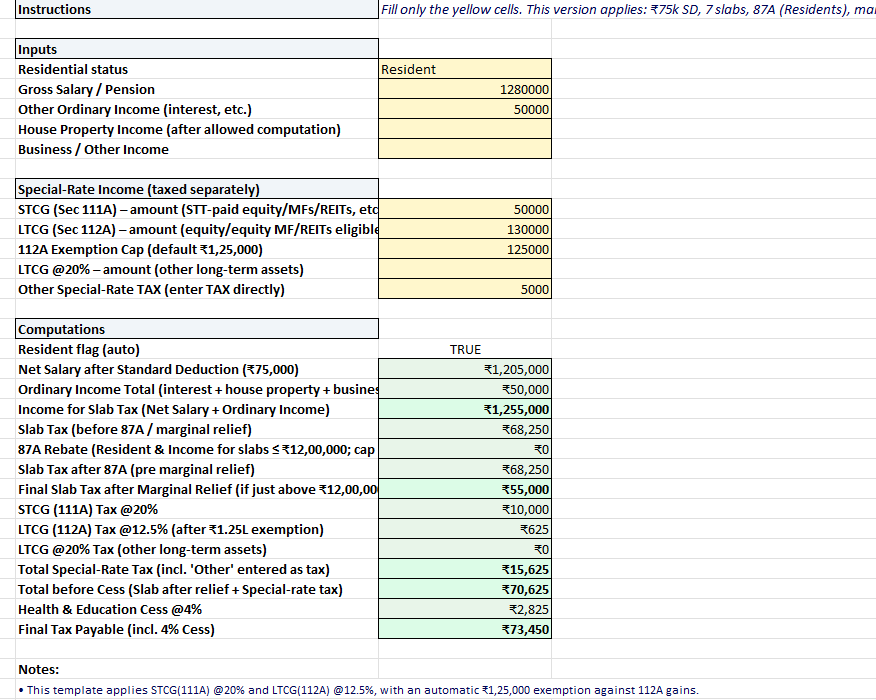

Looking for a simple and reliable Income Tax Calculator for AY 2026–27 (FY 2025–26)? This free Excel tool is built with the latest New Regime slab rates, ₹75,000 standard deduction, Section 87A rebate, and updated capital gains tax rules. Whether you are salaried, a pensioner, or an NRI, this calculator helps you compute your income tax in minutes. Download now and plan your taxes with ease.

Features of this Income tax Calculator

- Pre-loaded with New Regime slabs for AY 2026–27

- Auto-applies ₹75,000 standard deduction for salary/pension

- Section 87A rebate up to ₹12 lakh included

- Handles marginal relief just above ₹12,00,000

- Calculates STCG (111A) @ 20% and LTCG (112A) @ 12.5% (after ₹1.25L exemption)

- Shows final tax with 4% Health & Education Cess but does not include surcharge as applicable if total income exceeds ₹50 lacs.

How to Use This Income tax Calculator

- Enter your gross salary, interest, house property, and business income.

- Input capital gains (STCG/LTCG) separately in the dedicated fields.

- The sheet automatically applies standard deduction, rebate, and cess.

- Final tax payable is displayed instantly.

Free Download: Income Tax Calculator AY 2026–27 (Excel)

📥 [Download Now – Excel Calculator](#)

Why Use Our income tax Calculator?

- Designed by a Chartered Accountant with 13 years’ experience

- Based on Finance Act 2025 and CBDT notifications

- Easy-to-use, no macros, mobile-friendly

- Updated annually so you always stay compliant

Sources & References

Disclaimer

This income tax calculator is for general guidance only and does not substitute professional advice. Tax laws change frequently through Finance Acts, CBDT circulars, and judicial decisions. Please verify the latest provisions or consult a qualified professional for your case. TaxBizMantra is not responsible for decisions made solely on this tool.

FAQ – Income Tax Calculator AY 2026–27

Is this calculator free?

Yes, it’s 100% free to download and use.

Does it include both New and Old Regime?

Current version is built for New Regime AY 2026–27. We will update if rules change.

Can NRIs use this calculator?

Yes, but note that 87A rebate is not available to NRIs.

Does it cover capital gains?

Yes, both STCG (111A) and LTCG (112A) are included with updated rates.