MCA-Ready Authorised Share Capital Cost Estimator

Planning to raise your authorised share capital? Use this compliance-focused estimator to instantly compute MCA filing charges and state-wise stamp duty before filing SH-7.

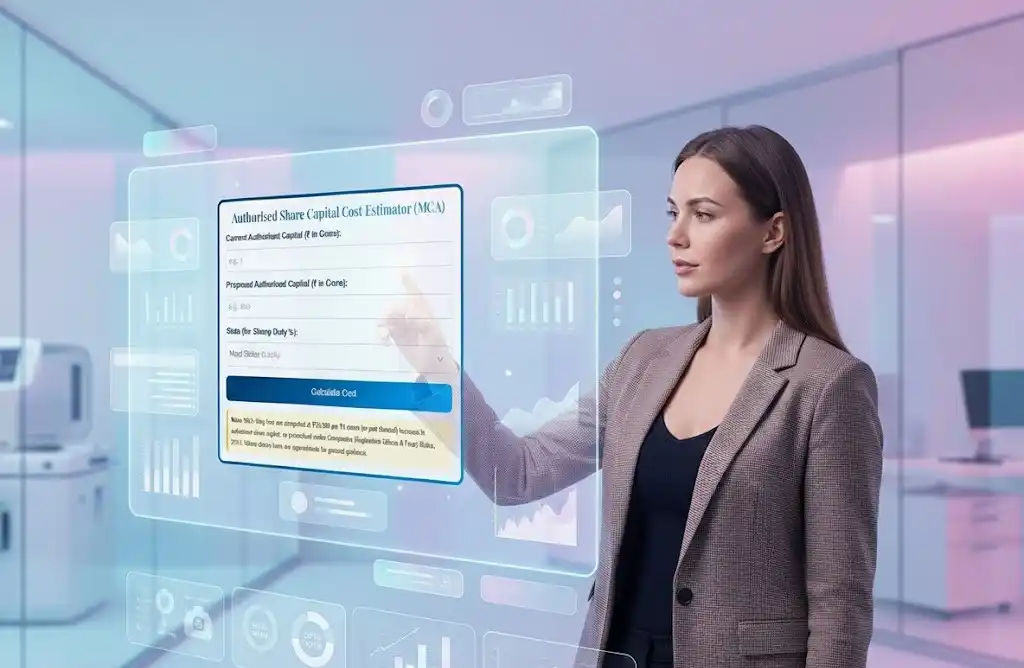

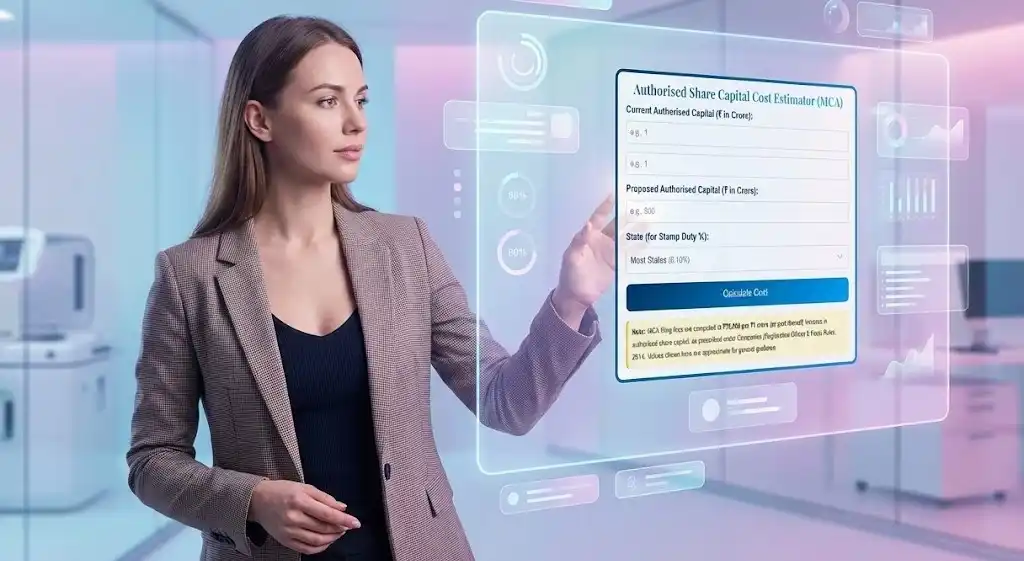

Authorised Share Capital Cost Estimator (MCA)

About This Estimator:

Increasing the authorised share capital of a company is a common requirement during fundraising, restructuring, onboarding investors, issue of new shares, or expanding the equity base. However, many businesses face confusion regarding the actual cost involved in filing Form SH-7 with the Ministry of Corporate Affairs (MCA).

To simplify this, TaxBizMantra provides a dedicated Authorised Share Capital Cost Estimator (MCA), designed specifically for compliance professionals, company secretaries, and business owners who want clarity before initiating the approval process.

This estimator applies the statutory fee structure notified under the Companies (Registration Offices and Fees) Rules, 2014. For authorised capital exceeding ₹1 crore, MCA charges a filing fee of ₹75,000 per ₹1 crore or part thereof, in addition to state-specific stamp duty payable on the alteration of the Memorandum of Association (MOA). The tool automatically computes both components and presents a clear breakdown so that you can budget your compliance costs accurately.

Understanding the cost implications is important before passing board resolutions, drafting shareholder approvals, or planning capital restructuring. This tool gives you a compliance-accurate view of potential expenses, enabling better decision-making during corporate actions.

TaxBizMantra’s focus is to simplify tax, finance, and corporate law for professionals and growing companies. Along with this estimator, you will find detailed guides, ROC procedures, checklists, and step-by-step explanations to help you stay compliant with the Companies Act, 2013.

Use this estimator before preparing your SH-7 filing, MOA alteration, or authorised capital modification to avoid last-minute surprises and ensure smooth compliance.

How to Use This Estimator

- Enter your company’s existing authorised capital.

- Specify the new authorised capital you intend to adopt.

- Choose your registered state, as stamp duty varies by jurisdiction.

- Click Calculate Cost to view the MCA filing fee and estimated stamp duty applicable for SH-7 filing.

How This Tool Helps

- Provides a compliance-accurate estimate of authorised capital increase costs.

- Helps you prepare for SH-7 filing, board resolutions, and MOA alteration.

- Supports better decision-making before raising capital or onboarding investors.

- Avoids miscalculation of MCA slabs and state-wise stamp duty.

- Ideal for CAs, CS professionals, founders, and finance teams managing corporate filings.