If money feels like sand slipping through your fingers, you aren’t alone. In 2025, India gives us powerful tools instant UPI, auto-SIPs, sweep FDs, low-cost index funds but those same tools make overspending ridiculously easy. As per my experience, most personal budget fail not because people are “bad with money,” but because the plan doesn’t match how cash actually moves in our lives. A workable budget must respect three truths: your actual cash-in-hand after tax, your monthly rhythm (rent, groceries, fuel, EMI), and your non-monthly ambushes (insurance premiums, school fees, Diwali travel, annual subscriptions).

This guide keeps things simple, evidence-aware, and action-heavy. We’ll map your money into four buckets you can understand at a glance, pick a budgeting method that fits your personality, and set up a five-jar bank flow that runs on autopilot from salary day. I’ll explain debt tactics that work in our context (ever seen 36% p.a. credit-card interest eat an entire raise?), show a clean plan for irregular income, and give you short weekly and monthly reviews that you’ll actually do. Based on the facts and what I’ve observed across hundreds of plans, the winner is always the one that is easiest to repeat on good months and bad. Let’s build that.

TL;DR / Executive Summary

Think of this as your two-minute briefing before you go deeper. It captures the moving parts—income, buckets, method, automation, and reviews—Use this as your quick-start to a personal budget that you can refine over time. It doubles as a quick reference for 50/30/20 India, zero-based budget India, Pay-Yourself-First, and sinking funds India.

- Know your true income: Budget with net pay (after TDS/EPF/insurance). Freelancers & business owners: park 30% for taxes instantly.

- Use 4 buckets: Bills (must-pay), Living (day-to-day), Goals (savings/SIPs), Sinking Funds (non-monthly costs).

- Pick your method: 50/30/20 method (simple) • Zero-Based (tight control) • Pay-Yourself-First (automation) • Hybrid (PYF + caps).

- Set up 5 jars (accounts/pots): Income Hub → Bills, Daily Spend (UPI), Goals & SIPs, Sinking Funds. Automate on salary +1 day.

- Kill expensive debt first: Avalanche (highest rate first) or Snowball (smallest balance first).

- Irregular income? Use Base-Pay model: pay yourself a fixed amount monthly; put surplus to Emergency Fund/SIPs.

- Reviews: 10-minute weekly and 30-minute monthly. Tweak only two lines at a time.

- 90-day rule: Give it three months before judging. That’s when it clicks.

Key Concept Summaries

Personal budget (India): A personal budget is a monthly plan that assigns every rupee to four buckets—Bills, Living, Goals, and Sinking Funds—so your salary flows through five bank “jars” on salary day. It uses automation and small weekly checks to keep spending intentional and savings consistent.

Sinking funds (India): Sinking funds are monthly set-asides for predictable non-monthly costs—insurance premiums, school fees, festival travel, repairs—so big bills are prepaid in small installments. This prevents borrowing, keeps budgets steady, and removes end-of-month stress.

Base-Pay model: The Base-Pay model pays freelancers a fixed monthly “salary” from business receipts after setting aside taxes. It stabilizes home cash flow, builds a buffer, and stops lifestyle swings when invoices arrive late or vary.

See Your Money Clearly: Income & the Four Buckets

Before any spreadsheet or app, clarity comes from knowing what truly comes in and where it truly goes. This part shows you how to compute real net income and sort spending into four buckets so your picture is honest and manageable. Once you see the flow, decisions become easier—and kinder. This is the foundation of a personal budget that reflects your real life.

Work with reality, not wishes. Use your last 3 months’ credits to find average net income (post TDS/EPF/VPF/insurance). Freelance or business? Average 6 months and move 30% to a Tax account the day money arrives. Now split outflows into four buckets:

- Bills (must-pay): Rent/EMI, utilities, school fees, insurance, internet/mobile, subscriptions.

- Living (day-to-day): Groceries, commute/fuel, eating out, personal care, small UPI swipes.

- Goals: Emergency fund, SIPs (equity/debt), PPF/NPS, big-purchase savings.

- Sinking Funds: Annual/seasonal costs—insurance premiums, Diwali travel, gifts, car/bike service, annual subscriptions, medical checkups.

Example: Ram earns an average net salary of ₹77,500 in Pune after reviewing three monthly credits of ₹78,200, ₹76,900, and ₹77,400, and his bank plus UPI history shows fixed Bills near ₹27,000 and day-to-day Living at about ₹14,000, so he assigns ₹19,000 to Goals (₹5,000 to emergency savings, ₹10,000 to an equity index SIP, and ₹4,000 to NPS/PPF) and ₹5,000 to Sinking Funds (₹1,000 for insurance premiums, ₹2,000 for Diwali travel and gifts, ₹1,200 for car care, and ₹800 for annual subscriptions), which totals roughly ₹65,000 and leaves ₹12,500 for flexibility; he then chooses to increase SIPs by ₹5,000, keep ₹4,000 as a buffer, and allow ₹3,500 for guilt-free fun so the plan feels disciplined without being joyless.

Budgeting Methods at a Glance

| Method | Best For | Pros | Watch-outs |

| 50/30/20 | Beginners & busy weeks | Simple, quick start | Needs may exceed 50% in metros |

| Zero-Based | Detail lovers; leak control | Max control, every rupee planned | Time-consuming; can feel rigid |

| Pay-Yourself-First | Automation-first doers | SIPs perfect; stress-free | Needs caps on leaky categories |

| Hybrid | Most people long-term | PYF + simple caps | Set realistic caps and revisit monthly |

Pick a Personal Budget Method You’ll Actually Follow

A method is a habit scaffold. Choose one that matches your personality and season of life so you stick with it on busy days too. Here are four practical approaches and a quick way to decide without overthinking. The right method turns your plan into a personal budget you’ll actually follow. If you are comparing 50/30/20 method with zero-based budget India, use the pros and watch-outs below to pick your style.

- 50/30/20 method: 50% Needs (Bills + essential Living), 30% Wants (non-essential Living), 20% Goals. Gentle and beginner-friendly.

- Zero-Based Budget: Every rupee gets a job; Income − Plan = 0. Maximum control; best if money “leaks” fast.

- Pay-Yourself-First (PYF): Move Goals + Sinking Funds first on salary day. Live on what remains. Automation lovers swear by this.

- Hybrid (PYF + caps): Pay yourself first, then cap your 2–3 “leaky” categories (e.g., eating out, ride-shares, online shopping).

Example: Neha, a Mumbai analyst, noticed that 50/30/20 kept breaking because eating-out and impulsive online purchases spilled over, so she shifted to a Hybrid approach where ₹25,000 moves to Goals and ₹5,000 to Sinking Funds on the day after salary, her Daily Spend account receives fixed weekly top-ups, and two “leaky” lines—eating out capped at ₹5,000 and online shopping at ₹3,000—are funded via prepaid wallets linked to UPI, which means her SIPs run on autopilot while enjoyable spending stays inside speed limits she can actually respect.

Build the Five-Jar Bank Flow

Structure beats willpower. Convert your chosen method into a banking setup that runs on rails—fixed transfers, weekly allowances, and smart SIP dates. You’ll stop relying on memory and start relying on good plumbing. Good structure is what makes a personal budget stick without daily effort.

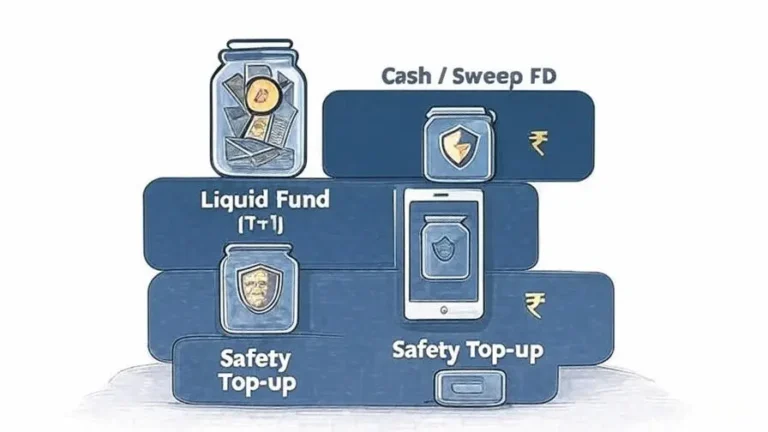

- Income Hub (salary lands here)

- Bills (EMI/rent, utilities, insurance, subscriptions)

- Daily Spend (UPI card/wallet for groceries, eating out)

- Goals & SIPs (mutual-fund SIPs, PPF/NPS, recurring deposits)

- Sinking Funds (annual/seasonal expenses)

Automation on salary +1 day: Fixed transfers to Bills, Goals, Sinking; weekly allowance to Daily Spend (e.g., ₹5,000 every Monday); set SIPs for 2nd–5th of the month to avoid end-month balance dips.

Example: Raj structures his banking so salary lands in an Income Hub and then standing instructions push ₹32,000 to a Bills account, ₹20,000 to Goals, and ₹6,000 to Sinking Funds, after which the Daily Spend account receives ₹6,000 every Monday for groceries and eating out and all UPI payments are mapped to that Daily Spend card, so when the weekly pot empties he naturally pauses discretionary buys and, because his rent is due on the 3rd and SIPs on the 4th, nothing bounces and nothing relies on memory.

Debt: Stop the Leak, Then Sail Faster

Debt can be a tool, but high-interest debt is a hole in the boat. Rank loans, pick a payoff path, and keep investing habits alive without sabotaging momentum. The goal is relief first, speed second. Clearing costly dues is what keeps your personal budget from leaking.

- Avalanche: Pay minimums on all loans; throw every extra rupee at the highest interest rate. Mathematically optimal.

- Snowball: Close the smallest balance first for quick wins. Psychologically powerful.

- Blend: Avalanche for credit cards; Snowball for motivation on the rest.

Tactical tips: Convert big card dues to a lower-rate EMI only if total cost falls sharply—and lock the card until cleared; don’t stop investing entirely—keep a small SIP (₹500–₹1,000) alive to preserve habit while you attack debt.

Example: Asha is juggling a ₹70,000 credit-card balance at roughly 36% per annum and a ₹2,00,000 personal loan at 16%, so she keeps all EMIs current, trims non-essentials by ₹4,000, routes every extra rupee to the high-interest card first, and preserves a token SIP of ₹500 to maintain the saving habit, which clears the card in about six months and then frees that same monthly firepower to snowball into the personal loan, cutting total interest more than any short-term investment could earn.

Irregular Income & Irregular Expenses

Two separate problems often feel like one. First, lumpy income makes planning hard; second, non-monthly costs ambush otherwise disciplined families. Here’s a stabiliser for both so your plan survives real-life India. Solve both and your personal budget becomes calm and predictable. This section is your blueprint for budgeting for irregular income so home cash flow stays calm

- Irregular income (freelancers/business owners): Use a Base-Pay model—average 6 months’ receipts, move 30% to Tax instantly, and transfer a fixed Base Pay to your personal budget monthly.

- Keep 2–3 months of Base Pay as buffer before increasing lifestyle.

- Irregular expenses (everyone): Build Sinking Funds for premiums, school fees, festivals, travel, repairs, medical checkups, annual subs.

- Take last year’s cost, add 10%, divide by 12; fund monthly via auto-transfer.

Example: Aisha, a freelance designer with monthly receipts ranging from ₹90,000 to ₹1.6 lakh, calculates a stable Base Pay of ₹80,000 for her home budget, parks 30% of each incoming payment into a separate Tax account the same day, and directs any surplus to her Emergency Fund until it reaches six months of expenses before boosting SIPs, while parallel Sinking Funds for Diwali travel and annual insurance premiums mean large seasonal costs are quietly prepaid across the year instead of exploding her month.

Reviews That Stick: Weekly 10 & Monthly 30

Consistency beats intensity. Use a light review rhythm you’ll actually follow: a quick weekly check to steer the ship and a short monthly tune-up to keep compounding on track. Short, repeatable reviews keep your personal budget on track.

- Weekly (10 minutes): Check Daily Spend balance; plan a low-cost weekend if thin.

- Weekly (10 minutes): Nudge ₹500–₹1,000 to Emergency Fund on light weeks.

- Weekly (10 minutes): Scan upcoming Sinking Fund obligations (e.g., car service, renewal).

- Monthly (30 minutes): Compare Plan vs Actual for the four buckets.

- Monthly (30 minutes): Adjust only two lines—usually Eating Out + Online Shopping.

- Monthly (30 minutes): Raise one SIP by ₹500–₹1,000 if you finished under plan.

- Monthly (30 minutes): Note any annual charge due in the next 60 days and top up that Sinking Fund.

Example: Vikas and Meera run a light routine where, every Sunday, they check the balances of the four buckets and, if the Daily Spend looks thin, they plan a low-cost weekend, then once a month they compare Plan versus Actual and adjust only two categories—often moving ₹1,000 from online shopping to the Emergency Fund if groceries ran high—so small course corrections accumulate and, within three months, their emergency pot crosses ₹1 lakh without any feeling of sacrifice.

Practical Application — Step-by-Step by Profile

Different lives need different dials. Pick the playbook that fits you today; you can always upgrade later. The steps are copy-ready—drop them in your notes and execute in order. Pick the steps that convert ideas into your personal budget in practice. Use the profile steps to turn ideas into an emergency fund India plan you can run on autopilot.

Students & First Jobbers

- Find net income (stipend vs salary) and any bank interest.

- Set a tiny budget: Bills ₹0–2k (phone), Living ₹6–8k (hostel/food), Goals ₹1,000 SIP, Sinking ₹500.

- Open a Daily Spend account for UPI; fund weekly.

- Build Emergency Fund to ₹25k → ₹50k → one month’s expenses.

- Raise SIP every stipend/raise by ₹500.

Example: Aman takes home ₹24,000 in Bengaluru and builds a tiny but durable structure by sending ₹2,000 to an equity SIP, ₹500 to a Sinking Fund for annual costs, and funding his UPI-linked Daily Spend with a weekly cap of ₹1,500, which keeps discretionary outflow predictable; after ten months this simple rhythm produces roughly ₹20,000 in emergency savings and around ₹22,000 invested, proving that small, automated amounts can snowball into strong financial habits.

Salaried Professionals (Mid-Career)

- Reconcile last 3 months’ bank credits to get net income.

- Map the four buckets from statements + UPI history.

- Choose Hybrid: PYF to Goals/Sinking; cap two leaky lines.

- Schedule SIPs for 2nd–5th; map UPI to Daily Spend account.

- Pre-fund insurance premiums & travel via Sinking Funds.

Example: Shreya’s monthly net income is ₹1.6 lakh in Gurgaon and her shape settles at Bills near ₹60,000, Living around ₹30,000, Goals at ₹40,000—split into ₹10,000 for emergency, ₹25,000 for equity SIPs, and ₹5,000 for NPS/PPF—plus ₹15,000 for Sinking Funds and ₹15,000 as buffer and treats, all automated via five accounts so that SIPs run between the 2nd and 5th, premiums are quietly prefunded, UPI draws from Daily Spend only, and the whole system behaves even during busy work cycles.

Business Owners / Freelancers

- Base-Pay your home budget (fixed monthly transfer).

- Separate business vs personal banking to stop cross-contamination.

- Move 30% to Tax on each receipt (not end-month).

- Keep 3–6 months of Base Pay as buffer.

- Use Sinking Funds for GST/advance-tax months, annual software, equipment.

Example: Dev is a freelance developer with about ₹28 lakh in mostly digital receipts across the year, so he separates business and personal banking, transfers a fixed Base Pay of ₹90,000 each month to the home side, moves 30% of every client payment into a dedicated Tax pot immediately, and directs the remaining surplus first to build a six-month Base-Pay buffer and then to SIPs, which means uneven client cycles no longer threaten rent or routine living costs.

Chartered Accountants (Practice & Industry)

- Practice owners: Track receivables; set Base-Pay for home; add Sinking Funds for peer review, ICAI events, software renewals.

- Industry CAs: Pre-decide a bonus/ESOP split (e.g., 50% Goals, 30% Sinking, 20% Treats).

- Codify a household month-end close: reconcile statements, raise one SIP by ₹500, log next month’s Sinking triggers.

Example: CA Anil, working in industry, automates ₹35,000 of monthly SIPs, allocates ₹8,000 to Sinking Funds for software renewals and family obligations, and holds a three-month buffer in a sweep-enabled account, while any ESOP sale follows a pre-decided split—half to long-term investments, nearly a third to upcoming obligations, and the rest to discretionary goals—so windfalls strengthen the plan without triggering lifestyle creep.

Conclusion

In my view, a budget that works isn’t about squeezing joy out of life. It’s about paying yourself first, protecting future you, and then spending the rest guilt-free. The trick is structure, not struggle. When your money flows through five jars and your UPI sits in a capped Daily Spend account, discipline is baked into the plumbing. You stop firefighting and start cruising.

As per my experience, the big wins come from boring moves done repeatedly: a tiny weekly review, a tiny monthly tweak, a tiny SIP increase after every raise. You don’t need 24 categories or fancy spreadsheets to feel in control. You need four buckets, a calendar nudge, and the courage to stick with the plan for 90 days. After that, it feels natural—like brushing your teeth.

If you’ve read this far, take one step today. Open or label the five jars. Schedule three standing instructions. Map your UPI to Daily Spend. Add a ₹500 SIP. That’s it. Do the weekly 10, the monthly 30, and watch your money become calmer, kinder, and more aligned with the life you want to build. Budgets don’t limit you; they free you—from guesswork, from end-of-month dread, from the nagging worry that you’re missing something. You’re not. You’ve got a system now. Run it.

FAQ

Q: What’s the simplest budget method for beginners in India?

A: Start with 50/30/20. It’s easy: 50% Needs, 30% Wants, 20% Goals. As per my experience, it removes decision fatigue and gets you moving. After 2–3 months, if leaks persist, switch to Hybrid—keep Pay-Yourself-First for Goals/Sinking and cap just two leaky lines like eating out and impulse shopping.

Q: How much should I keep in an Emergency Fund?

A: Aim for 3–6 months of expenses; students can start with ₹25k–₹50k. Freelancers should target 6–12 months because income fluctuates. Keep one month’s cash in savings and the rest in liquid/ultra-short debt mutual funds or sweep FDs. Refill after any withdrawal; treat it like a seatbelt.

Q: I get paid irregularly. How can I budget?

A: Use the Base-Pay model. Average 6 months’ receipts, set Base Pay (fixed monthly transfer to your home budget), and move 30% to Tax on each receipt. Build a buffer of 2–3 months of Base Pay, then invest surplus. This lowers stress during lean weeks.

Q: How do I stop UPI micro-spends from wrecking my plan?

A: Map your UPI to a separate Daily Spend account and fund it weekly (e.g., ₹5,000 on Mondays). When it’s empty, you’re done. This is the easiest “speed breaker” I’ve seen for small, frequent swipes that add up.

Q: Should I pause all investments while clearing debt?

A: Clear high-interest debt (credit cards) aggressively, but keep a small SIP (₹500–₹1,000) alive to preserve habit. Once the card is at ₹0, raise SIPs and attack lower-rate loans. Order matters; 36% p.a. interest is a budget killer.

Q: How do I plan for big annual costs like insurance or school fees?

A: Create Sinking Funds. Take the annual amount, add 10%, divide by 12, and auto-transfer monthly. When the bill arrives, you’ve already “paid” it in slow motion—no panic, no borrowing.

Q: What if my partner/parents spend differently?

A: Agree on common Bills and shared Goals, then give each person a no-questions-asked personal allowance funded from Daily Spend. Separate UPI cards reduce friction. In my experience, small independence prevents big arguments.

Q: Does a budget mean I must cut all fun?

A: No. A good budget protects fun on purpose. Add a “Freedom” line (₹2k–₹5k). Spend it guilt-free. When fun is planned, you’re less likely to binge-spend and blow up the month.

Q: Is 50/30/20 practical in metro cities with high rent?

A: Treat it as a shape, not dogma. If rent pushes Needs to 55–60%, trim Wants and keep Goals ≥ 15–20%. As income rises, push Goals back toward 20–30%. Progress beats perfection.

Q: I hate spreadsheets. Can I still budget?

A: Yes. Track five totals only: Bills, Living, Goals, Sinking, Buffer. Use banking “pots” or a notes app. The goal is repetition, not analytics.

Q: How do I budget a bonus or ESOP sale?

A: Pre-decide a split (e.g., 50% Goals, 30% Sinking, 20% Treats). Execute on day 1 so lifestyle creep doesn’t swallow it. For ESOPs, reserve for taxes first, then invest the planned portion.

Q: What’s a realistic savings rate for young professionals?

A: Start with 15–20%. Each raise, increase SIPs by 1–2% and avoid lifestyle creep. Within a couple of years, 25–30% becomes painless because automation does the heavy lifting.

Q: My expenses vary every month. How do I stay consistent?

A: Use weekly funding for Daily Spend and Sinking Funds for the non-monthly stuff. Then your monthly pattern becomes stable even if individual bills dance around.

Q: How do I choose between Avalanche and Snowball?

A: If you want the fastest math win, pick Avalanche (highest interest first). If you need motivation, Snowball (smallest balance first) gives quick wins. Many do Avalanche for cards and Snowball for the rest—best of both worlds.

Q: When will my budget finally feel “easy”?

A: Usually around day 90. Month 1 exposes leaks; Month 2 patches them; Month 3 feels natural. I’ve observed that people who stick to weekly 10 and monthly 30 cross this hump without drama.

Disclaimer

This article is educational and general in nature. Personal finances vary by person, city, and life stage. Please consider your risk profile, liabilities, and tax situation before acting. Investments are subject to market risks. When in doubt, speak with a qualified adviser.

Further Reading

Sources & References

- RBI (Reserve Bank of India) — Banking regulations and consumer education:

- SEBI — Personal Finance/Investments overview

- SEBI Investor Education (portal home)

- AMFI — Mutual fund investor education and SIP Calculator

- PFRDA — National Pension System (NPS) overview and FAQs:

- IRDAI — Insurance basics and regulatory information