ESOP Taxation in India 2025: Why It Matters and What You’ll Learn

Employee Stock Option Plans (ESOPs) are no longer a perk reserved for Silicon-Valley-style tech firms. In India, everyone—from high-growth startups to listed conglomerates—uses equity compensation to attract, motivate, and retain strong performers. For employees, ESOPs promise something salary alone rarely delivers: a stake in the long-term value they help create. For employers, ESOPs conserve cash, align incentives, and reduce attrition.

But ESOPs also introduce a tax puzzle with moving pieces: there are two distinct tax events (exercise/settlement and sale), different holding-period rules for listed vs unlisted or foreign shares, startup deferral provisions that change the timing (but not the amount) of tax, and evolving jurisprudence on issues like valuation under lock-in and one-off “compensation for value loss.” Add compliance layers—Rule 115 currency conversion for foreign plans, Schedule FA and Form 67 for cross-border cases—and it’s easy to see why even seasoned professionals want a clean, step-by-step guide.

This article aims to be that guide. We’ll explain how ESOPs income tax actually work, where tax bites (and why), what to file, where cross-border traps lie, and how to plan so the upside of ownership isn’t dulled by avoidable mistakes.

ESOP Rules in India: SEBI, Companies Act, Income-tax Act & FEMA

Indian ESOPs sit at the intersection of four frameworks:

• SEBI (listed companies): shareholder approvals, disclosures, plan hygiene.

• Companies Act, 2013: corporate governance, issuance mechanics, board/shareholder approvals.

• Income-tax Act, 1961: when and how employees are taxed; TDS obligations; capital-gains rules.

• FEMA: foreign securities held by residents; remittances; reporting for cross-border awards.

The tax piece is the spine of this article. In India, ESOP benefits are taxed first as a salary perquisite at exercise/settlement and later as capital gains when you sell. The Income Tax Department’s own guidance confirms: (i) perquisite is computed at exercise using FMV minus what you paid, (ii) FMV on exercise becomes your cost for capital gains, and (iii) the holding period for capital-gains classification runs from the date of allotment of shares.

For the official source of ESOP taxation rules, refer to the Income Tax Department’s PDF: “Taxation of Employee Stock Option Plan (ESOP)“

Understanding ESOP (Beyond the Buzzwords)

What exactly is an ESOP?

An ESOP lets an employee acquire ownership in the employer (or its group company) on favourable terms. That favourable element—free shares, a discount to market, or cash for appreciation—is what creates taxable benefit. ESOPs support four strategic goals: acquisition & retention, incentive alignment, cash efficiency, and ownership culture.

Key components & terminology of ESOP

Grant Date

You’re promised a future equity benefit via a grant letter/plan agreement. No tax yet—there’s no asset in your hands.

Vesting Period & Vesting Date

You earn the award over time and/or performance. A vested tranche becomes exercisable/deliverable—this supports long-term commitment.

Exercise/Settlement Date

When you exercise options/ESPP or receive RSU shares. In India, this is typically the first tax trigger for equity-settled awards as a salary perquisite under Section 17(2).

Exercise (Strike) Price

What you pay per share when exercising options/ESPP. A lower strike compared to FMV is what creates the taxable perquisite.

Fair Market Value (FMV) on Exercise

The reference market value on the exercise/settlement day used to compute perquisite and later treated as your cost for capital gains calculations.

Subscription FMV (ESPP)

A reference value at/around grant; plans apply a discount to set your actual purchase price.

Lock-in/Transfer Restrictions

True non-transferability can affect valuation arguments (see Legal developments).

How to Determine FMV at Exercise of ESOP (Rule 3 quick guide)

• Listed on one exchange (exercise day): FMV is the average of opening and closing prices on that exchange on the exercise date.

• Listed on multiple exchanges: Use the average of opening and closing on the exchange with the highest trading volume for that day.

• No trading on the exercise date: Use the closest preceding day’s closing price (or that of the exchange with the highest volume if multiple exchanges).

• Unlisted shares: Obtain FMV from a SEBI-registered merchant banker on a “specified date” = the exercise date or an earlier date within 180 days before exercise. Keep the valuation report.

Note: For perquisite computation, FMV on exercise is what counts—not the allotment date.

Common Equity Award Types (and how tax triggers differ)

Stock Options (classic)

Right (not obligation) to buy shares at a fixed exercise price later. If FMV > exercise price at exercise, you have a taxable perquisite.

RSUs (Restricted Stock Units)

No purchase price. On settlement, the company delivers shares (or cash equivalent). Perquisite arises on settlement; later sale gives capital gains.

Employee Stock Purchase Plan (ESPP)

A program that lets employees buy company shares—usually via payroll deductions—at a preset discount to a reference market price. (often 10–20%). Perquisite equals FMV minus your purchase price at purchase/settlement.

SARs/Phantom Stock

A right that pays you the increase (“appreciation”) in a company’s share price over a base price, without you having to buy the share first. Cash-settled awards paying you the appreciation since grant. Typically salary income only at payout (no capital gains because you never hold shares).

The Two-Stage Taxation Framework of ESOP (with formulas)

Stage 1 — Exercise/Settlement → Salary (Perquisite)

Perquisite (Salary) = (FMV on Exercise/Settlement − Exercise Price) × No. of Shares

• Options: FMV − exercise price

• RSUs: FMV − 0 (since you pay nothing)

• ESPP: FMV − your discounted purchase price

Employers must include this perquisite in salary and deduct TDS.

Startup deferral (Section 80-IAC / Section 192(1C)):

For employees of eligible start-ups, TDS on the perquisite is deferred until the earliest of: (1) 48 months from the end of the assessment year of allotment, (2) date of sale, or (3) cessation of employment. Tax must then be deposited within 14 days; the rate applied is the rate in force for the year of allotment. This is cash-flow relief, not a tax waiver.

Stage 2 — Sale of Shares → Capital Gains

Capital Gain = (Sale Price − FMV used at Exercise/Settlement) × No. of Shares

The FMV on exercise becomes your cost of acquisition for capital-gains purposes; your holding period runs from the date of allotment of shares (not the exercise date).

Two-Event Tax Path (Flowchart)

GRANT → no tax

↓ (time / performance)

VEST → right to exercise/deliver accrues; still no tax

↓

EXERCISE / SETTLEMENT → Salary (Perquisite)

Perq = (FMV on exercise – Exercise price) × shares

Employer deducts TDS; for eligible start-ups, TDS can be deferred (Sec 192(1C)

[FMV here becomes your COST for capital gains later]

↓

HOLDING PERIOD → track days/months for ST/LT bucket

Listed: LT if ≥ 12 months; Unlisted/Foreign: LT if ≥ 24 months

↓

SALE → Capital Gains

Gain = (Sale price – FMV at exercise) × shares

Apply correct rate by asset + date window (23-Jul-2024 change)

↓

ITR FILING → Report perquisite under Salary, gains under Capital Gains

Cross-border? Use Rule 115 for FX conversion, and Form 67 for FTC (timelines apply)

Capital-Gains Rules & Rates for ESOP (what changed from 23 July 2024)

Holding-period classification:

• Listed equity (STT-paid): Long-term if ≥ 12 months.

• Unlisted Indian shares & most foreign shares: Long-term if ≥ 24 months.

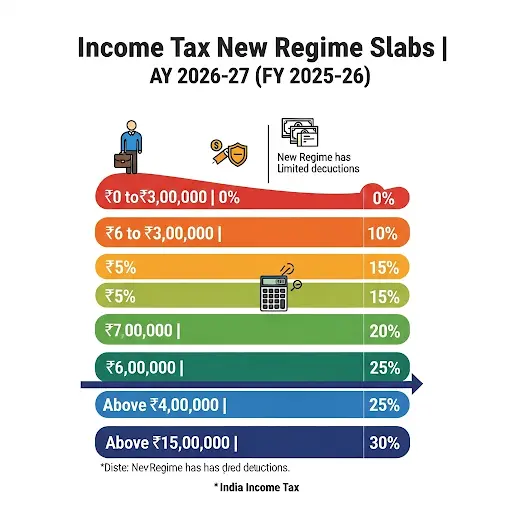

Rate changes for transfers on/after 23 July 2024:

• STCG (Sec 111A) on listed equity/equity MF/business trust: 20% (was 15% before 23-Jul-2024).

• LTCG (Sec 112A) on listed equity/equity MF/business trust: 12.5% (was 10% before 23-Jul-2024) with ₹1.25 lakh annual exemption.

• LTCG (other categories, incl. unlisted): generally 12.5% post-change; check specifics.

Add surcharge and cess as applicable.

At-a-Glance Capital-Gains Rate Matrix

| Asset type | Holding period for LTCG | Sale before 23-Jul-2024 | Sale on/after 23-Jul-2024 | When to use |

| Listed equity / equity MF / business trust (STT-paid) | ≥ 12 months | LTCG 10% (exemption ₹1,00,000) | LTCG 12.5% (exemption ₹1,25,000) | If shares/units are sold on exchange; check STT & date window. |

| STCG 15% | STCG 20% | If holding < 12 months and sale date falls in the window. | ||

| Unlisted Indian shares | ≥ 24 months | LTCG 20% with indexation | LTCG 12.5% (no indexation) | Typical for private companies; check holding period. |

| STCG: slab | STCG: slab | If holding < 24 months. | ||

| Foreign shares | ≥ 24 months | LTCG 20% with indexation | LTCG 12.5% (no indexation) | Applies to overseas parent equity too. |

| STCG: slab | STCG: slab | If holding < 24 months. |

Worked Examples (step by step)

Example A — Listed ESOP (rate-window awareness)

Grant: 1 Jan 2023

Vesting: 25% p.a. over 4 years

Exercise Price: ₹200; FMV on exercise (1 Jan 2024): ₹350

Shares exercised: 250; Sale date: 1 Jul 2024 (exchange) at ₹400

Stage 1 – Exercise (1 Jan 2024)

Perquisite = (₹350 − ₹200) × 250 = ₹37,500 → taxed as salary; TDS by employer.

Stage 2 – Sale (1 Jul 2024)

Holding ≈ 6 months → short-term.

STCG = (₹400 − ₹350) × 250 = ₹12,500.

Rate for 1 Jul 2024 is 15% (111A old rate; 20% applies only for transfers on/after 23-Jul-2024).

Base tax = ₹1,875 (+ surcharge/cess if any).

Example B — Unlisted Indian company (ESPP + RSU; two sales)

Exercise/Settlement: 31 Jan 2021; FMV = ₹55

ESPP: 100 @ ₹40; RSU: 20 shares delivered

Sale-1: 3 Jun 2022 → 85 @ ₹80; Sale-2: 20 Nov 2024 → 35 @ ₹90

Perquisite (31 Jan 2021)

ESPP: (₹55 − ₹40) × 100 = ₹1,500; RSU: (₹55 − 0) × 20 = ₹1,100

Total perquisite = ₹2,600.

Sale-1 (3 Jun 2022): Holding < 24 months → STCG at slab; STCG = (₹80 − ₹55) × 85 = ₹2,125.

Sale-2 (20 Nov 2024): Holding > 24 months → LTCG @ 12.5%; LTCG = (₹90 − ₹55) × 35 = ₹1,225.

Example C — Cross-border ESOP (US-listed parent; apportionment + FTC)

Vesting: 24 months (10 in India; 14 in Germany)

Exercise: 15 Mar 2025; FMV $120; Strike $70; Shares 100; FX ₹84/$

Sale later at $150; assume Indian resident at sale

Perquisite (gross INR) = ($120 − $70) × 100 × ₹84 = ₹4,20,000.

Apportionment: India 10/24 = 41.67% potentially taxable in India; remainder in Germany (subject to treaty).

Currency conversion: Rule 115 on relevant dates (exercise for salary; sale for gains).

FTC: If both countries tax, file Form 67 within timelines; keep foreign tax certificates.

Foreign assets: Report holdings in Schedule FA (calendar-year basis).

Cross-Border ESOPs: What Really Matters

• Determine residency separately at exercise/settlement and at sale—these are independent taxable events.

• Use workdays during vesting to apportion perquisite across countries; maintain a day-count table.

• Follow Rule 128 for foreign tax credit. File Form 67 within permitted timelines (best practice: before filing ITR).

• Schedule FA follows calendar-year disclosure; reconcile opening → additions → disposals → closing.

Funding the Exercise: Sell-to-Cover & Cash Planning

At exercise/settlement, you can either:

• Fund from pocket: Arrange exercise price (if any) + TDS. Outward remittances for foreign plans can trigger TCS if annual thresholds are crossed.

• Sell-to-cover: Broker/company sells a portion of delivered shares to fund TDS; you receive net shares. For clarity, disclose the same-day sale leg as STCG with sale value = FMV and cost = the same FMV (gain ≈ nil).

Mini Q&A — Sell-to-Cover: How do I disclose it?

Q1. Does sell-to-cover create capital gains?

A. Technically yes, but because sale occurs at ~FMV on the same day as acquisition, gain ≈ nil.

Q2. How do I show it in my return?

A. Add an STCG line with sale value = FMV and cost = FMV (exercise/settlement day). Keep broker contract note + perquisite working.

Q3. Why is the cost equal to FMV?

A. The exercise-day FMV used for perquisite becomes your cost of acquisition for capital gains.

Compliance—Documents & Return-Filing Workflow for ESOP

Employee documents:

• Grant/vesting/exercise/settlement letters; FMV workings

• Form 16 + Form 12BA (perquisite details)

• Broker/ESOP portal statements; contract notes for each sale

• Dividend statements; foreign tax certificates (for FTC)

• For foreign shares: year-end quantity reconciliation (opening/purchases/sales/closing)

Employer processes:

• Clear plan rules (lock-ins, forfeiture, transferability); employee FAQs

• Independent valuations for unlisted companies; robust TDS workings; timely Form 16/12BA

• SEBI/ROC compliance where applicable

ITR steps:

1) Map exercise/settlement and sale dates

2) Convert forex using Rule 115 on correct dates

3) Report perquisite under Salary (startup deferral schedule where applicable)

4) Report capital gains using FMV at exercise as cost; classify ST/LT correctly

5) Foreign items: Schedule FA (calendar year) + FSI/TR + Form 67 for FTC within timelines

6) Add brief Notes to Computation explaining cross-border apportionment/treaty basis when relevant

Recent Legal Developments (why they matter)

• FMV during lock-ins: Delhi HC (Ravi Kumar Sinha) held that shares under complete transfer embargo lacked marketability; perquisite could not be benchmarked to a free-trade market price. Preserve plan/trust documents if you take this position.

• One-time “option value loss” compensation: Courts have differed on salary vs capital character. If you receive such a payout, prepare a short tax-position memo and expect scrutiny until a higher-court view settles the issue.

Practical Playbook for ESOP (timing, cash-flow, risk)

• Exercise timing: Consider slab rate now vs next FY, cash flow for TDS, and company outlook.

• Sale timing: Watch holding-period thresholds and the 23-Jul-2024 rate switch for listed assets.

• Mobility planning: If moving in/out of India, revisit vesting/exercise to control apportionment and double-tax risk.

• Diversification: Avoid over-exposure to a single stock post-exercise.

• Paper trail: Clean records end many queries before they start.

Conclusion

ESOP can genuinely create wealth—and loyalty—when handled well. Think of them as a two-event tax story: (1) Exercise/settlement → Salary (perquisite); and (2) Sale → Capital gains (with exercise-day FMV as your cost). Layer in residency, sourcing, and treaty rules for cross-border cases; maintain spotless documentation; respect rate windows and holding periods; and, where facts are unusual (lock-ins, one-off compensation, multi-country vesting), document your position and be ready to explain it. Do this consistently, and you’ll keep friction low while preserving the upside that equity compensation is meant to deliver.

FAQs-ESOP taxation in India 2025

Do I pay tax twice on ESOPs?

Yes—once as salary/perquisite at exercise/settlement, and again as capital gains on sale, using the exercise-day FMV as cost

RSUs vs Options—how does tax differ?

Both trigger perquisite at settlement/exercise; RSUs have no exercise price so the entire FMV is perquisite. Later sale → capital gains.

I used sell-to-cover. Any capital gains?

The sale is a transfer but usually at the same FMV as your cost on the same day; gain ≈ nil. Disclose as STCG with sale = cost = FMV.

How do I convert USD amounts for tax?

Use Rule 115 TTBR on the relevant date—exercise for salary, sale for capital gains.

Missed Form 67—can I still get FTC?

Post-2022 amendment, filing till the end of the assessment year can still allow FTC, but best practice is before filing your ITR.

Are foreign ESOPs taxable in India if I am resident?

Generally yes (global income). Complete Schedule FA/FSI/TR and claim FTC where eligible.

What are the current equity capital-gains rates?

For transfers on/after 23-Jul-2024: STCG 20% (111A) and LTCG 12.5% (112A) with ₹1.25 lakh exemption; earlier transfers: 15%/10%.

When is long-term classification achieved?

Listed equity: ≥ 12 months; Unlisted/foreign: ≥ 24 months.

Disclaimer

This article is for general information and does not constitute professional advice. Tax rules change via Finance Acts, CBDT notifications, and judicial decisions. Verify the latest provisions or consult a qualified professional for your specific case. TaxBizMantra is not responsible for decisions made solely on this content.

Further Reading

Income Tax Slabs for AY 2026–27

Sources & References

Taxation of Employee Stock Option Plan (ESOP- Income tax Department