Introduction

Section 17(5)(d) of the CGST Act blocks input tax credit on goods and services used for construction of immovable property when such construction is done “on own account.” This short phrase, though not defined anywhere in the GST law, has been the centre of prolonged litigation since the introduction of GST.

For a long time, taxpayers took the view that construction of immovable property meant for commercial exploitation, such as leasing or renting, could not be treated as construction “on own account.” As per our view, this argument gained traction mainly because GST is a tax on supply, and leasing of immovable property is itself a taxable outward supply. Several High Courts accepted this line of reasoning, leading to uncertainty in the application of Section 17(5)(d).

The controversy reached the Supreme Court in Safari Retreats, where the constitutional validity of Section 17(5)(d) and the scope of the phrase “on own account” came under consideration. The Supreme Court upheld the provision and, in doing so, clarified the true legal meaning of “on own account.” As per our view, the judgment has decisively shifted the interpretation away from the nature of use of the property and placed it squarely on ownership and capitalisation of the immovable asset.

This article examines only one issue — the meaning of the expression “on own account” in Section 17(5)(d) after the Supreme Court’s decision in Safari Retreats. As per our view, the ruling now represents the Supreme Court’s final word on this expression, leaving no scope for further interpretational debate, except on pure questions of fact.

Section 17(5)(d): Statutory Context of “On Own Account”

Section 17 of the CGST Act deals with apportionment of credit and blocked input tax credit. Sub-section (5) lists specific situations where ITC is expressly blocked, even if the inward supplies are otherwise used in the course or furtherance of business. Clause (d) of this sub-section is one such blocking provision.

Section 17(5)(d) denies ITC on goods or services received by a taxable person for construction of an immovable property (other than plant and machinery) when such construction is on his own account, including where the property is intended to be used in the course or furtherance of business.

Two aspects of the provision are important. First, the blockage applies even when the constructed property is used for business purposes. Second, the legislature has consciously used the expression “on his own account” without providing any statutory definition. As per our view, this deliberate drafting indicates that the legislature intended to block credit based on the character of the construction activity, and not on the manner in which the completed property is subsequently used.

The phrase “construction” is explained in the Explanation to Section 17 to include reconstruction, renovation, additions or alterations, to the extent such costs are capitalised to the immovable property. As per our view, the reference to capitalisation strongly links the blocking provision to ownership and asset creation, rather than to operational use or revenue generation.

It is also significant that Section 17(5)(d) does not use expressions such as “self-use” or “personal use.” Instead, it uses the broader phrase “on own account.” As per our view, this choice of words expands the scope of the blockage to cover situations where the taxable person creates or capitalises an immovable asset for itself, irrespective of whether that asset is later leased, rented, or otherwise commercially exploited.

This statutory context is crucial to understanding why disputes arose around the meaning of “on own account,” and why courts were called upon to interpret this phrase in the absence of a clear definition.

Pre-Safari Retreats Judicial Understanding (Brief Context)

Before the Supreme Court examined the issue in Safari Retreats, different High Courts had adopted divergent views on the meaning of the expression “on own account” in Section 17(5)(d). The core dispute was whether construction of immovable property intended for leasing or renting could be treated as construction on the taxpayer’s own account.

One line of reasoning, accepted by certain High Courts, was that when immovable property is constructed with the intention of being let out, the taxpayer is not constructing the property for itself, but for providing taxable outward supplies in the form of leasing services. As per this view, such construction was said to be in the course or furtherance of business, and therefore outside the scope of “on own account.”

Another strand of reasoning emphasised the business use of the property. Since leasing of immovable property is a taxable supply under GST, it was argued that denial of ITC would break the input-output credit chain, which is a fundamental feature of GST.

As per our view, these interpretations placed excessive emphasis on the end use of the immovable property and did not sufficiently account for the statutory language of Section 17(5)(d), which expressly blocks ITC even where the property is used in the course or furtherance of business.

This divergence in judicial opinion ultimately led to the matter being considered by the Supreme Court in Safari Retreats, where the focus shifted from the nature of outward supply to the legal meaning of “on own account.”

Supreme Court in Safari Retreats: The Settled Meaning of “On Own Account”

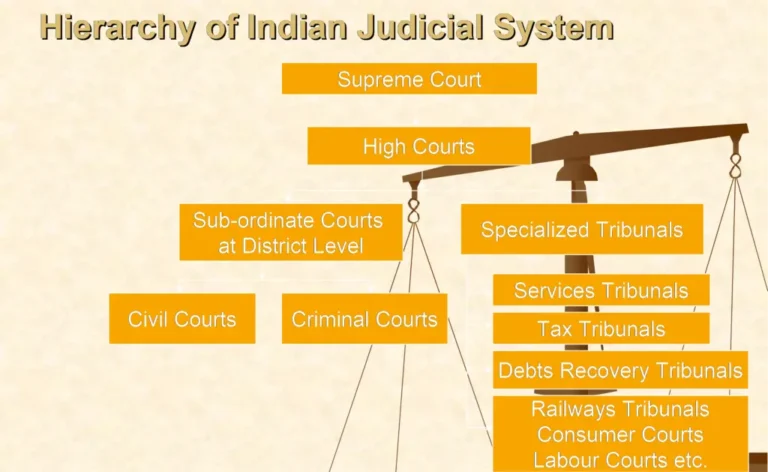

The controversy surrounding Section 17(5)(d) of the CGST Act finally reached the Supreme Court in Safari Retreats Private Limited & Anr. v. Chief Commissioner of Central Goods and Services Tax & Ors. (2024). The appeal arose from the decision of the Orissa High Court in Safari Retreats Private Limited v. Chief Commissioner of CGST (2019), where input tax credit was allowed on construction of shopping malls intended to be let out.

The Supreme Court upheld the constitutional validity of Section 17(5)(d) and, in doing so, examined the true meaning of the expression “on own account.” As per our view, this interpretation now conclusively settles the legal position and overrides all contrary High Court rulings.

The Court rejected the argument that construction of immovable property meant for leasing or renting falls outside the scope of “on own account.” It observed that the GST law expressly blocks ITC even where the immovable property is used in the course or furtherance of business, and therefore the nature of outward supply cannot determine eligibility of credit under Section 17(5)(d).

A decisive factor highlighted by the Supreme Court was that the construction resulted in creation of an immovable property owned by the taxpayer and capitalised in its books of account. As per our view, the Court treated ownership and capitalisation as the controlling tests for determining whether construction is on the taxpayer’s own account.

The Supreme Court further clarified that the expression “on own account” does not mean personal use or self-occupation. Instead, it covers situations where a taxable person constructs immovable property for itself, as opposed to constructing it for another person in the capacity of a works contractor. Leasing or renting of such property does not alter its legal character as property constructed on own account.

By shifting the focus away from commercial exploitation and firmly anchoring it in asset creation and ownership, the Supreme Court has settled the interpretation of Section 17(5)(d). As per our view, after the decision in Safari Retreats (SC, 2024), the expression “on own account” must be understood to include all constructions resulting in an owned and capitalised immovable asset, irrespective of subsequent use.

Conclusion — Safari Retreats as the Supreme Court’s Final Word

The decision of the Supreme Court in Safari Retreats Private Limited & Anr. v. Chief Commissioner of Central Goods and Services Tax & Ors. (2024) brings long-standing litigation on Section 17(5)(d) of the CGST Act to a close. The meaning of the expression “on own account”, which was the root cause of conflicting High Court rulings, now stands conclusively settled.

As per our view, the Supreme Court has made it clear that the test under Section 17(5)(d) is not how the immovable property is used, but whether the property is constructed, owned, and capitalised by the taxable person. Once these conditions are met, the construction is on the taxpayer’s own account, and input tax credit is blocked, even if the property is later leased, rented, or otherwise used for taxable outward supplies.

In other words, “If an immovable property (other than plant and machinery) is constructed by a taxable person, owned by it, and capitalised in its books, the construction is “on own account”.

Consequently, input tax credit is blocked, even if the property is subsequently leased, rented, or otherwise used for taxable outward supplies.

The earlier distinction drawn between self-use and commercial use has been decisively rejected. Leasing of immovable property does not convert construction into a service-oriented activity for the purpose of ITC eligibility. As per our view, the Supreme Court has reaffirmed that construction of immovable property falls within a blocked credit category under the statutory scheme of Section 17(5)(d) of the CGST Act.

After Safari Retreats (SC, 2024), the law leaves no scope for interpretational manoeuvring on the phrase “on own account.” What remains open is only the factual application of the provision — whether, in a given case, the construction is truly for the taxable person itself or for another person as a works contractor. Beyond this limited factual inquiry, the legal position now stands settled.

As per our view, Safari Retreats represents the Supreme Court’s final word on Section 17(5)(d), and taxpayers as well as tax authorities must now apply the provision strictly in line with this settled interpretation.

You May Also Like

Sources

- Safari Retreats Private Limited & Anr. v. Chief Commissioner of Central Goods and Services Tax & Ors.

– Supreme Court of India, 2024 - Safari Retreats Private Limited v. Chief Commissioner of CGST

– Orissa High Court, 2019

Disclaimer

This article is for informational purposes only and reflects the author’s understanding of the law as on the date of publication. It does not constitute legal or professional advice. Readers should seek appropriate professional guidance before acting on the basis of this information.