SIP Lumpsum & SWP Calculator – Goal, Step-up, Charts (Free)

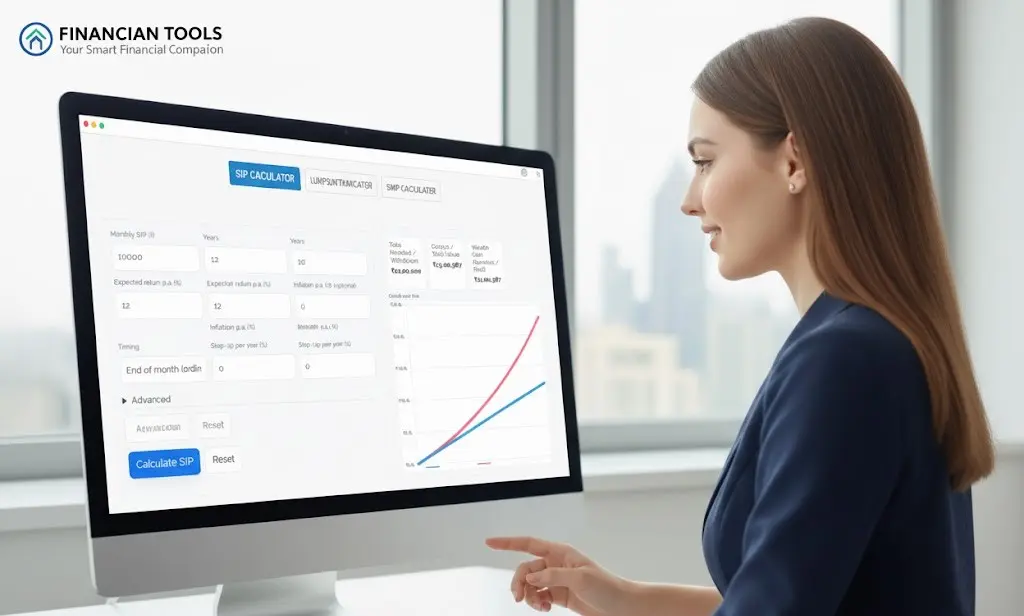

Use this SIP Lumpsum & SWP calculator to plan investments the right way. Back-solve your Goal SIP, add Step-up, choose compounding, and view growth plus a donut breakdown of Invested vs Wealth Gain. Numbers are fast, accurate, and inflation-aware. It works as a goal sip calculator, step up sip calculator, and sip calculator with inflation—plus a lumpsum return calculator and swp calculator india with charts.

Do you want more free Tools- Please explore Our All-in-One EMI Calculator and Term Loan Adv Calc.

SIP, Lumpsum & SWP Calculators Goal back-solve • Step-up • Charts • Real (inflation-adjusted)

Plan investments with precise math and a clear chart. Toggle SIP timing, add Step-up, adjust compounding (in Advanced), and see real values.

Advanced

Advanced

Advanced

Advanced

What this calculator does

This SIP Lumpsum & SWP calculator helps Indian investors answer four practical questions in one place:

- SIP: How much will my monthly SIP grow to? What if I use beginning of month timing or add a yearly step-up?

- Goal SIP: For a target corpus (education, house down-payment, retirement), what monthly SIP is needed?

- Lumpsum: What will a one-time investment become over time, considering compounding and inflation?

- SWP: If I withdraw a fixed amount every month, how long will the corpus last (or what remains after X years)?

You also see a growth chart and a donut chart splitting the final value into Invested and Wealth Gain (or Withdrawn vs Remaining for SWP).

How to use (quick steps)

- Pick a tab: SIP, Goal SIP, Lumpsum, or SWP.

- Enter the basic inputs (amount, years, expected return).

- Open Advanced to set compounding (Monthly/Quarterly/Yearly).

- (SIP) Choose Timing (End/Beginning) and optionally add a Step-up %.

- Click Calculate → read the KPIs, growth line, and donut breakdown.

- (Goal SIP) Note Monthly SIP Needed shown in the KPI box.

- (SWP) Check if/when the corpus could be exhausted.

Key terms

SIP (Systematic Investment Plan)

A fixed monthly investment in a mutual fund. In this sip lumpsum swp calculator, SIP grows using monthly compounding and your chosen Timing (End/Beginning of month). Example: ₹10,000/month for 10 years at 12%.

Goal SIP

You enter a target corpus and years; the tool back-solves the monthly SIP needed to reach it. Helpful for queries like “how much monthly SIP for 1 crore.”

Step-up SIP

An SIP that increases every year by a set %, e.g., 10%. Models salary growth and accelerates compounding.

Lumpsum Investment

A one-time amount invested today, compounded over time. Use when you receive a bonus or sale proceeds; this page also serves as a lumpsum return calculator with compounding options.

SWP (Systematic Withdrawal Plan)

A fixed monthly withdrawal from a corpus. The tool shows remaining corpus (or run-out time) and a donut split of Withdrawn vs Remaining—useful for retirement planning; a practical swp calculator india scenario.

Compounding Frequency

How often returns are credited: Monthly / Quarterly / Yearly. We convert your choice to an equivalent monthly rate for accurate month-by-month math.

Expected Return p.a. (%)

Your assumed annual return (not guaranteed). For equity funds many planners test 10–12% long term; for debt 6–8%. Always check scheme factsheets.

Inflation & Real (inflation-adjusted) Value

Inflation reduces purchasing power. Enter Inflation p.a. to see Nominal vs Real wealth gain; real value ≈ nominal ÷ (1+inflation)^years. (Great for “sip calculator with inflation” searches.)

Timing: End vs Beginning of Month

Beginning-of-month SIP compounds for one extra period each month versus End-of-month, so results are slightly higher.

Run-out (SWP)

If monthly withdrawal W exceeds sustainable growth, the corpus may exhaust. The tool estimates the month/year it runs out.

Formulas

- SIP (end-of-month) future value:

FV = P * ((1 + i)^N − 1) / i, whereiis the monthly equivalent rate; beginning-of-month multiplies FV by(1 + i). Step-up increasesPannually and we simulate month-by-month. - Goal SIP (back-solving

P):P = FV * i / ((1 + i)^N − 1); divide by(1 + i)for beginning-of-month contributions. - Lumpsum:

FV = P * (1 + i)^N. - SWP remaining corpus after

Nmonths:C_N = C0*(1+i)^N − W*((1+i)^N − 1)/i. IfW > C0*i, a run-out time exists. - Inflation: real value ≈ nominal value ÷

(1 + inflation)^years.

Worked examples (illustrative)

Example 1 — SIP

₹10,000/mo for 10 years at 12% (monthly compounding), end-of-month timing: you’ll see total invested ≈ ₹12,00,000 and final value ≈ ₹23L, with a donut showing Invested vs Wealth Gain.

Example 2 — Goal SIP

Target ₹1 crore in 15 years at 12% (monthly compounding), end-of-month timing: the tool back-solves the Monthly SIP Needed and shows the path to the goal.

(Figures are indicative; taxes, costs, and product terms apply.)

Tips for better plans

- For conservative planning, try Quarterly or Yearly compounding and add inflation to view real purchasing power.

- Use Beginning-of-month timing if your SIP auto-debuts early each month; it compounds slightly more.

- Add a Step-up (e.g., 10% yearly) to match growing income and reach goals faster.

- For SWP, test a lower withdrawal if the donut shows the corpus shrinking too fast.

Real-world scenarios

- How much monthly SIP for 1 crore?

Open Goal SIP, set target ₹1,00,00,000, 15–20 years, 10–12% return. The tool back-solves the monthly SIP and shows the impact of a 10% yearly step-up. - SIP vs Lumpsum (India)

Compare a fixed bonus as lumpsum with the same amount spread as SIP. Use this page as your sip vs lumpsum calculator india—the donut highlights where Wealth Gain is higher. - Retirement SWP

Enter your corpus and monthly need in SWP to see if/when funds may exhaust. It doubles as a practical swp calculator india for post-retirement cash flows. - Conservative planning

Prefer Quarterly/Yearly compounding and add inflation to view real (purchasing-power) returns—the effect is easy to see in the KPIs and the donut.

FAQ

Is this calculator for Indian mutual funds?

Yes—values display in ₹ and support SIP/SWP conventions common in India.

Do you store my inputs?

No. All calculations run in your browser.

Are returns guaranteed?

No. They are hypothetical; check scheme factsheets, costs, and taxes.

Which compounding frequency should I choose?

Monthly is standard for mutual fund illustrations; Quarterly or Yearly gives a conservative view. The calculator converts your choice to an equivalent monthly rate for accurate month-by-month math.

What return rate should I use?

Use scheme-appropriate, long-term expectations (e.g., equity 10–12%, debt 6–8%) as a working assumption, not a promise. Always check your scheme factsheet and costs.

Does Step-up SIP assume salary growth?

Yes, it models an annual increase in contribution (e.g., 10% every year) and compounds it month by month.

What’s the difference between Beginning vs End of month for SIP?

Beginning-of-month SIP compounds one extra period each month versus End-of-month. Results will be slightly higher with “Beginning”.

Are results inflation-adjusted?

If you enter Inflation p.a., KPIs show both Nominal and Real gains so you can judge purchasing power, not just rupee totals.

Is this a goal sip calculator?

Yes. In Goal SIP, enter the target corpus and years. The calculator back-solves the monthly SIP. (It’s a full goal sip calculator with timing and compounding options.)

Is there a step up sip calculator mode?

Yes—use SIP → Step-up per year (%). That effectively makes this a step up sip calculator with month-by-month compounding.

Is this a sip calculator with inflation?

Yes. Add Inflation p.a. to see nominal vs real wealth gain. Many users specifically need a sip calculator with inflation for long-term goals.

Can I use it as a lumpsum return calculator?

Yes. The Lumpsum tab computes future value by compounding and shows the gain split—so it serves as a lumpsum return calculator too.

Is this a swp calculator india?

Yes. The SWP tab models monthly withdrawals and shows remaining corpus or run-out time—making it a practical swp calculator india.

Related tools:

- EMI Calculator All in One – plan monthly repayments of Car Loan, Personal Loan and Home Loan

- Term Loan EMI Calculator (Adv) – fixed-tenor business/term loans.

- Basic EMI Calculator– Easy and simple for layman.

- Due Date Calculator -Don’t miss your deadline of compliance

Disclaimer: For education only—estimates are illustrative, not guarantees. Taxes/charges may apply. Inputs stay in your browser. Please consult a SEBI-registered adviser before investing.