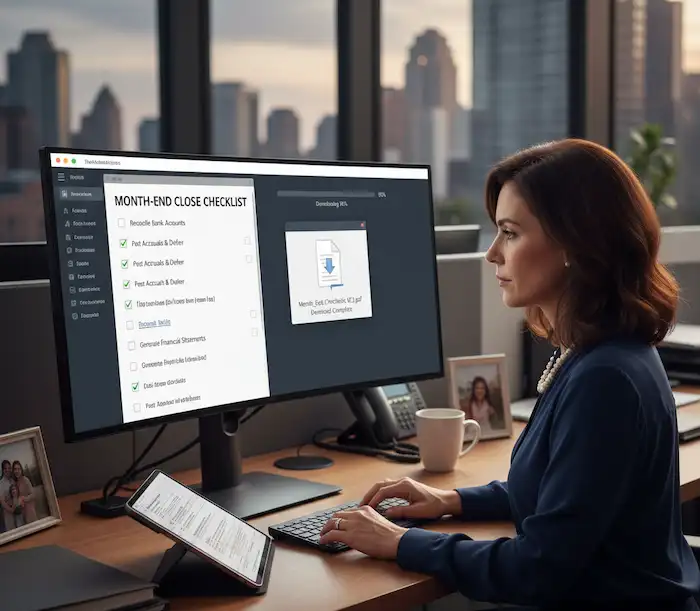

Close your books in T+3—without late nights.

If month-end still means last-minute entries, scattered emails, and approval delays, this free month end close checklist Excel (India) gives you a single Closing Tasks table, a live finance dashboard Excel, and a clean maker-checker tracker. Paste your tasks, set Target Day (T-5…T+3) or a date, and watch Done, In-Progress, Overdue, and Approvals update in real time—no macros. For the full method behind this template, see our T+3 Close Blueprint.

Why this month end close Checklist template (India) works

Generic lists don’t help you finish. This month end close checklist template India is designed around Indian realities—GST TDS month end cut-offs, AP AR closing checklist needs, GR/IR reconciliation, inter-company, and routine journals.

- T+3 close mindset: Target Day buckets (T-5…T+3) shift work earlier so T day is calm.

- Approvals made clear: The built-in maker checker template shows MC Required/Pending and CFO Needed/Pending.

- Audit-friendly: Overdue items and late-entry exceptions are visible; evidence is easy to show.

- No VBA: Pure formulas and a structured Table mean stable, IT-friendly use.

If you’re rolling out process improvements, the structure aligns with the DMAIC approach in our Lean Six Sigma guide and the T+3 blueprint.

What’s inside (worksheets)

1) Closing Tasks (editable master)

An Excel Table named Tasks with practical columns for a complete AP AR closing checklist and month-end flow: Task Name, Owner, Function, Status (Not Started / In Progress / Done), Target Day (T-5…T+3) or Target Date, Due Date (for Overdue), Pending at Level (Maker / Checker / CFO), Maker-Checker Req?, Checker Approved?, CFO Sign-off Needed, CFO Approved?, Exception (Late Entry?), and an automatic Overdue? flag. This is your working list.

2) Dashboard (auto)

Live tiles for Total, Done, In-Progress, Not Started, Overdue, a status pie, and a Target-Day bar. It’s a lightweight finance dashboard Excel that updates when you edit the table.

3) Maker–Checker (auto)

Counters for MC Required, MC Pending Approval, CFO Sign-off Needed, CFO Pending Approval, Late Entry Exceptions, and Overdue MC/CFO Items—a simple but effective maker checker template.

4) Read Me (quick start)

Two-minute setup plus tips to customise for your close calendar.

How to use (simple 5-step flow)

- Add tasks to Closing Tasks and assign Owners. Keep Status choices simple.

- Set a Target Day (T-5…T+3) or a Target Date for every activity—this creates a visible month end close checklist Excel timeline.

- For journals, invoices, and sensitive entries, set Pending at Level (Maker / Checker / CFO). The maker checker template sheet updates automatically.

- Run a 15-minute daily huddle in close week: open the Dashboard, clear Overdue, then resolve MC/CFO Pending.

- Standardise wins (e.g., GR/IR reconciliation, T-2 accruals, inter-co confirmations) with a short SOP and keep tracking in the file.

For broader process fixes and a 90-day plan, use the Lean Six Sigma guide and keep the FAQ handy: Lean Six Sigma Finance FAQ.

Where this adds the most value

- AP / AR: intake checklists, posting windows, disputes, early cut-offs (great for an AP AR closing checklist).

- GR/IR: ageing and reason-codes that reduce last-minute noise; visible GR/IR reconciliation status.

- Inter-company: aligned timelines that stop T-day surprises.

- Bank reco & payroll accruals: predictable sequencing reduces rework.

- GST/TDS: better timing and ownership at GST TDS month end means fewer reversals and comments.

Benefits you’ll notice in the first month

- A visible close calendar inside your month-end closing template India via Target-Day buckets.

- Fewer post-close journals because cut-offs move earlier.

- Faster approvals using the maker checker template counters.

- A calmer, more repeatable T+3 close.

Want the operating rhythm behind the sheet? Read the T+3 Close Blueprint next.

FAQs

Is this month end close checklist Excel really free?

Yes. It’s free for internal business use. Duplicate it per entity or month. You can change colours, add columns, and the finance dashboard Excel will still work.

We use “Target Date,” not “Target Day.” Will the dashboard work?

Yes. The formulas detect Target Day, Target Date, or any header beginning with “Target.” You can keep dates or T-buckets; both support a T+3 close.

How does maker–checker tracking work in this template?

Set Pending at Level to Maker, Checker, or CFO. The sheet updates MC Required, MC Pending, CFO Needed, and CFO Pending automatically—making it a practical maker checker template.

Can this replace our AP AR closing checklist?

You can copy your AP AR closing checklist into the Closing Tasks table and use the Status and Target-Day buckets. The Dashboard will surface bottlenecks and overdue items instantly.

Does it help with GST TDS month end?

It doesn’t file returns, but it enforces visibility and timing. That reduces reversals and review comments at GST TDS month end.

How do we track GR/IR reconciliation?

Create GR/IR reconciliation tasks by entity/vendor, assign owners and Target Days, and track them on the Dashboard. Exceptions and overdue items become obvious.

Do I need VBA or Power Query?

No. It’s pure Excel with COUNTIF/COUNTIFS/SUMPRODUCT and a structured Tasks table. Safe, portable, and easy to maintain.

What results should we expect in 30 days?

Fewer post-close journals, faster approvals, and a visible glide path to a T+3 close. Teams typically recover a day of effort just by using the template consistently.

Disclaimer:

This free Month-End Close Checklist Excel (India 2025) is an educational template to improve internal process visibility. It is not accounting, tax, legal, audit, or compliance advice. Requirements vary by company, industry, ERP, and regulation (Companies Act, Ind AS, GST/TDS, RBI/SEBI norms, and internal SoD/ITGC policies). You are responsible for reviewing and customising the workbook, validating formulas, and obtaining approvals from management and your auditors. Sample tasks/fields are illustrative and outcomes (including a T+3 close) are not guaranteed. Use at your own risk—TaxBizMantra provides the template “as is,” makes no warranties, and does not access or store your data.