While presenting the Union Budget 2026–27, the Government has largely retained existing income-tax rates and slabs, with the focus shifting towards structural reform, procedural simplification, rationalisation of penalties, and sector-specific policy support. The emphasis is on improving tax administration and long-term certainty rather than headline rate changes.

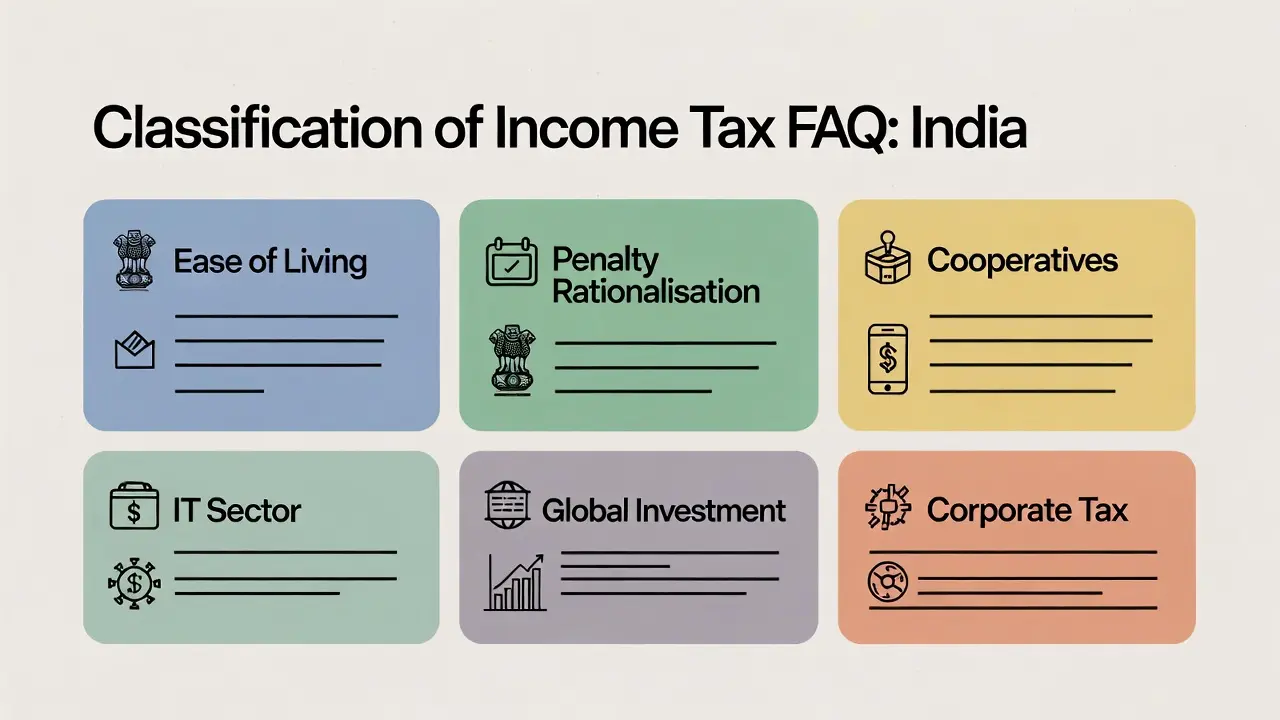

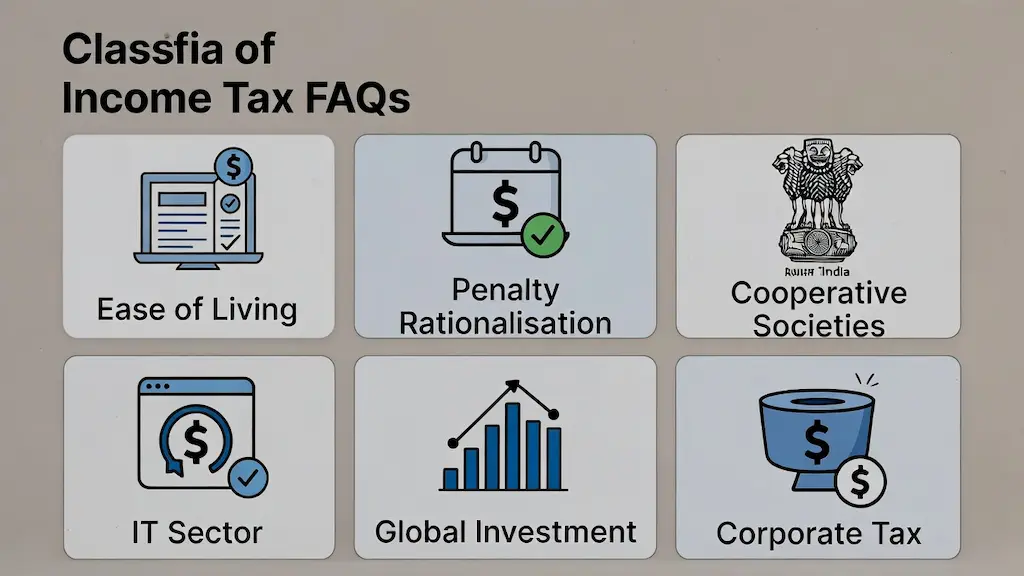

To clearly explain the policy intent behind these measures, the Income Tax Department has adopted a classification of income tax FAQs by grouping the direct tax proposals of Budget 2026–27 into specific thematic categories. This framework, also reflected in the official FAQs issued with the Finance Bill, 2026, helps taxpayers and professionals understand the rationale behind individual amendments by linking them to broader reform objectives such as ease of living, litigation reduction, sectoral growth, and corporate tax simplification.

Set out below is an overview of this official classification of income tax FAQs, along with links to detailed, category-wise FAQ articles.

(A) Ease of Living

The “Ease of Living” category covers income-tax proposals aimed at simplifying compliance, reducing procedural complexity, and improving the overall taxpayer experience. Measures under this heading focus on making routine tax processes less burdensome and reducing avoidable friction between taxpayers and the tax administration.

The intent is to move towards a more facilitative, technology-driven, and trust-based tax system. Proposals in this category typically relate to assessments, revised return timelines, dispute resolution mechanisms, and simplification of routine compliance requirements.

👉 Read detailed FAQs on Ease of Living measures

(B) Rationalising Penalty and Prosecution

This category deals with reforms to penalty and prosecution provisions under the income-tax law. The focus is on reducing overlapping penalties, limiting excessive discretion, and ensuring that enforcement action is proportionate to the nature and severity of non-compliance.

Budget 2026 seeks to clearly distinguish between serious tax evasion and procedural or technical defaults. The broader objective is to reduce adversarial tax administration while retaining deterrence for wilful and significant violations.

👉 Read detailed FAQs on rationalisation of penalty and prosecution

C) Cooperatives

Proposals classified under this category relate to cooperative societies. These measures reflect the Government’s continued policy focus on strengthening the cooperative sector through targeted tax reliefs and rationalisation of existing provisions.

The classification includes amendments intended to improve clarity, remove anomalies, and ensure fair and consistent tax treatment for cooperative institutions operating across various sectors.

👉 Read detailed FAQs for cooperative societies

(D) Supporting IT Sector as India’s Growth Engine

This category includes income-tax measures targeted at supporting the information technology and digital services sector. Recognising the strategic role of the IT sector in India’s economic growth, Budget 2026 introduces measures aimed at providing tax certainty and long-term stability.

The focus is on encouraging sustained investment, reducing disputes, and reinforcing India’s position as a global hub for technology and digital services.

👉 Read detailed FAQs on IT sector tax measures

(E) Attracting Global Business and Investment

Proposals under this category are designed to enhance India’s attractiveness as a destination for global business and investment. These measures focus on improving certainty in cross-border taxation and facilitating international business operations.

The classification reflects the Government’s intent to align India’s tax framework with global best practices and create a stable environment for long-term capital inflows.

👉 Read detailed FAQs on global business and investment measures

(F) Rationalization of Corporate Tax Regime

This category deals with rationalisation of corporate tax provisions rather than changes in headline tax rates. The emphasis is on simplifying the corporate tax framework, aligning provisions across regimes, and reducing interpretational complexity.

By focusing on structural clean-up instead of frequent rate changes, Budget 2026 aims to provide stability and predictability to businesses.

👉 Read detailed FAQs on corporate tax rationalisation.

(G) Rationalisation of Other Direct Tax Provisions

This residual category covers miscellaneous direct tax proposals that do not fall within the major thematic headings but remain important for compliance and clarity. These include targeted exemptions, clarifications, and procedural adjustments across the income-tax framework.

Though incremental in nature, these measures collectively contribute to a cleaner, more coherent tax system.

👉 Read detailed FAQs on other direct tax provisions

Closing Note

The above classification provides a structured lens through which the income-tax proposals of Budget 2026–27 can be understood. Each category addresses a distinct policy objective, and the detailed FAQs under each heading explain the scope and application of the proposals.

Readers may refer to the linked category-wise FAQ articles for official clarifications and detailed explanations.