Company Incorporation Cost Calculator (India) – ROC, Stamp Duty & DSC

Instantly calculate the total cost of company incorporation in India based on authorised capital, state-wise stamp duty, and DSC requirements.

Covers ROC filing fees, SPICe+ charges, MOA/AOA stamp duty, and optional DSC costs as per applicable rules.

What Costs Are Included in Company Incorporation?

The Company Incorporation Cost Calculator is designed to estimate the statutory and government-related expenses incurred while incorporating a company in India under the Companies Act, 2013. These costs arise at the time of filing incorporation forms with the Ministry of Corporate Affairs (MCA) and are largely non-negotiable, as they are prescribed by law.

The primary components included in this estimator are ROC filing fees, stamp duty on constitutional documents (MOA and AOA), and Digital Signature Certificate (DSC) costs, where applicable. ROC filing fees are linked to the authorised share capital of the proposed company, while stamp duty varies based on the state of incorporation. DSC costs depend on the number of directors and subscribers who are required to digitally sign incorporation forms.

This tool focuses strictly on government fees and mandatory statutory charges. Any professional or consultancy fees charged by Chartered Accountants, Company Secretaries, or incorporation service providers are intentionally excluded, as such costs vary widely based on service scope and commercial arrangements.

Legal Basis of ROC Fees and Stamp Duty

ROC filing fees are governed by the Companies (Registration Offices and Fees) Rules, 2014, read along with relevant MCA notifications issued from time to time. These rules prescribe fee slabs based on the authorised capital of the company at the time of incorporation. Higher authorised capital generally results in higher ROC fees.

Stamp duty on incorporation documents, namely the Memorandum of Association (MOA) and Articles of Association (AOA), is levied under state-specific stamp laws. Since stamp duty is a state subject under the Constitution of India, the rates and computation methods differ from one state to another. Some states levy stamp duty as a percentage of authorised capital, while others prescribe fixed or slab-based amounts.

This calculator applies commonly prevailing stamp duty rates used in most states to arrive at an indicative estimate. It is intended for planning and comparison purposes and should not be treated as a substitute for state-specific professional advice.

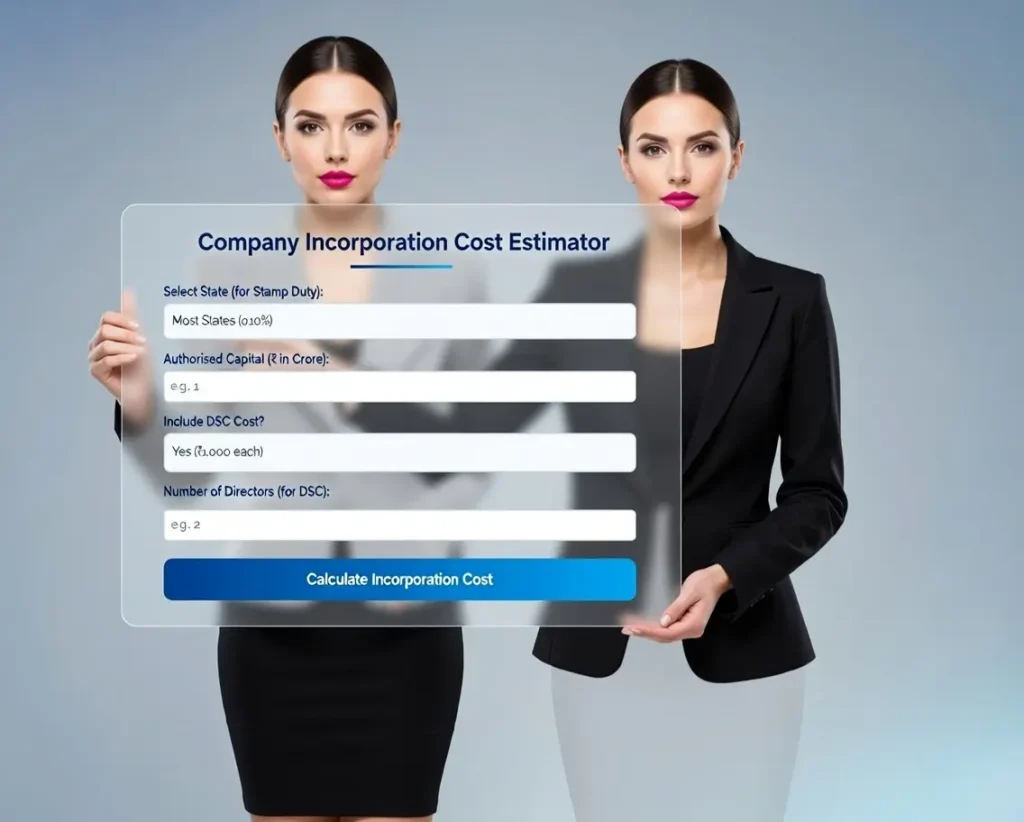

How to Use This Company Incorporation Cost Calculator

Using the Company Incorporation Cost Calculator is straightforward and does not require any technical or legal expertise. Users are required to enter only basic inputs that are normally decided at the planning stage of incorporation and Click “Calculate Incorporation Cost” to view the estimated total.

Select the state to apply the relevant stamp duty rate

Enter the authorised capital of the proposed company

Choose whether DSC cost should be included

Enter the number of directors requiring DSC

Why Incorporation Cost Varies Across States

One of the most common reasons for variation in company incorporation cost is state-wise stamp duty. While ROC fees remain uniform across India, stamp duty rates and structures are notified independently by each state government. As a result, the same company with identical authorised capital may incur different incorporation costs depending on the state of registration.

This calculator accounts for such variations by allowing users to factor in stamp duty at the estimation stage itself. This feature is particularly useful for startups and businesses that have flexibility in choosing their registered office location.

Private Limited Company vs OPC vs LLP – Cost Perspective

A Private Limited Company generally involves higher incorporation costs compared to a One Person Company (OPC) due to differences in compliance structure and stamp duty application. Limited Liability Partnerships (LLPs) follow a completely different statutory framework and fee structure under the LLP Act, 2008.

This calculator is designed exclusively for company incorporation under the Companies Act, 2013 and should not be used to estimate LLP registration costs.

Common Mistakes While Estimating Incorporation Cost

Many founders underestimate incorporation costs by ignoring stamp duty or assuming that professional fees are included in statutory charges. Others fail to account for DSC costs for multiple directors or rely on outdated ROC fee slabs.

This calculator helps reduce such errors by providing a structured and transparent estimation based on current statutory norms.

Key Points to Remember

The calculator estimates government and statutory costs only

Professional or consultancy fees are not included

Stamp duty varies by state and may change due to notifications

Figures are indicative and meant for planning purposes

Best suited for founders, startups, and professionals

Frequently Asked Questions (FAQs)