Implementing Lean Six Sigma in Finance Teams: A Practical Guide

Month‑end shouldn’t feel like a fire drill. Fix one finance process in 90 days with lean six sigma finance India—TAT reduction, higher FPY, calmer audits, and visible COPQ savings.

Month‑end shouldn’t feel like a fire drill. Fix one finance process in 90 days with lean six sigma finance India—TAT reduction, higher FPY, calmer audits, and visible COPQ savings.

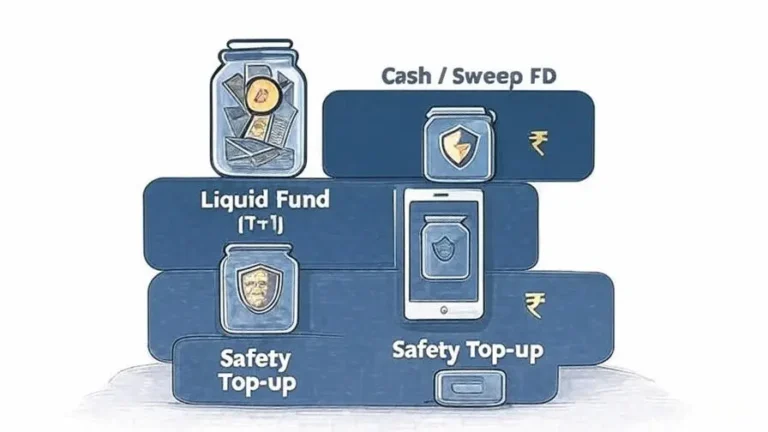

A practical guide to size, park, and protect your emergency fund in India—layered for liquidity and linked to your budget’s five-jar flow.

Tired of budgets that die by Day 10? India’s 4-bucket, 5-jar system tames UPI, automates SIPs, and brings calm to money—starting today

Stop chasing hot picks. Build a resilient India-2025 portfolio—equity (India+global), TMFs, a measured gold sleeve, and cash for action. Learn the exact weights and rules.

If cash is the lifeblood of your business, invoice quality is the artery. Most delays in collections are not disputes about value, they are preventable errors: wrong GSTIN, missing PO, mismatched quantities, IRN rejection, or no proof of delivery. This Invoice-Defects Tracker gives finance and sales…

Get a lender-grade 13-week cash flow forecast for India. One-page summary, MSME/GST cadence, UPI/TReDS, OD/CC headroom and breach flags. Free Excel download.

This guide turns cash timing from a headache into a habit. Learn the 13-week cash flow method for India with a step-by-step template, exact formulas, AR ageing collection patterns, and UPI/TReDS tactics. Includes a fully worked example, playbooks, pitfalls, and a simple Friday cadence you can run every week.

Working capital is cash trapped in operations. This India-focused guide explains the operating cycle and CCC (DIO + DSO − DPO), walks through the key ratios with ideal ranges, highlights MSME/GST nuances, and shows—via ABC Co and EcoSolar—how tightening collections, right-sizing inventory, and setting fair payables can unlock ₹-crore cash without straining relationships. Make cash a weekly habit, not a once-a-quarter scramble.

A practical guide to lease accounting under Ind AS 116 and IFRS 16. Learn the scope, lease term judgments, right-of-use asset and lease liability, variable payments, lease modifications, subleases, sale-and-leaseback, and disclosure templates—with simple examples and mini journal entries. Includes a short Ind AS vs IFRS differences note.

A clear, comprehensive guide to Ind AS 115 / IFRS 15. Walk through the 5-step model, determine and allocate the transaction price, handle contract costs, and present/disclose correctly—including Para 109AA (excise) and the Para 126AA contracted-price reconciliation—with simple examples.