As the financial year 2025-26 begins, it’s time to review your investments. Smart tax planning can save you thousands and help grow your wealth. Here’s a guide to the best tax-saving options under the Income Tax Act, with tips to help you.

🏆 Best Tax-Saving Instruments You Can Use

- ELSS – Equity Linked Savings Scheme: A popular choice among young investors and risk-takers, ELSS offers market-linked returns with a 3-year lock-in period. Historical data suggests an average return of 10-15%. Though long-term capital gains (LTCG) over ₹1 lakh are taxed at 10%, ELSS remains an attractive option for those seeking higher returns.

- Section: 80C (₹1.5 lakh limit)

- Lock-in: 3 years

- Returns: Market-linked (10–15% historical average)

- Taxability: LTCG over ₹1 lakh taxed at 10%

- Ideal for: Young investors, risk-takers

- [Invest via Groww/Zerodha (Affiliate Link)]

- PPF – Public Provident Fund: A low-risk investment option, PPF offers guaranteed returns of around 7.1% per annum, with a 15-year lock-in period. As it falls under the EEE (exempt-exempt-exempt) category, the returns are fully tax-free, making it an ideal choice for conservative investors and long-term savers.

- Section: 80C

- Lock-in: 15 years

- Returns: ~7.1% (guaranteed by Govt.)

- Taxability: EEE (fully tax-free)

- Ideal for: Conservative investors, long-term savers

- NPS – National Pension Scheme: Designed for retirement planning, NPS offers market-linked returns with an additional ₹50,000 deduction under section 80CCD(1B). Although the lock-in period is till retirement, partial withdrawals are tax-free, making it a valuable investment instrument for those planning for their golden years.

- Section: 80CCD(1B) (additional ₹50,000 over 80C)

- Lock-in: Till retirement

- Returns: 8–10% (market-linked)

- Taxability: Partial withdrawal tax-free

- Ideal for: Retirement planning

- Term Life Insurance: While it doesn’t offer returns, term life insurance provides financial security for your family in the event of your untimely demise. With premiums and sum assured being tax-free, it’s a crucial investment for all taxpayers, especially those with dependents.

- Section: 80C

- Lock-in: Till policy maturity

- Returns: No return – pure protection

- Taxability: Premium & sum assured tax-free

- Ideal for: Financial security for family

- Health Insurance Premium: Investing in health insurance not only safeguards your health but also provides tax benefits. You can claim deductions up to ₹25,000 (₹50,000 for senior citizens) under section 80D, making it an essential investment for all taxpayers, especially families. Apart from this INR 5000 preventive health check-ups deduction is allowed.

- Section: 80D

- Limit: Up to ₹25,000 (₹50,000 for senior citizens)

- Taxability: Premiums are deductible

- Ideal for: All taxpayers, especially families

- Home Loan Principal & Interest: For homeowners, claiming deductions on home loan principal and interest can lead to significant tax savings. With the bonus of joint home loans doubling the benefit, it’s an attractive option for those with a home loan.

- Section: 80C (principal), 24(b) (interest up to ₹2L)

- Ideal for: Homeowners

- Bonus: Joint home loans double the benefit

- 5-Year Tax Saving Fixed Deposits: A low-risk investment option, 5-year tax saving fixed deposits offer returns ranging from 6.5-7.5% per annum, with a 5-year lock-in period. Although the interest is taxable, it’s an ideal choice for those seeking low-risk investments.

- Section: 80C

- Lock-in: 5 years

- Returns: ~6.5–8.2% (varies by bank)

- Taxability: Interest is taxable

- Ideal for: Low-risk investors

⚖️ Old vs New Regime – Which One to Choose?

Selection of old and new tax regimes, depend on your tax saving investment, exemption and deduction. The old regime allows all the above deductions and exemption allowed section 10, while the new one offers lower tax slabs but no deductions except employers’ contribution to NPS.

Income Tax Slab Old Regime Vs. New Regime for FY 2024-25 (A.Y 2025-26)

| Income Slab | Old Regime | New Regime |

| Up to ₹2.5L | Nil | Nil |

| ₹2.5L–₹5L | 5% | 5% |

| ₹5L–₹7.5L | 20% | 10% |

| ₹7.5L–₹10L | 20% | 15% |

| ₹10L–₹12.5L | 30% | 20% |

| ₹12.5L–₹15L | 30% | 25% |

| Above ₹15L | 30% | 30% |

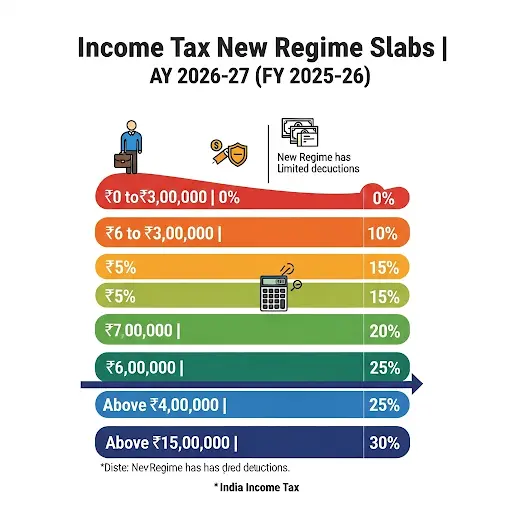

Income Tax Slab Old Regime Vs. New Regime for FY 2025-26 (A.Y. 2026-27)- Finance Bill 2025 make the new tax regime more lucrative due to increased slab , Rabate and marginal relief since income tax in India follows the progressive slab rate structure and tax rate increases as income rises.

| Income Slab | Old Regime ( below the age <60)* | New Regime (U/s 155BAC) |

| Up to ₹2.5L | Nil | Nil |

| ₹2.5L–₹4L | 5% | Nil |

| ₹4L–₹5L | 5% | 5% |

| ₹5L–₹8L | 20% | 5% |

| ₹8L–₹10L | 20% | 10% |

| ₹10L–₹12L | 30% | 10% |

| ₹12L–₹16L | 30% | 15% |

| ₹16L–₹20L | 30% | 20% |

| ₹20L–₹24L | 30% | 25% |

| Above ₹24L | 30% | 30% |

| Rebate u/s 87A | INR 12,500 | INR 60,000 |

| Standard Deduction | INR 50,000 | INR 75,000 |

| Pros/Cons | Higher tax Rate with exemption and deduction under section 80 | Lower tax rate without exemption and deduction except employers’ contribution in NPS upto 14% of Basic pay. |

| Surcharge ( Subject to marginal relief available) | 10% on income between INR 5 mn to 20 mn 15% on income between INR 10 mn to INR 20 mn 25% on income between INR 20 mn to INR 50 mn 37% on income above INR 50 mn (for Old regime only). For new regime maximum surcharge rate is 25% on Income > INR 2 cr. | |

| Cess | 4% on Tax amount | |

| Tips: No tax payable under new regime if income upto INR 12.75 Lacs due to increased rebate of INR 60,000 and Standard deduction of INR 75,000. Hence if your income upto INR 12 lacs go with the new tax regime without any further analysis. | ||

| * Person with age brackets of more than 60 to 80 – Exemption limit is INR 3 Lacs and more than 80 years exemption limit is INR 5 Lacs under the old regime. | ||

Remarks: Where the total income includes any dividend income and/or income chargeable under section 111A/112/112A, the rate of surcharge on the amount of income tax computed on that part of income, shall not exceed 15 per cent.

💡 Tip: If your total deductions exceed ₹2.5 lakh and housing loan interest of INR 2 Lacs, you’ll likely benefit from the old regime. [Use our Regime Comparison Calculator – Click to Download (Excel)]

| Practical Example of Tax calculation under Old Vs New Tax Regime | |||

| Total Income | Basic Tax Payable under Old Regime | Basic Tax Payable under New Regime | Conclusion |

| INR 12,00,000 | INR 1,63,800 with cess 4% | Nil | New Regime beneficial |

| INR 25,00,000 | INR 5,69,400 with cess 4% | INR 3,19,800 | New Regime beneficial |

| INR 45,00,000 | INR 11,93,400 with cess 4% | INR 9,43,800 | New Regime beneficial |

| INR 55,00,000 | INR 15,52,200 with cess 4% and surcharge | INR 13,00,000 | New Regime beneficial |

| Tips: If you have investment of INR 2.5 Lacs and housing loan interest of INR 2 lacs, your tax liabilities get reduced by INR 1.8 Lacs approx. | |||

⚠️ Common Deduction allowed under Old vs New Tax Regime for FY 2025-26 (A.Y. 2026-27)

- Retirement benefits, gratuity, Leave encashment

- Commuted pension

- Retrenchment compensation

- VRS benefits

- EPFO: Employer contribution

- NPS withdrawal benefits

⚠️ Common Mistakes to Avoid

- Procrastination: Avoid waiting until March to invest; plan early to maximize your tax savings.

- Lack of diversification: Don’t choose investments solely for tax-saving purposes; consider your risk tolerance, goals, and liquidity needs.

- Inadequate planning: Ensure you have a comprehensive financial plan in place to avoid last-minute decisions.

Conclusion

Tax-saving investments are not essential to reduce your tax burden but choose the option wisely considering your risk appetite and financial goals By planning early and avoiding common mistakes, you can reduce your tax burden and build a solid financial foundation.

Disclaimer

This article is for general information and does not constitute professional advice. Tax rules change via Finance Acts, CBDT notifications, and judicial decisions. Verify the latest provisions or consult a qualified professional for your specific case. TaxBizMantra is not responsible for decisions made solely on this content.