HRA Exemption & Taxable HRA Calculator AY 2026-27

Calculate HRA exemption instantly (AY 2026-27)

Find your exact HRA exemption before filing ITR.

No login • No email • Result in 10 seconds

Enter salary and rent below ↓

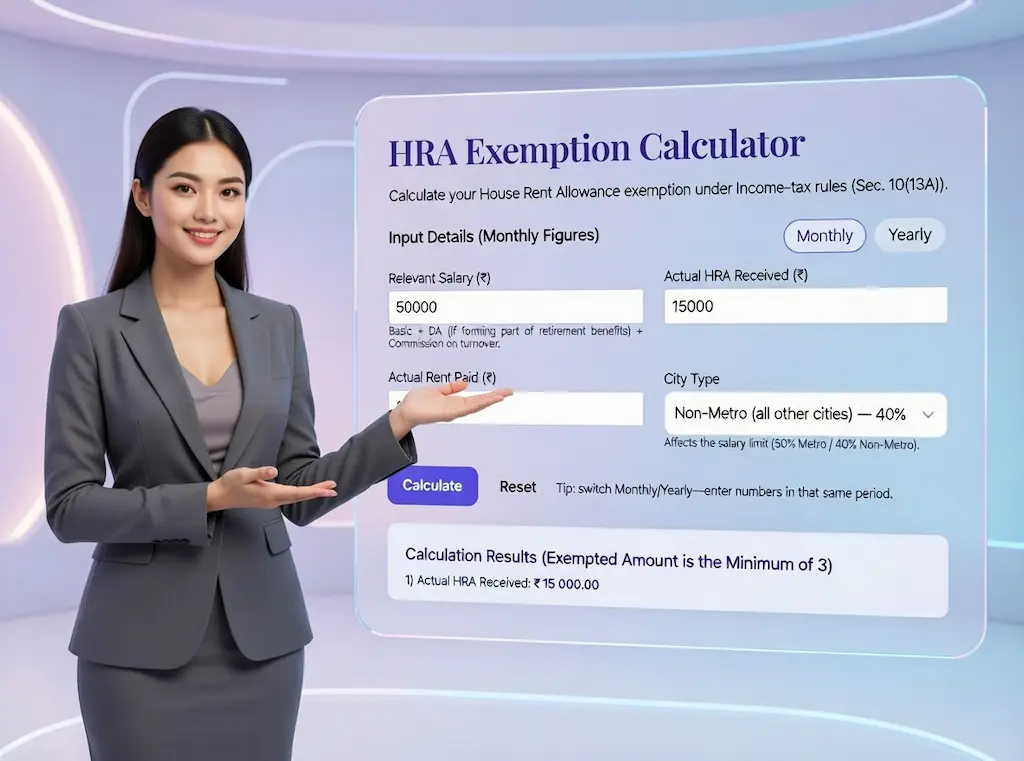

HRA Exemption Calculator

Calculate your House Rent Allowance exemption under Income-tax rules (Sec. 10(13A)).

Input Details (Monthly Figures)

Basic + DA (if forming part of retirement benefits) + Commission on turnover.

Affects the salary limit (50% Metro / 40% Non-Metro).

Calculation Results (Exempted Amount is the Minimum of 3)

1) Actual HRA Received: ₹ 0.00

2) Rent paid − 10% of Relevant Salary: ₹ 0.00

3) Salary limit (40% / 50%): ₹ 0.00

Exempted HRA (Non-Taxable)

₹ 0.00Taxable HRA

₹ 0.00Note: This is an estimate. Verify with your payroll and consult a tax professional.

How HRA exemption works (Section 10(13A))

Your house rent allowance exemption is the least of these three amounts:

- Actual HRA received from your employer

- Rent paid – 10% of Relevant Salary

- Percentage of Relevant Salary based on city type: 50% (Metro: Mumbai/Delhi/Kolkata/Chennai) or 40% (Non-Metro)

If Rent paid ≤ 10% of Relevant Salary, limit (2) becomes zero—often making the entire HRA taxable. This calculator codifies the HRA exemption rules Section 10(13A) exactly.

How to use the calculator (Monthly & Yearly)

- Choose Monthly or Yearly and enter values in the same period.

- Fill Relevant Salary, HRA received, Rent paid.

- Select Metro (50%) or Non-Metro (40%).

- Click Calculate to see the three limits, exempted HRA, and taxable HRA.

This hra calculator india view mirrors payslip calculations (monthly) and year-end planning (yearly).

Worked example: how to calculate HRA (with numbers)

Scenario (Monthly, Non-Metro):

- Relevant Salary: ₹50,000

- Actual HRA received: ₹15,000

- Rent paid: ₹20,000

Three limits:

- HRA received = ₹15,000

- Rent paid – 10% of Relevant Salary = ₹20,000 – ₹5,000 = ₹15,000

- 40% of Relevant Salary = ₹20,000

Exemption = least of (₹15,000, ₹15,000, ₹20,000) = ₹15,000

Taxable HRA = ₹15,000 – ₹15,000 = ₹0

Switching to Metro would make limit (3) ₹25,000, but the least still remains ₹15,000. This is the standard hra exemption formula your employer uses.

Old vs New tax regime (can I claim HRA?)

- Old regime: HRA exemption under Section 10(13A) is available.

- New regime (115BAC): HRA exemption is not available, and HRA becomes taxable.

Use this page to measure your old-regime benefit, then compare with your new-regime tax to decide.

Practical tips to avoid disallowance

- HRA without rent receipt: Employers usually need rent receipts; if monthly rent exceeds ₹50,000, landlord PAN is typically required.

- HRA when living with parents: Allowed if you actually pay rent under a valid rent agreement and transfer funds; parents must report rental income.

- Own house + HRA: If you live in a different rented home due to work, HRA may still apply (facts matter).

- Prefer bank/UPI transfers over cash for a clean audit trail.

- Only Mumbai, Delhi, Kolkata, Chennai qualify for the Metro 50% rate; all others are Non-Metro 40%.

FAQs

1) What is HRA exemption under Section 10(13A)?

Answer: HRA exemption is a tax relief on House Rent Allowance for salaried employees. Under Section 10(13A), the exempt amount is the least of: (1) actual HRA received, (2) rent paid minus 10% of Relevant Salary, and (3) 50% of Relevant Salary for Metro cities or 40% for Non-Metro cities.

2) How do I calculate HRA exemption — what are the three limits?

Answer: Compute all three limits and take the minimum:

- Actual HRA received;

- Rent paid − 10% of Relevant Salary;

- 50% of Relevant Salary (Metro: Mumbai, Delhi, Kolkata, Chennai) or 40% (Non-Metro).

Any remaining HRA becomes taxable.

3) What counts as Relevant Salary for HRA?

Answer: Relevant Salary = Basic salary + DA (only if it forms part of retirement benefits) + commission as a fixed % of turnover (if applicable). Other allowances/perquisites are excluded for HRA purposes.

4) Which cities qualify for 50% and which for 40% in HRA?

Answer: 50% applies only to Mumbai, Delhi, Kolkata, Chennai (Metro). All other cities are Non-Metro and use the 40% limit.

5) Can I claim HRA under the new tax regime (Section 115BAC)?

Answer: No. HRA exemption under Section 10(13A) isn’t available in the new tax regime (115BAC). If you opt for the new regime for the year, HRA received is generally fully taxable.

6) How do I quickly find taxable HRA?

Answer: First compute the exempt HRA as the least of the three limits. Then:

Taxable HRA = Actual HRA received − Exempt HRA.

The calculator shows both values instantly.

7) Is the HRA calculator valid for both monthly and yearly figures?

Answer: Yes. Switch between Monthly and Yearly and enter numbers in the same period. The exemption formula is identical; only the input period changes.

8) Can I claim HRA without rent receipts?

Answer: Employers typically require rent receipts to allow exemption. If monthly rent exceeds ₹50,000, the landlord’s PAN is usually required for TDS compliance. Keep rent agreement and proof of payment.

9) Can I claim HRA when living with parents?

Answer: Possible if you actually pay rent under a valid rent agreement and make verifiable transfers (bank/UPI). Your parents must report this rent as income where applicable. Avoid sham arrangements.

10) What if my rent paid is less than or equal to 10% of salary?

Answer: If rent ≤ 10% of Relevant Salary, the “rent minus 10%” limit becomes zero and the least of the three limits is often zero—so HRA exemption may not be available and HRA becomes taxable.

11) Does the calculator cover Metro vs Non-Metro automatically?

Answer: Yes. Select Metro or Non-Metro in the input. The calculator applies 50% for Metro and 40% for Non-Metro when computing the third limit.

12) Is this calculator authoritative for filing?

Answer: It implements the standard HRA exemption formula for guidance. Final treatment depends on your pay structure, documents, and regime choice. Consult your payroll team or a tax professional before filing.

Relevant Tools

- TDS Late-Deposit Interest Calculator (optimize TDS interest)

- https://taxbizmantra.com/tools/salary-calculator/

- Income-tax FAQs – Salary & HRA (rules, documents, examples)

Short disclaimer

This tool is for guidance only. Tax treatment depends on documents, pay structure, and regime choice. Please consult your payroll team or tax professional.