- GSTR-1 and GSTR-3B (Monthly / QRMP), CMP-08, and relevant annual forms where applicable.

- Audience notes (Regular/QRMP/Composition) are shown to help avoid filing the wrong return.

Income-tax

- Advance Tax instalments, plus TDS/TCS payment and return due dates.

- Hints for quarterly statements (24Q/26Q/27Q) and TCS 27EQ filing windows.

PF & ESIC

- Monthly contribution deadlines for employers, with typical “15th of the month” guidance and notes where holidays may shift the date.

This Tax Due Dates Calendar is maintained so older years remain accessible for reference and reconciliations—handy during audits and year-end close.

Who Should Use This

- SME owners & finance leads: See everything due in one view; plan cash outflows for taxes and payroll-linked dues.

- Accountants & CAs: Create client-specific filters, subscribe via ICS, and keep teammates aligned without manual reminder lists.

- Founders & freelancers: Track just the forms that apply to you (e.g., Advance Tax + TDS) without wading through the entire compliance universe.

Tips & Good Practice (to avoid late fees)

- QRMP users: GSTR-3B is quarterly; upload GSTR-1 details monthly via IFF for the first two months of each quarter.

- Plan ahead: Bank cut-off times and public holidays still matter—schedule payments a day early to be safe.

- Use ICS—not screenshots: The live ICS feed keeps your calendar current if a date moves.

- One calendar, many people: Share the subscribed calendar with your team so everyone sees the same deadlines.

- Document everything: For notices or extensions, store PDFs/links in your internal drive and add a note against the event in your calendar.

Need more practical utilities? Explore our complete tax tools directory on ToolSuite for calculators, planners and compliance helpers in one place.

You May Also Like

FAQs

What’s the difference between Export (.ics) and Subscribe (live ICS)?

Export creates a one-time calendar file. Subscribe adds a live URL to your calendar so new/changed dates sync automatically.

What timezone do reminders use?

Asia/Kolkata (IST). If your device is in another timezone, your calendar app will convert times automatically.

I’m on the QRMP scheme. Which returns are quarterly vs monthly?

For QRMP: GSTR-3B is quarterly; GSTR-1 details are uploaded monthly via IFF for the first two months of the quarter.

Are PF/ESIC due dates always the 15th?

Usually yes for the previous month’s wages, unless notified otherwise or affected by a holiday/weekend shift.

Where do I see Advance Tax due dates?

Search “advance tax” to see the four instalments (15%/45%/75%/100%) for the financial year.

Can I subscribe to only a quarter?

Yes—use the quarter filter on the page and click Subscribe; the link will include

fromandtodates for that quarter.Will I get pop-up reminders?

Calendar apps show notifications based on your settings. Our ICS includes a default reminder; you can add more in your app.

Disclaimer & Sources

This calendar is for general guidance. Dates may change due to notifications or extensions. Always confirm with the official portal/notification before filing. If you spot a correction, please contact us.