An emergency fund is your financial airbag. It doesn’t look exciting on a statement, but when life slams the brakes—job loss, medical bills, urgent repairs—it keeps you out of high-interest debt. In 2025 India, UPI makes spending effortless, credit cards hover around 36% p.a. if you revolve, and BNPL is common. As per my experience, people don’t skip building an emergency fund because they’re careless; they skip it because it feels vague: how much is enough, where to keep it, and whether it will hurt returns. This emergency fund India guide explains how much emergency fund you need, where to keep it, and how to refill it fast.

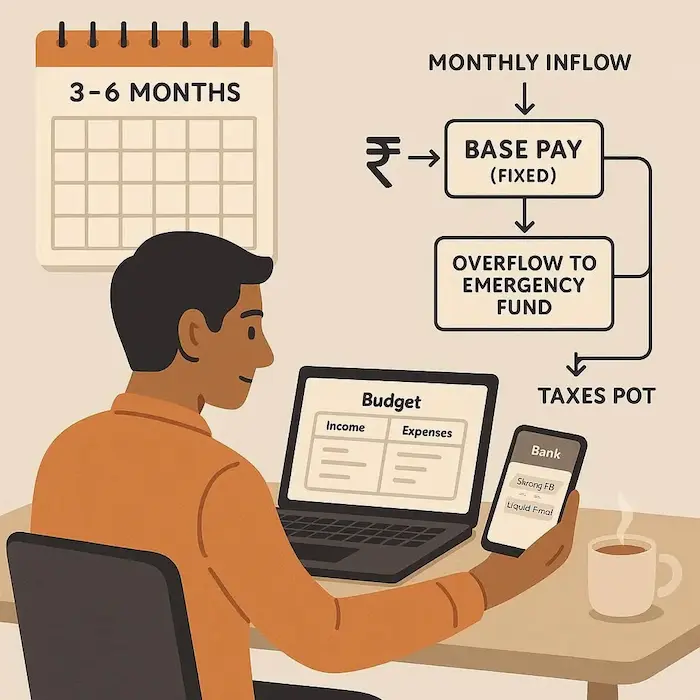

Based on the facts and widely-accepted practices, most salaried households do well with 3–6 months of core expenses, while freelancers and business owners stay safer at 6–12 months because income is lumpy. The key is to reach that number in stages and park it smartly—one month in instant cash, the rest in low-volatility near-cash—so it’s liquid, safe, and still earns a reasonable return. This guide covers sizing, parking layers, usage rules, refill strategy, and role-specific steps that fit naturally with a four-bucket budget and a five-jar banking flow. For quick clarity on how much emergency fund to target, think in 3–6 months expenses for salaried and higher for variable incomes.

TL;DR / Executive Summary

Think of this as your two-minute brief before you implement. It answers how much emergency fund is prudent in India and compares liquid fund vs FD with a sweep FD India option for instant access. A simple rule of thumb is 3–6 months expenses for most salaried households.

- Target size: Salaried (stable) 3–6 months; single-income with dependents 4–8 months; freelancers/business owners 6–12 months; students start with ₹25k → ₹50k → one month.

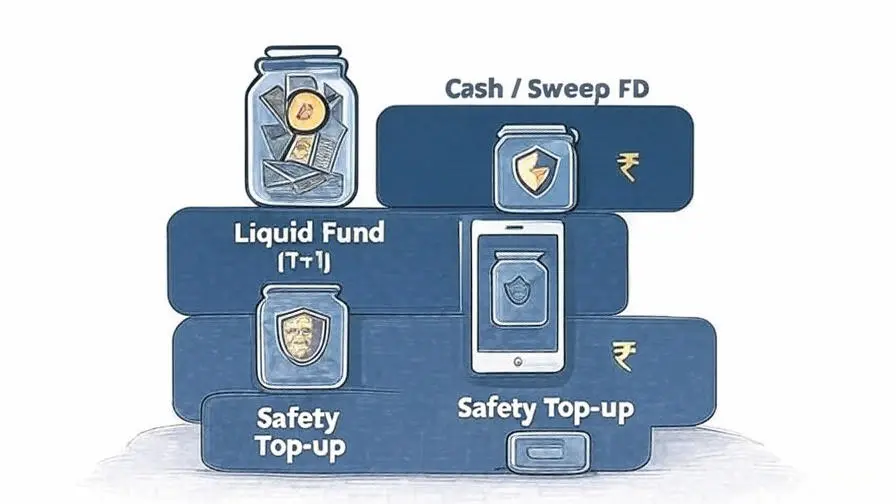

- Parking mix: First month in savings/sweep FD (instant access); remainder in liquid or ultra-short duration debt funds (quick redemption, low volatility).

- Funding plan: Pay-Yourself-First transfers on salary +1; weekly UPI caps; windfalls via a pre-decided split (e.g., 60% Emergency, 30% Goals, 10% Treats).

- Usage rules: Only for true emergencies (income loss, medical need, essential repair). Refill on priority; keep SIPs alive if possible.

Why an Emergency Fund Comes First

An emergency fund is not a return-maximizer; it’s a risk controller. Without it, small shocks become costly debt spirals. With it, you protect SIP discipline, avoid distress selling, and keep choices calm when life is not. Think of it as the seatbelt for your wallet—boring until it saves you. A resilient emergency fund India setup protects compounding without chasing risky returns.

- Prevents high-interest borrowing during shocks (credit cards ~36% p.a. if revolved).

- Keeps SIPs running through rough patches so compounding continues.

- Reduces decision stress; emergencies turn into logistics, not crises.

Example: Priya faces a scooter breakdown and an unexpected medical bill in the same week, but because she kept one month of expenses in savings and the next two months in a liquid fund, she pays immediately without touching credit, keeps SIPs running, and refills the fund over the next quarter by tightening weekend spends and routing part of her bonus to the cushion.

How Much Is Enough (for You)

Your number should reflect your life, not a generic percentage. Calculate core expenses, pick a sensible months-of-cover band based on stability and dependents, and set stepping-stone milestones so progress feels achievable. If you are wondering how much emergency fund to hold, start with 3–6 months expenses and adjust for dependents and job stability.

- List core monthly expenses: rent/EMI, utilities, groceries, medicines, essential transport, insurance, school fees.

- Pick cover months: stable job 3–6; single income with dependents 4–8; freelance/business 6–12; add a buffer for medical needs.

- Set milestones: one month first, then three months, then the full target in 12–24 months.

Example: Arjun’s family spends ₹82,000 a month on core needs and relies on one salary while supporting parents, so he targets six months, or ₹4.92 lakh; he plans stepping stones—₹1 lakh in 90 days, ₹2.5 lakh in a year, and full six months in two years—so the goal is big but never overwhelming.

Where to Park the Money (Layered Approach)

Park the money in layers so you get speed for midnight emergencies and better yield for the rest. Liquidity and safety come first; returns are a bonus. This section compares liquid fund vs FD and shows how a sweep FD India can serve as Layer 1 for instant access.

Layer 1 — Immediate cash (one month of expenses):

- Savings account or sweep FD linked to your bank for on-demand access.

- Keep this in a Bills or dedicated Emergency sub-account for clarity.

Layer 2 — Near-cash (remaining months):

- Liquid or ultra-short duration debt mutual funds (low volatility, T+1/T+2 redemption).

- Check expense ratios, exit loads, and redemption timelines; avoid complexity.

Optional Layer — Bridge:

- If available, a small overdraft against FD at low spread can bridge while you redeem from the fund.

Example: Kabir keeps ₹90,000 (one month) across savings and a sweep FD for instant access and parks the remaining ₹2.7 lakh of his target in a liquid fund, so midnight emergencies are covered from savings while the fund tops up the account the next business day without panic or performance-chasing.

Build It Fast (Without Breaking Your Budget)

You don’t need a lump sum; you need reliable inflow and a few smart levers. Automate the base, use weekly caps to control micro-spends, and pre-decide windfall splits so “extra money” behaves. These steps work for everyone, including a practical emergency fund for freelancers with lumpy invoices.

- Pay-Yourself-First: auto-transfer on salary +1 into your Emergency pot.

- Weekly UPI cap in a separate Daily Spend account; roll any leftover to the Emergency pot on Sundays.

- Windfalls (bonus, refund): pre-decide a split, e.g., 60% Emergency, 30% Goals, 10% Treats.

- If you carry expensive debt, build a mini-fund (₹25k–₹50k), clear the debt aggressively, then scale the fund.

Example: Riya sets a ₹5,000 weekly UPI cap, routes any leftover to her Emergency pot every Sunday, sends 60% of her bonus there by rule, and trims ride-hailing for three months, and these small moves add roughly ₹1.2 lakh in 10 months without touching her SIPs.

When to Use It (and How to Refill)

Define “emergency” before the crisis so you don’t second-guess under stress. Use the fund only for true shocks, refill it on priority, and try to keep your investing habit alive. Clear rules ensure your emergency fund India is used only when it truly matters.

- Use for income loss, urgent medical needs, and essential home/vehicle repairs affecting safety or earning ability.

- Do not use for planned expenses—cover those with Sinking Funds.

- After use, pause non-essentials, redirect surplus to refill first, and add a calendar reminder for monthly top-ups.

Example: Imran needs ₹28,000 for a critical car repair he depends on for work, so he draws from Layer 1 savings and schedules a redemption from his liquid fund; he then refills over two months by cutting online shopping by ₹1,500 a week and allocating most of a festival bonus to restore the cushion.

Special Cases & Smart Tweaks

Adjust the target and parking to match your season of life. Students and dual-income couples can start smaller; freelancers and those with health considerations should aim higher. This is especially relevant when designing an emergency fund for freelancers and solo business owners.

- Students/first job: start with ₹25k → ₹50k → one month; park in savings/sweep, consider a liquid fund after ₹75k–₹1 lakh.

- Dual-income households: if both jobs are secure, 3–4 months can be fine; if one income is variable, target 5–8 months.

- Freelancers/business owners: Base-Pay model; keep two months of Base Pay in savings/sweep and the balance in a liquid fund; ring-fence 30% of each receipt for taxes.

- Health considerations: push toward the upper band and ensure health insurance is active; premiums belong in Sinking Funds, not the emergency pot.

Example: Tanvi and Rohit both work in tech with similar salaries, so they agree to maintain four months of core expenses—one month in savings and three months in a liquid fund—and because both are insured and employable, they avoid overfunding while still sleeping well.

Practical Application — Step-by-Step by Profile

Copy these steps into your notes; execute this week. The aim is momentum, not perfection. Use them to size how much emergency fund you need and to choose liquid fund vs FD sensibly.

Students & First-Jobbers

- Compute core monthly spend (hostel/food/phone/commute).

- Target ₹25k → ₹50k → one month; park in savings/sweep.

- Auto-transfer ₹1,000–₹2,000 on salary day; cap UPI weekly.

- On windfalls, route 60% to the fund until one month is done.

Example: Aman earns ₹24,000 net in Bengaluru, caps UPI at ₹1,500 per week, moves ₹2,000 monthly to the emergency pot, and commits 60% of stipend increases to the fund, and in 10 months he crosses ₹20,000 while still investing ₹2,000 a month via SIP.

Salaried Professionals (Mid-Career)

- List core expenses; pick a 3–6 month target.

- Keep one month in savings/sweep; rest in a liquid fund.

- Set a standing instruction on salary +1; place SIPs on 2nd–5th.

- Use windfalls with a pre-decided split to reach target faster.

Example: Shreya targets ₹4.8 lakh (six months), keeps ₹80,000 in savings/sweep and the balance in a liquid fund, funds ₹30,000 monthly via Pay-Yourself-First, and directs half her bonus to the emergency pot, and she reaches her goal in 16 months without interrupting equity SIPs.

Business Owners / Freelancers

- Compute Base Pay from 6-month receipts; target 6–12 months.

- Hold two months of Base Pay in savings/sweep; rest in a liquid fund.

- Route 30% of each receipt to a separate Tax account.

- During lean months, draw from the fund; refill after peak invoices.

Example: Dev pays himself ₹90,000 Base Pay, holds ₹1.8 lakh in savings/sweep and ₹3.6 lakh in a liquid fund toward a 6-month goal, and since 30% tax is ring-fenced at receipt, he never dips into emergency money to pay dues even when clients pay late.

Chartered Accountants (Practice & Industry)

- Practice owners: tie target to 2–3 months of operating draw and monitor receivables to reduce shocks.

- Industry CAs: set 3–6 months and automate refill after any use.

- Pair with a Sinking Fund for premiums, software renewals, and annual dues.

Example: Maya keeps three months of household core costs across savings and a liquid fund and a separate software-renewal sinking fund, and when she paid for an unexpected medical test, she refilled the emergency pot using the next bonus per her pre-set 60/30/10 rule.

Conclusion

In my view, an emergency fund feels boring—until it becomes the most comforting thing you own. It’s the quiet buffer that lets you make good decisions when life gets loud. As per my experience, the people who win with money rarely have perfect investments; they have reliable cushions and repeatable systems. Done right, an emergency fund India plan is the most calming line in your personal finances.

Build the fund in stages, park it in layers, and protect it with clear usage rules. Link it tightly with your budget: put the monthly transfer on salary +1 day, keep one month instantly available, and place the remainder in a liquid fund. When a real emergency hits, use it without guilt, then refill with intent.

Finally, connect this with your five-jar banking flow and Sinking Funds so emergencies and annual costs never collide. That’s when money stops being a source of stress and becomes a dependable teammate.

FAQ

Q: How many months of expenses should I keep in an emergency fund?

A: For most salaried households, 3–6 months works well; single-income families with dependents often prefer 6 months; freelancers and business owners target 6–12 months due to lumpy income. Think in stages: reach one month first, then three, then the full target so you stay motivated and don’t disrupt SIPs or essential living. This 3–6 months expenses guidance is a practical emergency fund India benchmark.

Q: What qualifies as a true emergency?

A: Income loss, urgent medical needs, and essential home or vehicle repairs that affect safety or earning ability are true emergencies. Planned costs—vacations, annual premiums, festival shopping—belong in Sinking Funds, not in the emergency pot. This boundary keeps the cushion intact for life’s surprises rather than predictable events.

Q: Should EMIs be included in my emergency fund calculation?

A: Yes. If an expense continues during a crisis, include it. EMIs, insurance premiums, school fees, groceries, utilities, and essential transport are part of core monthly needs. If you exclude EMIs, you risk late fees or defaults at the worst time, which can hurt your credit and add penalties.

Q: Where should I keep the first month of the fund?

A: Use a savings account or a sweep FD tied to your bank for instant access. This ‘Layer 1’ handles midnight emergencies and weekends. Keep the rest in a liquid or ultra-short duration debt fund to balance safety, quick redemption, and a reasonable return without taking equity risk. This balances liquid fund vs FD by keeping Layer 1 in cash or sweep FD India and Layer 2 in a liquid fund.

Q: Are liquid funds safe enough for emergencies?

A: They are designed for low volatility and quick redemption, but they are not guaranteed like bank deposits. That’s why one month stays in cash or sweep FD, and the remainder goes to the fund. Always read the scheme document, check expenses and exit loads, and avoid over-concentration in any single issuer.

Q: What if I have credit card debt—should I still build the fund?

A: Build a mini emergency fund of ₹25k–₹50k to handle small shocks, then pay down the card using Avalanche or Snowball. Once the card hits zero, scale the fund to 3–6 months. This sequence balances urgency (high-interest debt) with safety (small cushion) without getting trapped in revolving interest. This sequencing keeps the emergency fund India intact while you clear high-interest dues.

Q: How quickly can I build it realistically?

A: A blended method works: a Pay-Yourself-First transfer on salary +1, a weekly UPI cap with leftovers swept to the fund, and a fixed windfall rule like 60/30/10 (Emergency/Goals/Treats). Most households can reach one month in 3–6 months and three months within 12–18 months depending on income and discipline. It also answers how much emergency fund to accumulate first—one month—then scale to 3–6 months expenses.

Q: Should I invest part of it in equity for higher returns?

A: No. The emergency fund’s job is certainty and fast access, not high returns. Equity can drop sharply at the same time a personal crisis strikes. Keep equity for long-term goals like retirement or education; keep the emergency money in cash/sweep and low-volatility debt funds.

Q: Is a fixed deposit better than a liquid fund?

A: For immediate access, a savings account or sweep FD is excellent. For the remaining months, a liquid or ultra-short fund offers flexibility and competitive post-tax outcomes. Many households blend both—FD for Layer 1 immediacy and a liquid fund for Layer 2—so choose based on comfort, access, and tax bracket.

Q: How are taxes handled on the emergency fund?

A: Interest on savings/FDs is taxed per your slab, while debt fund taxation depends on holding and current rules. Treat returns as secondary to liquidity and safety. The small yield difference should not drive decisions here; the priority is instant or near-instant access when trouble hits.

Q: Can I combine emergency and sinking funds?

A: Keep them separate. Sinking Funds are for predictable non-monthly costs (premiums, school fees, festival travel), while the Emergency Fund is for surprises. Combining them often leads to accidental spending of your safety net on predictable bills, leaving you exposed during real emergencies. This preserves your emergency fund India from being drained by predictable bills.

Q: What happens after I reach the target?

A: Redirect new contributions back to Goals (SIPs/NPS/PPF). Maintain the emergency fund by topping up only when expenses rise or after you use it. Review quarterly to ensure the amount still matches your life, and keep Layer 1 at one month for immediate needs.

Q: How do I refill after using the fund?

A: Make it a priority line item: temporarily reduce Wants, increase your Pay-Yourself-First transfer, and route windfalls primarily to the emergency pot until it’s back at target. Most moderate withdrawals can be restored in 2–4 months if you follow Weekly 10 and Monthly 30 reviews.

Q: Is cash at home necessary?

A: Keep only a small amount (₹3,000–₹10,000) for brief outages or local emergencies. Otherwise rely on digital access to savings/sweep and your liquid fund. Too much cash at home invites theft/loss risk and earns nothing, which weakens your overall plan over time.

Q: How does health insurance interact with the emergency fund?

A: Health insurance covers big bills, while the emergency fund covers deductibles, co-pays, travel to hospitals, medicines not covered, and post-discharge costs. Keep premiums in a Sinking Fund so you don’t raid the emergency pot, and review coverage annually to match your family’s needs. Together they form a robust emergency fund India framework for medical surprises.

Disclaimer

This article is educational and general in nature. Personal finances vary by person, city, and life stage. Please consider your risk profile, liabilities, and tax situation before acting. Investments are subject to market risks. When in doubt, speak with a qualified adviser.

Further Reading

Sources & References

- AMFI — https://www.amfiindia.com

- PFRDA FAQ — https://www.pfrda.org.in

- IRDAI FAQ— https://irdai.gov.in