Section 94B Thin Capitalisation: Why This Rule Matters in India

Across the world, governments are grappling with a common challenge: multinational enterprises (MNEs) shifting profits out of operating jurisdictions without moving real economic activity. In India, this problem became most visible through thin capitalisation arrangements, where foreign groups loaded their Indian subsidiaries with excessive intra-group debt to drain taxable profits.

Why debt? Because interest is deductible.

Why not equity? Because dividends are not.

This imbalance created a straightforward tax arbitrage that enabled companies to reduce taxable profits in India, move income to low-tax jurisdictions, and present financial results that appeared weak not because operations were poor, but because financing was deliberately structured to erode the tax base.

As economic activity grew in India but taxable profits migrated abroad, the government recognised the widening disconnect. To address this, the Finance Act 2017 introduced Section 94B Thin Capitalisation rules, aligned with the OECD’s BEPS Action Plan 4. The provision restricts interest deduction to 30% of EBITDA whenever borrowing is influenced by a non-resident Associated Enterprise (AE), directly or indirectly.

In a single step, India put in place a rule designed to:

- Protect its tax base from artificial erosion

- Prevent excessive interest deductions through related-party debt

- Promote responsible cross-border financing

- Align domestic law with modern international tax standards

Section 94B is far more than a mathematical limitation. It marks a fundamental shift in how India evaluates debt, equity, and fairness in international taxation, ensuring that income is taxed where economic activity—and not just paper financing—actually occurs.

OECD BEPS Background – How Excessive Debt Became a Global Tax Loophole

The roots of Section 94B lie in a global movement to combat profit shifting through financial structuring. The OECD BEPS Project, launched in 2013, studied how MNEs manipulated debt to reduce tax liability in high-tax jurisdictions. BEPS Action Plan 4 specifically targeted the use of excessive interest deductions as a tax-avoidance strategy.

What OECD Observed Globally

- Subsidiaries were being loaded with disproportionate intra-group debt.

- Groups created back-to-back loans, using banks only as intermediaries.

- Interest rates charged by AEs often exceeded market norms.

- High interest deductions produced artificial operating losses.

- Profits shifted to low-tax or no-tax jurisdictions.

To curb this, OECD recommended that all countries adopt a fixed ratio rule, limiting interest deductions to a percentage of EBITDA — generally 10% to 30%.

Why India Followed the OECD Framework

India faced the same challenges, especially in:

- Infrastructure

- Energy & EPC

- Technology subsidiaries

- Highly leveraged MNC-controlled manufacturing units

Excessive debt enabled profit shifting on a scale that threatened the domestic tax base.

Therefore, India implemented Section 94B with the following BEPS-aligned features:

| OECD Recommendation | India’s Implementation (Section 94B) |

|---|---|

| Limit interest deduction to 10–30% of EBITDA | 30% of EBITDA |

| Cover AE-influenced third-party loans | Covered via deeming rule |

| Allow carry-forward of disallowed interest | Allowed for 8 years |

| Exclude regulated financial sectors | Banking & insurance excluded |

With this, India joined a globally coordinated effort to restrict profit shifting through debt structuring.

What Is Thin Capitalisation?

Thin capitalisation refers to a situation where a company is financed with much more debt than equity, especially when the debt comes from a related party. This has a critical tax implication:

- Equity returns (dividends) are not deductible.

- Debt returns (interest) are fully deductible.

Multinationals exploited this difference by deliberately undercapitalising their subsidiaries and loading them with AE loans. The higher the debt, the higher the deductible interest — and the lower the taxable profit in India.

Why Thin Capitalisation Is a Problem

- Erodes taxable income in India even when the subsidiary performs well.

- Shifts profits offshore as interest flows to parent entities or group companies.

- Creates unfair advantage over purely domestic businesses that rely on market borrowing.

- Distorts financial statements, making companies appear more leveraged than they actually are.

- Reduces transparency in analysing profitability and capital structure.

Illustration of Pre-94B Profit Shifting

Before Section 94B, it was common for a foreign parent to:

- Invest only ₹10 crore as equity,

- Provide ₹200 crore as intercompany loan,

- Charge high interest (say 12%–15%),

- Deduct huge interest in India,

- Book income abroad where tax rates were lower.

A profitable Indian company could report little to no taxable income due to interest deductions engineered by the group treasury.

Why Section 94B Was Needed

- Transfer Pricing rules alone could not fully curb debt structuring.

- Interest benchmarking was not enough when the quantum of debt itself was excessive.

- India needed a mechanical, objective rule to restrict deductions.

- OECD’s fixed ratio rule offered the solution — cap interest deduction based on EBITDA.

Section 94B now ensures that operating profit, not group structuring, determines how much interest deduction is allowable.age.

When Does Section 94B Apply? – Scope & Trigger Points Clearly Explained

This provision does not apply to all businesses or all interest. It applies only where there is a risk of base erosion.

Applicable Entities

- Indian companies

- Permanent Establishments (PEs) of foreign companies

Trigger Condition: Interest > ₹1 crore

Section 94B applies if AE-linked interest exceeds ₹1 crore in a financial year.

Direct and Deemed AE Debt

94B applies when:

- A loan is taken directly from a non-resident AE, OR

- A loan is taken from any third-party lender but the AE:

- Guarantees it

- Provides security

- Issues comfort letters

- Deposits matching funds

This prevents back-door structuring where AE influence is hidden behind a bank loan.

Exclusions

Section 94B does not apply to:

- Banking companies

- Insurance companies

These industries operate under regulated leverage norms and must maintain high debt levels legitimately.

Associated Enterprise (AE) – Practical and Realistic Understanding Under Section 92A

Section 92A defines AE in a broad manner, covering ownership, control, management, financial dependence, and commercial dependence.

Examples of AE relationships:

- Parent company holding 26%+ voting rights

- Companies under common shareholding

- Entities where one participates in management decisions of the other

- A lender that guarantees or funds 51%+ of total debt

- Exclusive distribution or procurement relationships

- IP licensing arrangements creating economic dependence

In Section 94B, AE determination is crucial because the rule applies only to non-resident AEs or loans influenced by them.

Even implicit guarantees may create AE linkage if behaviour shows reliance on the AE.

Please refer bare act definition from Income Tax Act. Meaning of associated enterprise.

What Counts as “Debt” and “Interest”? – Understanding the Breadth of Section 94B

6.1 Debt Includes Much More Than Loans

“Debt” under 94B includes:

- Traditional loans

- Finance leases

- Financial instruments with interest elements

- Back-to-back arrangements

- Hybrid instruments

- Any arrangement generating deductible finance charges

6.2 Interest or Similar Nature Includes:

- Interest paid to AEs

- Interest paid to banks where AE guarantee exists

- Guarantee fees

- Arrangement/commitment fees

- Premium/discount on debt instruments

- Any borrowing-related charge that is deductible

What Is Excluded?

- Interest to Indian banks without AE involvement

- Interest to domestic NBFCs without AE influence

- Capitalised interest not debited to P&L

This ensures the rule targets foreign-linked structuring, not routine domestic financing.

How to Calculate EBITDA for Section 94B – Teacher Style Explanation

EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation) is the anchor of Section 94B.

The logic is simple: interest deduction must depend on operational performance.

EBITDA = PBT + Interest + Depreciation + Amortisation

Key Points:

- Add back all interest, not just AE interest.

- Remove extraordinary items from PBT.

- Apply Transfer Pricing adjustments first.

- EBITDA cannot be negative (in practice, deduction becomes zero).

Example of EBITDA Calculation

PBT: 50

Interest: 75

Depreciation: 15

Amortisation: 5

EBITDA = ₹145 crore

This forms the backbone of the 30% limitation rule.

Numerical Example

Suppose below is the data of A Ltd .

- PBT: ₹50 crore

- Depreciation: ₹15 crore

- Amortisation: ₹5 crore

- Total Interest: ₹75 crore

- AE interest: ₹40 crore

- AE-guaranteed bank interest: ₹10 crore

- Domestic interest: ₹25 crore

Step 1: EBITDA

= 50 + 75 + 15 + 5 = ₹145 crore

Step 2: AE-linked interest

= 40 + 10 = ₹50 crore

Step 3: 30% of EBITDA

= 30% × 145 = ₹43.5 crore

Step 4: Allowed vs Disallowed

Allowed = 43.5 crore

Disallowed = 6.5 crore

Step 5: Domestic interest

₹25 crore allowed fully outside 94B.

The 30% Interest Deduction Rule – The Core of Section 94B

The law imposes a limit:

Allowed Interest = Lower of:

- 30% of EBITDA

- AE-linked interest

This ensures deduction cannot exceed operational capacity.

Why 30%?

- OECD recommended 10%–30%

- India chose flexibility with anti-abuse strength

Practical Impact

If AE interest is low → cap is AE interest

If AE interest is high → cap is 30% EBITDA

It is a self-adjusting rule that adapts to real business performance.

Carry Forward of Disallowed Interest

Disallowed interest is not lost permanently.

It can be carried forward for eight years, and claimed when:

- EBITDA improves, and

- AE interest falls below 30% of EBITDA

This keeps the rule fair for businesses experiencing temporary downturns.

Taxpayers must track this year-wise, similar to business losses.

Common Mistakes & Litigation Risks Under Section 94B

Although Section 94B appears numerical and straightforward, most disputes arise not from the 30% EBITDA formula but from errors in identifying AE involvement, misclassifying interest, incorrect EBITDA computation, and inadequate documentation. Tax authorities increasingly scrutinise thin capitalisation arrangements, and many assessments turn adverse simply because taxpayers underestimate how broadly Section 94B operates. Below are the most frequent mistakes and litigation triggers.

1. Misidentifying AE-Linked Debt

A major source of litigation is misunderstanding what qualifies as AE-linked borrowing. Taxpayers often assume Section 94B applies only to direct loans from non-resident AEs, but the law clearly covers third-party loans guaranteed, supported, or influenced by an AE. Risks arise when:

- AE issues a guarantee or comfort letter

- AE provides security or matching deposits

- Group treasury participates in loan negotiations

- “Non-binding” letters are treated by officers as implicit guarantees

Even indirect AE influence may cause a domestic loan to be recharacterised as AE debt.

2. Misclassification of Interest or Finance Charges

Section 94B applies to “interest or of similar nature,” a phrase interpreted broadly. Litigation commonly occurs when companies fail to treat the following as AE-linked interest:

- Guarantee fees

- Arrangement fees or commitment charges

- Discount or premium on debt instruments

- Other borrowing-related finance charges

These items often push AE interest above the ₹1 crore threshold unexpectedly.

3. Incorrect EBITDA Computation

Disputes arise when EBITDA is computed incorrectly due to:

- Using accounting EBITDA instead of statutory computation

- Including extraordinary items

- Excluding amortisation or certain depreciation

- Ignoring transfer pricing adjustments before applying 94B

Even small computational errors can materially impact allowable interest.

4. Weak Documentation and Evidence

Tax authorities frequently request extensive documentation. Litigation risk increases when companies cannot produce:

- AE guarantee agreements

- Sanction letters showing AE involvement

- Treasury emails or internal approvals

- TP benchmarking and interest workings

In the absence of clear evidence, officers often infer AE influence.

5. Poor Tracking of Disallowed Interest

Many taxpayers fail to maintain proper year-wise tracking of carried-forward disallowed interest, leading to incorrect claims or forfeiture of deductions.

Compliance Requirements & Practical Challenges – What Tax Teams Must Prepare For

Taxpayers must maintain robust documentation because assessments often focus on:

- Proof of AE guarantee or influence

- Loan sanction terms

- Intercompany agreements

- Email correspondence showing treasury involvement

- Transfer pricing benchmarking

- Detailed EBITDA calculation workings

- Year-wise tracking of disallowed interest

Typical challenges include:

- Mixing AE and non-AE interest

- Treating comfort letters as non-binding (officers treat them as guarantees)

- Missing TP adjustments

- Miscomputing EBITDA

- Inadequate documentation of AE involvement

Strong treasury–tax team coordination is essential.

FAQs – The Questions Taxpayers Ask Most

Does Section 94B apply to domestic bank loans?

Only if a foreign AE guarantees or influences the loan.

Is the ₹1 crore threshold based on total interest?

No, only AE-linked interest.

Are capitalised interest expenses included?

No, if not debited to P&L.

Does Transfer Pricing override 94B?

No—TP applies first, then 94B.

Can disallowed interest be carried forward indefinitely?

No, max 8 years.

Do comfort letters count as guarantees?

Often yes, depending on facts.

Does 94B apply to startups funded by foreign VCs?

Yes, if debt is AE-linked; equity funding is not affected.

Does 94B apply even if interest rate is at arm’s length?

Yes. TP checks rate; 94B checks quantum.

Does the rule apply to LLPs?

No, only companies and PEs.

Can Indian subsidiaries rely only on equity to avoid 94B?

Yes—94B applies only to debt-linked financing.

Do hybrid instruments count as debt?

If they create deductible interest-like charges, yes.

Conclusion – India’s Push Toward Responsible Cross-Border Financing

Section 94B is far more than a numerical limitation.

It signals India’s commitment to:

- Transparency

- Substance over form

- Fair taxation

- OECD-aligned global standards

The rule does not discourage borrowing.

It discourages tax-motivated borrowing.

For multinationals, it means capital structures must now reflect genuine business needs.

For taxpayers, it means better documentation, more careful planning, and a clearer understanding of AE influence.

For India, Section 94B safeguards revenue, enhances credibility, and ensures profits are taxed where value is created.

Related Reading

- Intimation Notice U/s 143(1): Meaning & Best Process Guide 2025

- Best Guide For ESOP Tax In India 2025: Rules, Rates & Filing

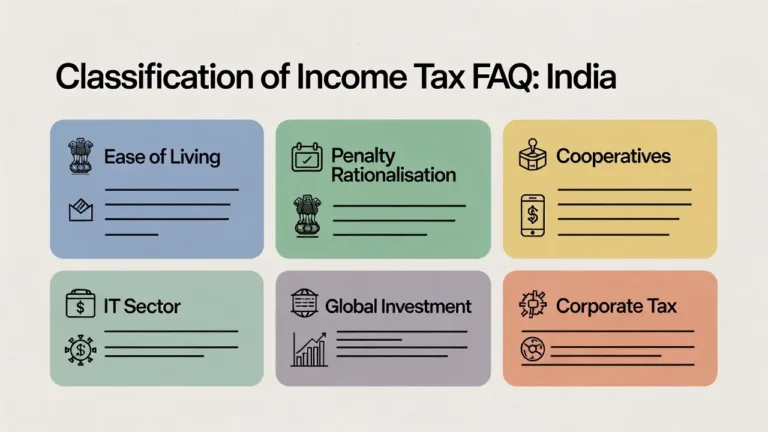

- Income Tax FAQs India – Clear Answers For Finance Act 2025

Disclaimer: This article is for educational purposes only and should not be treated as professional tax advice. Please consult a qualified advisor before taking any action.