Section 149 Reassessment Time Limit: When a Notice Becomes Invalid (2026 Guide)

Received a reassessment notice after 3 years? The Section 149 reassessment time limit may determine whether the notice is legally valid or time-barred.

Stay on top of Income Tax in India with plain-English guides, worked examples, and checklists. This category covers slab rates and New vs Old Regime comparisons, HRA, standard deduction, common 80C/80D/80G deductions, and taxation of salary, house property, capital gains, and other income. You’ll find step-by-step explainers for Form 16, Form 26AS, AIS/TIS, advance tax and self-assessment tax, plus filing tips for ITR-1 to ITR-3. We also break down topics like TDS/TCS, interest under 234A/B/C, set-off of losses, and documentation to keep for scrutiny. Each article is CA-curated and kept current with Finance Act updates, circulars, and judicial trends. Whether you’re an employee, consultant, landlord, or small business owner, use these guides to plan, avoid penalties, and file accurately. For quick math, check the Tools hub for our free online calculators; for deeper learning, browse the FAQs embedded in each post.

Received a reassessment notice after 3 years? The Section 149 reassessment time limit may determine whether the notice is legally valid or time-barred.

Reassessment fails when based on change of opinion. Learn how courts treat such notices as void despite section 148A and lack of fresh tangible material.

This FAQ section explains the income-tax proposals introduced in Union Budget 2026–27 under the theme of Attracting Global Business and Investment, with specific focus on data centre–related provisions. It covers tax exemptions for foreign companies, conditions applicable to specified data centres, and compliance requirements, helping readers understand the scope and intent of these measures.

This FAQ section explains the income-tax provisions applicable to cooperative societies under Union Budget 2026–27. It covers key amendments relating to deductions, dividend taxation, federal cooperatives, and inclusion of multi-state cooperative societies under the Income-tax Act, 2025, helping readers clearly understand the scope and applicability of these changes.

This FAQ section explains the Ease of Living measures introduced in Union Budget 2026, focusing on simplified income-tax compliance, revised return timelines, TDS rationalisation, electronic processes, and taxpayer-friendly reforms under the Income-tax Act, 2025. The FAQs help individuals, professionals, and businesses clearly understand the scope and impact of these changes.

Budget 2026–27 introduces several rationalisation measures across other direct tax provisions. This article reproduces the official FAQs exactly as issued, without interpretation, for professional and exam reference.

Budget 2026–27 introduces specific rationalisation measures in corporate taxation. This article reproduces all 15 official FAQs exactly as issued, without interpretation.

This page compiles official, question-wise FAQs on Income-tax penalties and prosecution provisions as amended by the Finance Bill, 2026, including changes relating to the Income-tax Act, 2025, Updated Returns, Black Money Act, crypto reporting, and search-related assessments.

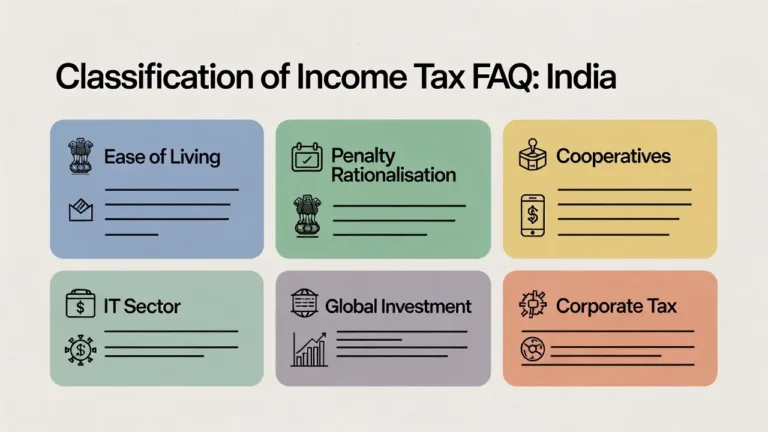

The Income Tax Department has classified the direct tax proposals of Budget 2026–27 into specific thematic categories to explain the policy intent behind the Finance Bill, 2026. This article explains the official classification of Budget 2026 income tax FAQs, covering ease of living measures, penalty and prosecution reforms, sector-specific initiatives, corporate tax rationalisation, and other direct tax provisions, with links to detailed category-wise FAQ clarifications.

Union Budget 2026 focuses on tax certainty and structural reforms rather than headline rate changes. While income-tax and GST rates remain unchanged, the Budget introduces key procedural reforms including rollout of the new Income-tax Act, consolidation of assessment and penalty proceedings, rationalisation of TDS and TCS rates, STT changes for derivatives, IFSC/GIFT City incentives, and GST compliance simplification. This article summarises the key tax highlights relevant for taxpayers, businesses and investors.