Why this Income tax calculation guide matters

FY 2025–26 brings practical changes that make the New Income tax Regime genuinely simpler for many salaried taxpayers. Salary and pension now enjoy a ₹75,000 standard deduction; residents can get nil slab tax up to ₹12,00,000 taxable income (which translates to nil tax up to ₹12.75 lakh salary for salaried, after the standard deduction); and the seven-slab grid starts at a clean ₹4 lakh basic exemption. Meanwhile, capital gains sit outside slab math and are taxed at special rates (this year, STCG 111A @ 20% and 112A LTCG @ 12.5% after a ₹1.25 lakh exemption). Follow the steps below, and you can compute your own tax confidently—no app needed.

In this Income tax calculation guide, you’ll learn:

- A clear 7-step method to compute New Regime tax

- A fill‑in worksheet you can reuse each year

- Worked examples (₹12.75L nil‑tax; ₹18L; a capital‑gains mix; a marginal‑relief case)

- A snapshot table to sanity‑check your result

- A quick Old‑vs‑New sense check

- A single, schema‑ready FAQ set (for Rank Math)

Key Highlights:

- Standard deduction (salary/pension): ₹75,000

- Section 87A (residents only): when taxable income for slabs ≤ ₹12,00,000, slab tax (up to ₹60,000) becomes ₹0 — for salaried, this enables nil tax up to ₹12.75 lakh salary

- Marginal relief (just over ₹12L): caps pre‑cess slab tax to the excess over ₹12,00,000

- Capital gains (special rates): STCG 111A @ 20%; 112A LTCG @ 12.5% after ₹1,25,000 exemption on eligible equity/equity MF/REITs; other LTCG @ 20% (as applicable)

Quick Start guide

- Salary/Pension − ₹75,000 = Net Salary

- Add ordinary income (interest + house‑property result + business) = Income for slab tax

- Apply the 7 slabs to that amount

- If resident and ≤ ₹12,00,000 → apply 87A (cap ₹60k). If just over ₹12L → apply marginal relief

- Add capital‑gains tax separately: STCG(111A) @ 20%; 112A LTCG @ 12.5% after ₹1.25L exemption; other LTCG @ 20%

- Add 4% cess (and surcharge if applicable)

Visual flow: Gross Salary → (− ₹75,000) → Net Salary → + Ordinary Income → Income for Slab Tax → Slab Tax → 87A / Marginal Relief → + Special‑Rate Tax (STCG/LTCG) → + 4% Cess → Final Tax

The 7‑Step Method (Detailed Walkthrough of Income tax calculation)

Step 1 — Gather your income inputs

Collect salary/pension (Form 16), interest, house‑property result, business/other income. Keep capital gains aside for now (STCG 111A, 112A LTCG, other LTCG).

Step 2 — Apply the standard deduction

Subtract ₹75,000 from gross salary/pension to get Net Salary. This is a flat deduction available under the New Regime for salary/pension.

Step 3 — Build “Income for slab tax”

Add Net Salary (Step 2) + interest + house‑property result + business/other. Do not include capital gains here.

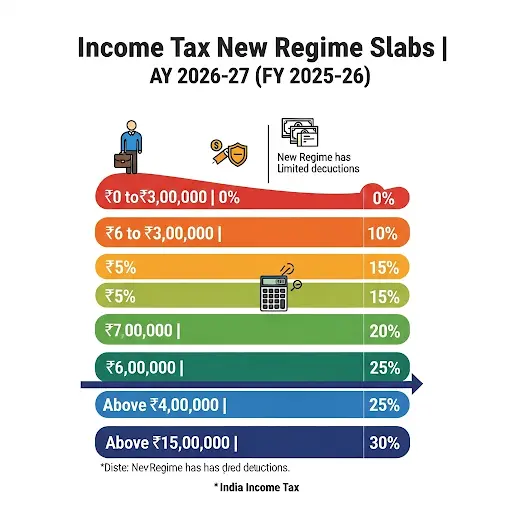

Step 4 — Compute slab income tax using the 7 bands

Apply the New Regime slabs to the ‘Income for slab tax’. Calculate band-by-band; the result is your pre‑relief slab tax.

Step 5 — Apply reliefs: 87A or marginal relief (as applicable)

If you are a Resident and ‘Income for slab tax’ ≤ ₹12,00,000, Section 87A reduces slab tax (up to ₹60,000) to ₹0. If your taxable (for slabs) is just over ₹12L, cap the pre‑cess slab tax to (taxable − ₹12L).

Step 6 — Add special‑rate taxes (compute separately)

Now add capital‑gains taxes computed on their own: STCG 111A @ 20%; 112A LTCG @ 12.5% after a ₹1,25,000 exemption on eligible equity/equity MF/REITs; other LTCG typically @ 20%.

Step 7 — Add cess (and surcharge) to reach final income tax

Add 4% health & education cess on income tax slab after reliefs + total special‑rate tax]. Apply surcharge if thresholds trigger.

Download here Income tax computation excel utility

Computation of Income tax – Master Table (AY 2026–27 / FY 2025–26)

| Particulars | Amount (₹) | Notes |

| Gross Salary / Pension | 12,75,000 | |

| Less: Standard Deduction | 75,000 | New Regime salary/pension |

| Net Salary for Slabs (A) | 12,00,000 | Auto: 12,75,000 − 75,000 |

| Interest income | – | |

| House-property result | – | As per New Regime rules |

| Business / Other income | – | |

| Income for Slab Tax (B) | 12,00,000 | A + ordinary incomes (no gains) |

| Slab tax on (B) | 60,000 | Apply 7 slabs |

| Less: 87A rebate (Resident; if B ≤ 12,00,000) | 60,000 | Cap ₹60,000 → slab tax becomes 0 |

| Marginal relief (if just over ₹12L) | – | Cap pre‑cess slab tax to (B − 12,00,000) |

| Slab tax after reliefs (C) | 0 | |

| Special-rate tax: STCG (111A) @ 20% | – | |

| Special-rate tax: LTCG (112A) @ 12.5% (post ₹1.25L exemption) | – | |

| Special-rate tax: Other LTCG @ 20% | – | |

| Total special-rate tax (D) | – | |

| Total before cess (C + D) | – | |

| Health & Education Cess @ 4% | – | |

| Final income tax payable | – |

Worked examples (step‑by‑step)

Example 1: Salaried ₹12.75 lakh (resident; no gains) → Nil tax

| Component | Value |

| Net Salary for slabs | ₹12,00,000 (12.75L − 0.75L standard deduction) |

| Slab tax (pre‑relief) | ₹60,000 |

| 87A (resident) | ₹60,000 → slab tax becomes ₹0 |

| Special‑rate taxes | ₹0 |

| Final Income tax (incl. cess) | ₹0 |

Example 2: Salaried ₹18.00 lakh (resident; no gains)

| Component | Value |

| Net Salary for slabs | ₹17,25,000 (18.00L − 0.75L standard deduction) |

| Slab tax (pre‑relief) | ₹1,45,000 (band‑by‑band) |

| Reliefs | 87A N/A; marginal relief N/A |

| Cess @4% | ₹5,800 |

| Final income tax | ₹1,50,800 |

Example 3: Salary ₹10.50L + STCG(111A) ₹1.00L (resident)

| Component | Value |

| Net Salary for slabs | ₹9,75,000 (10.50L − 0.75L standard deduction) |

| Slab tax (pre‑relief) | ₹37,500 |

| 87A (resident) | ₹37,500 → slab tax becomes ₹0 |

| STCG(111A) @20% | ₹20,000 |

| Cess @4% on special‑rate tax | ₹800 |

| Final income tax | ₹20,800 |

Example 4: Taxable for slabs ₹12,10,000 (resident) → Marginal relief

| Component | Value |

| Income for slabs | ₹12,10,000 |

| Slab tax (pre‑relief, approximate) | > ₹60,000 |

| Marginal relief cap (pre‑cess) | Cap to ₹10,000 (excess over ₹12L) |

| Cess @4% | ₹400 |

| Final income tax | ₹10,400 |

Snapshot table

| Taxable for slabs (after SD; no gains) | Slab tax (pre‑cess) | 87A / Relief | Final with 4% cess |

| ₹8,00,000 | ₹20,000 | 87A → 0 | ₹0 |

| ₹10,00,000 | ₹40,000 | 87A → 0 | ₹0 |

| ₹12,00,000 | ₹60,000 | 87A → 0 | ₹0 |

| ₹12,10,000 | >₹60,000 | Relief → ₹10,000 | ₹10,400 |

| ₹13,00,000 | ₹75,000 | — | ₹78,000 |

| ₹15,00,000 | ₹1,05,000 | — | ₹1,09,200 |

| ₹20,00,000 | ₹2,00,000 | — | ₹2,08,000 |

Marginal relief: the “just over ₹12L” safeguard

If your taxable income for slabs is only slightly above ₹12,00,000, marginal relief ensures your pre‑cess slab tax does not exceed the excess over ₹12,00,000.

| Income for slabs | Cap (pre‑cess) | Cess 4% | Final income tax |

| ₹12,00,000 | ₹0 | ₹0 | ₹0 |

| ₹12,05,000 | ₹5,000 | ₹200 | ₹5,200 |

| ₹12,10,000 | ₹10,000 | ₹400 | ₹10,400 |

| ₹12,50,000 | ₹50,000 | ₹2,000 | ₹52,000 |

House property & capital gains (what to remember)

- Self‑occupied interest isn’t available like in the old regime. For let‑out, compute rental income as per rules; interest/set‑off is more restricted than in Old Regime. Include only the resulting figure in slab income.

- Special‑rate of income tax is separate: STCG(111A) @ 20%; 112A LTCG @ 12.5% after ₹1.25L exemption on eligible equity/equity MF/REITs; other LTCG @ 20% (as applicable). These amounts generally don’t get 87A.

Old vs New (Selection Guide)

- Choose New Regime of income tax if you’re salaried with modest exemptions/deductions and no large HRA/home‑loan interest.

- Check Old Regime if you have high HRA, substantial housing interest, and full80C/80D/NPS — run one side‑by‑side before filing.

Conclusion

Start with salary, subtract ₹75,000, compute slab income tax on ordinary income, apply 87A (or marginal relief if just over ₹12L), then add special‑rate taxes (STCG 20%, 112A LTCG 12.5% after ₹1.25L, other LTCG 20%) and 4% cess. If you claim large HRA/home‑loan interest, compare Old vs New once. Otherwise, for many salaried taxpayers near ₹12–13L, the New Regime is cleaner—and often cheaper.

Disclaimer

This article is for general information and does not constitute professional advice. Tax rules change via Finance Acts, CBDT notifications, and judicial decisions. Verify the latest provisions or consult a qualified professional for your specific case. TaxBizMantra is not responsible for decisions made solely on this content.

Further Reading

Sources & References

- Income Tax Department – FAQs on Computation of Tax (official)

- Income Tax Department – Tax Rates and Marginal Relief (official)

FAQ

Q1. What are the New Tax Regime slabs for AY 2026–27 (FY 2025–26)?

A. ₹0–4,00,000: Nil; ₹4,00,001–8,00,000: 5%; ₹8,00,001–12,00,000: 10%; ₹12,00,001–16,00,000: 15%; ₹16,00,001–20,00,000: 20%; ₹20,00,001–24,00,000: 25%; Above ₹24,00,000: 30%. Add 4% health & education cess at the end; surcharge may apply at higher incomes.

Q2. What is the standard deduction in the New Regime?

A. Salaried individuals and pensioners get a flat ₹75,000 standard deduction in the New Regime. Subtract this from gross salary/pension before applying slabs.

Q3. How is “nil tax up to ₹12 lakh / ₹12.75 lakh salary” achieved?

A. If you’re a resident and your taxable income for slabs is ≤ ₹12,00,000, Section 87A gives a rebate up to ₹60,000, reducing slab tax to ₹0. For salaried: ₹12.75L − ₹0.75L (SD) = ₹12.00L, so slab tax becomes zero (no cess).

Q4. What is marginal relief just above ₹12 lakh?

A. When taxable income for slabs is slightly above ₹12,00,000, your pre-cess slab tax is capped to the excess over ₹12,00,000. Example: at ₹12,10,000, tax is ₹10,000 (cap) + 4% cess = ₹400 → ₹10,400 final.

Q5. Do capital gains get the 87A rebate?

A. Generally no. Special-rate income is taxed separately: STCG (Sec 111A) @ 20%; LTCG (Sec 112A) @ 12.5% after a ₹1,25,000 exemption on eligible equity/equity MF/REITs; other LTCG may be @ 20%. Compute slab tax and apply 87A/marginal relief first, then add gains tax.

Q6. How do I compute tax under the New Regime (step-by-step)?

A. (1) Salary/Pension − ₹75,000 = Net Salary. (2) Add ordinary income (interest + house-property result + business) → Income for slabs. (3) Apply 7 slabs. (4) If resident and ≤ ₹12L, apply 87A; if just over, apply marginal relief. (5) Add STCG/LTCG tax separately. (6) Add 4% cess (and surcharge if applicable).

Q7. Which is better for me: New or Old Regime?

A. New usually wins for salaried people with modest exemptions/deductions and no big HRA/home-loan interest. Old can win if you have high HRA, substantial housing interest, and full 80C/80D/NPS—run one side-by-side before filing.

Q8. Do NRIs get the 87A rebate?

A. No. Section 87A is available only to resident individuals. NRIs compute tax normally under the chosen regime without 87A.

Q9. How is house-property income treated in the New Regime?

A. Compute house-property income as per rules; self-occupied interest isn’t available like in the Old Regime. For let-out, standard 30% deduction on rent applies; interest/set-off is more restricted than Old Regime. Include only the resulting figure in slab income.

Q10. Can I switch between New and Old Regime every year?

A. Salaried taxpayers can choose the regime at return filing each year. Business/profession taxpayers have switching restrictions—change carefully.

Q11. How do cess and surcharge apply?

A. After adding slab tax (post 87A/relief) and special-rate taxes, apply 4% cess on the total. Surcharge kicks in at higher incomes as per the prevailing thresholds.

Q12. Quick example with gains: Salary ₹10.50L + STCG(111A) ₹1.00L (resident)

A. Slab side: ₹10.50L − ₹0.75L = ₹9.75L → slab tax ₹37,500 → 87A reduces slab tax to ₹0. STCG @20% = ₹20,000; cess 4% = ₹800 → Final = ₹20,800.