Articles & Guides on Tax, Finance & Accounting in India

Practical Insights on Income Tax, GST, Accounting, and Wealth Planning in India

Stay updated with expert insights on Income Tax, GST, Accounting, Personal Finance, Corporate Finance, and Wealth Planning. Our guides simplify complex topics into practical, step-by-step knowledge for individuals, businesses, and professionals.

Clear, Practical Guidance on Income Tax, GST & Finance

Browse our articles by category to quickly access the tax and finance insights that matter most to you. Whether you’re looking for clarity on Income Tax filing, GST compliance, accounting best practices, personal finance planning, corporate finance, or wealth management, our content is structured for easy discovery and practical use. Each guide is written to break down complex laws, rules, and procedures into clear, step-by-step explanations—helping individuals, entrepreneurs, and professionals in India make informed decisions with confidence.

Explore Income Tax Guides

Learn how income tax works — ITR filing basics, deductions, and compliance explained in simple language.

Section 149 Reassessment Time Limit: When a Notice Becomes Invalid (2026 Guide)

Received a reassessment notice after 3 years? The Section 149 reassessment time limit may determine whether the notice is legally valid or time-barred.

Change of Opinion: Why Reassessment Fails

Reassessment fails when based on change of opinion. Learn how courts treat such notices as void despite section 148A and lack of fresh tangible material.

Budget 2026 FAQs on Attracting Global Business and Investment (Data Centres)

This FAQ section explains the income-tax proposals introduced in Union Budget 2026–27 under the theme of Attracting Global Business and Investment, with specific focus on data centre–related provisions. It covers tax exemptions for foreign companies, conditions applicable to specified data centres, and compliance requirements, helping readers understand the scope and intent of these measures.

Budget 2026: FAQs on Tax Provisions for Cooperative Societies

This FAQ section explains the income-tax provisions applicable to cooperative societies under Union Budget 2026–27. It covers key amendments relating to deductions, dividend taxation, federal cooperatives, and inclusion of multi-state cooperative societies under the Income-tax Act, 2025, helping readers clearly understand the scope and applicability of these changes.

Union Budget 2026: Ease of Living Measures for Taxpayers and Businesses (FAQs)

This FAQ section explains the Ease of Living measures introduced in Union Budget 2026, focusing on simplified income-tax compliance, revised return timelines, TDS rationalisation, electronic processes, and taxpayer-friendly reforms under the Income-tax Act, 2025. The FAQs help individuals, professionals, and businesses clearly understand the scope and impact of these changes.

Budget 2026–27 FAQs on Rationalisation of Other Direct Tax Provisions

Budget 2026–27 introduces several rationalisation measures across other direct tax provisions. This article reproduces the official FAQs exactly as issued, without interpretation, for professional and exam reference.

Explore GST Guides

Step-by-step resources on GST returns, input tax credit, and indirect tax updates for businesses.

Union Budget 2026 – Key Changes in Income Tax, TDS/TCS, STT and GST

Union Budget 2026 focuses on tax certainty and structural reforms rather than headline rate changes. While income-tax and GST rates remain unchanged, the Budget introduces key procedural reforms including rollout of the new Income-tax Act, consolidation of assessment and penalty proceedings, rationalisation of TDS and TCS rates, STT changes for derivatives, IFSC/GIFT City incentives, and GST compliance simplification. This article summarises the key tax highlights relevant for taxpayers, businesses and investors.

ITC on Leasing of Commercial Property — Post Safari Retreats Reality

ITC on leasing of commercial property under GST remains available in limited circumstances despite Safari Retreats. This article explains how Section 17(5)(d) applies to lease rentals and construction-linked credits.

Why ITC on Telecom Towers Is Blocked under GST — Statute vs Court Views

ITC on telecom towers continues to be blocked under GST despite their critical business role. This article explains how Section 17 overrides earlier judicial views and why functional arguments fail post-GST.

ITC on Plant & Machinery — What Civil Structures Still Qualify Post-GST

ITC on plant and machinery under GST remains a high-risk area, particularly where civil structures and foundations are involved. This article explains the statutory scope of Section 17(5), the limited role of the functional test, and the eligibility of civil components post-GST.

Functional Test vs Statutory Bar under GST: Limits of Judicial Interpretation

A principled analysis of the conflict between functional interpretation and statutory prohibition under GST, examining the constitutional limits of judicial interpretation in fiscal law.

ITC on immovable property — what survives after Safari Retreats (SC)

This article explains whether ITC on immovable property under GST is available on construction after the Supreme Court’s Safari Retreats judgment, focusing on Section 17(5) restrictions and practical compliance implications.

Explore Accounting & IFRS Guides

Understand accounting standards, IFRS concepts, audits, and financial reporting essentials.

Accounting of Compound Financial Instruments under Ind AS 32 and Ind AS 109 — A Practical Guide

This article offers a practical and comprehensive guide to accounting for Compound Financial Instruments (CFIs) such as CCDs, CCPS and OCDs under Ind AS 32 and Ind AS 109. It explains classification, liability–equity split, embedded derivatives, discounting, EIR calculation, and conversion accounting with clear examples and journal entries, enabling professionals to interpret and apply Ind AS requirements with confidence.

Common Control Business Combinations under Ind AS 103: Practical Issues and Correct Accounting Approach

Common control business combinations under Ind AS 103 often create confusion, especially in PE-backed restructurings. This article explains the meaning of control, pooling of interest vs acquisition method, treatment of comparatives, capital reserve and consolidation mechanics through a practical case study.

The Hidden Mistake in CWIP Accounting: What Everyone Gets Wrong About ROU Depreciation & Lease Interest

Many companies still capitalise land ROU depreciation or lease-liability interest into CWIP—an error that violates Ind AS logic, inflates project cost and distorts financial reporting. This article explains why these costs must be expensed, supported by economic reasoning and Ind AS 16, 23 and 116.

Ind AS 116 & IFRS 16 — Leases (Clear, Practical Guide with Examples)

A practical guide to lease accounting under Ind AS 116 and IFRS 16. Learn the scope, lease term judgments, right-of-use asset and lease liability, variable payments, lease modifications, subleases, sale-and-leaseback, and disclosure templates—with simple examples and mini journal entries. Includes a short Ind AS vs IFRS differences note.

Ind AS 115 & IFRS 15: Revenue Recognition — 5-Step Model

A clear, comprehensive guide to Ind AS 115 / IFRS 15. Walk through the 5-step model, determine and allocate the transaction price, handle contract costs, and present/disclose correctly—including Para 109AA (excise) and the Para 126AA contracted-price reconciliation—with simple examples.

Explore Personal Finance Guides

Smart guides on budgeting, insurance, tax planning, and money management for individuals.

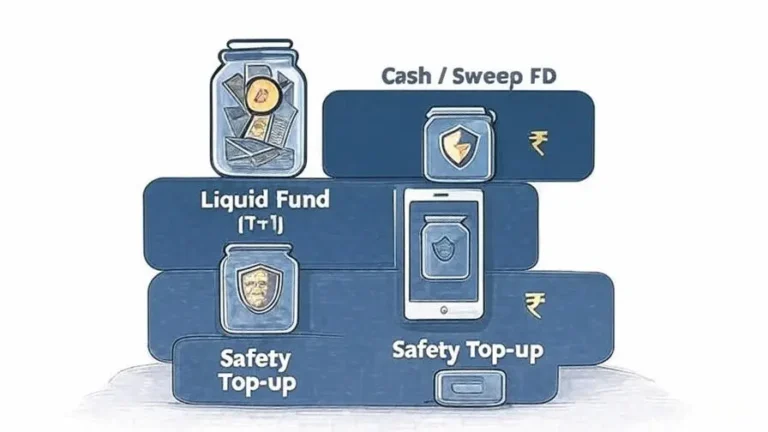

Emergency Fund Planning 2025: How Much & Where to Park It

A practical guide to size, park, and protect your emergency fund in India—layered for liquidity and linked to your budget’s five-jar flow.

How to Build a Personal Budget That Actually Works

Tired of budgets that die by Day 10? India’s 4-bucket, 5-jar system tames UPI, automates SIPs, and brings calm to money—starting today

Explore Corporate Finance Guides

Insights on business finance — capital structure, project funding, mergers, and financial strategy.

Invoice-Defects Tracker (Excel, India) — Reduce DSO

If cash is the lifeblood of your business, invoice quality is the artery. Most delays in collections are not disputes about value, they are preventable errors: wrong GSTIN, missing PO, mismatched quantities, IRN rejection, or no proof of delivery. This Invoice-Defects Tracker gives finance and sales…

13-Week Cash Flow Forecast (India) — Free Excel Template

Get a lender-grade 13-week cash flow forecast for India. One-page summary, MSME/GST cadence, UPI/TReDS, OD/CC headroom and breach flags. Free Excel download.

13-Week Cash Flow Forecast Plan: Full Guide, Template Logic & Worked Example

This guide turns cash timing from a headache into a habit. Learn the 13-week cash flow method for India with a step-by-step template, exact formulas, AR ageing collection patterns, and UPI/TReDS tactics. Includes a fully worked example, playbooks, pitfalls, and a simple Friday cadence you can run every week.

Working Capital Optimization in India 2025

Working capital is cash trapped in operations. This India-focused guide explains the operating cycle and CCC (DIO + DSO − DPO), walks through the key ratios with ideal ranges, highlights MSME/GST nuances, and shows—via ABC Co and EcoSolar—how tightening collections, right-sizing inventory, and setting fair payables can unlock ₹-crore cash without straining relationships. Make cash a weekly habit, not a once-a-quarter scramble.

Explore Investment & Wealth Planning Guides

Learn strategies for wealth creation — mutual funds, stocks, retirement planning, and tax efficiency.

Asset Allocation by Age: How Indian Investors Should Invest in Their 20s, 30s, 40s & 50s

Asset allocation is not a fixed formula. It changes as income, responsibilities, and goals evolve. This guide explains how Indian investors should allocate equity, debt, gold, and cash at different life stages.

Best Asset Allocation Strategies for Indian Investors in 2025

Stop chasing hot picks. Build a resilient India-2025 portfolio—equity (India+global), TMFs, a measured gold sleeve, and cash for action. Learn the exact weights and rules.

Explore Process Improvement Guides

Productivity hacks and process optimization ideas for businesses and professionals.

Month End Close Checklist Excel (India 2025) — Free, Pro-Grade Template

Free Excel month-end closing template India: T-5…T+3 buckets, maker-checker counters, and a live finance dashboard excel. Drop in your tasks and hit T+3.

Month-End Close (India) 2025: The T+3 Blueprint for Finance Teams

Month-end shouldn’t be a fire drill. Use this T+3 blueprint—DMAIC, T-2 accruals, intake hygiene, and small STP pilots—to cut close time, lift FPY, and calm audits in 90 days.

Six Sigma Finance FAQ (India 2025)

Confused by Lean Six Sigma in finance? This India-ready FAQ shows how to lift FPY, cut TAT, and lower COPQ—so month-end finally calms down.

Implementing Lean Six Sigma in Finance Teams: A Practical Guide

Month‑end shouldn’t feel like a fire drill. Fix one finance process in 90 days with lean six sigma finance India—TAT reduction, higher FPY, calmer audits, and visible COPQ savings.

Explore Free Download

Month End Close Checklist Excel (India 2025) — Free, Pro-Grade Template

Free Excel month-end closing template India: T-5…T+3 buckets, maker-checker counters, and a live finance dashboard excel. Drop in your tasks and hit T+3.

Invoice-Defects Tracker (Excel, India) — Reduce DSO

If cash is the lifeblood of your business, invoice quality is the artery. Most delays in collections are not disputes about value, they are preventable errors: wrong GSTIN, missing PO, mismatched quantities, IRN rejection, or no proof of delivery. This Invoice-Defects Tracker gives finance and sales…

13-Week Cash Flow Forecast (India) — Free Excel Template

Get a lender-grade 13-week cash flow forecast for India. One-page summary, MSME/GST cadence, UPI/TReDS, OD/CC headroom and breach flags. Free Excel download.

GST Registration Checklist 2025-Free Download

Download your free GST Registration Checklist 2025. Covers all required documents for owned, rented, and residential premises, along with small steps of GST registration. Backed by official CBIC, GST Council, and GSTN sources. A practical tool to avoid rejection and simplify compliance for businesses and professionals.

Income Tax Calculator for AY 2026–27 (FY 2025–26) – Free Excel Download

Download our free Excel Income Tax Calculator for AY 2026–27 (FY 2025–26). Built with the latest New Regime slab rates, ₹75,000 standard deduction, Section 87A rebate, and capital gains tax updates, this easy-to-use tool lets you compute your tax in minutes. Perfect for salaried, pensioners, and NRIs to plan taxes quickly and accurately.

Latest Post from Our Articles & Guides

Productivity hacks and process optimization ideas for businesses and professionals.

Section 149 Reassessment Time Limit: When a Notice Becomes Invalid (2026 Guide)

Received a reassessment notice after 3 years? The Section 149 reassessment time limit may determine whether the notice is legally valid or time-barred.

Change of Opinion: Why Reassessment Fails

Reassessment fails when based on change of opinion. Learn how courts treat such notices as void despite section 148A and lack of fresh tangible material.

Budget 2026 FAQs on Attracting Global Business and Investment (Data Centres)

This FAQ section explains the income-tax proposals introduced in Union Budget 2026–27 under the theme of Attracting Global Business and Investment, with specific focus on data centre–related provisions. It covers tax exemptions for foreign companies, conditions applicable to specified data centres, and compliance requirements, helping readers understand the scope and intent of these measures.

Budget 2026: FAQs on Tax Provisions for Cooperative Societies

This FAQ section explains the income-tax provisions applicable to cooperative societies under Union Budget 2026–27. It covers key amendments relating to deductions, dividend taxation, federal cooperatives, and inclusion of multi-state cooperative societies under the Income-tax Act, 2025, helping readers clearly understand the scope and applicability of these changes.

Union Budget 2026: Ease of Living Measures for Taxpayers and Businesses (FAQs)

This FAQ section explains the Ease of Living measures introduced in Union Budget 2026, focusing on simplified income-tax compliance, revised return timelines, TDS rationalisation, electronic processes, and taxpayer-friendly reforms under the Income-tax Act, 2025. The FAQs help individuals, professionals, and businesses clearly understand the scope and impact of these changes.

Budget 2026–27 FAQs on Rationalisation of Other Direct Tax Provisions

Budget 2026–27 introduces several rationalisation measures across other direct tax provisions. This article reproduces the official FAQs exactly as issued, without interpretation, for professional and exam reference.

Stay Updated with Tax & Finance Insights

Join the TaxBizMantra community and get the latest updates on tax tips, GST compliance, accounting strategies, and business finance insights — delivered straight to your inbox. Stay ahead with expert advice you can trust.