Budget 2026–27 proposes certain rationalisation measures across other direct tax provisions of the Income-tax law. These proposals do not involve changes in tax rates; instead, they focus on specific provisions, procedural aspects, and clarificatory issues that directly affect compliance and day-to-day tax administration.

The objective of these changes is to address practical difficulties faced in implementation, remove interpretational ambiguity, and ensure smoother application of the law in routine tax matters.

The FAQs on rationalisation of other direct tax provisions reproduced below contain the official clarifications issued under Budget 2026–27. They are presented verbatim and without interpretation, for ease of reference, examination use, and professional practice.

BUDGET 2026: RATIONALISATION OF OTHER DIRECT TAX PROVISIONS

I. Buyback of Shares (Section 2(40)(f) and 69 of the Income-tax Act, 2025)

Q.1 How is consideration received on buy-back of shares currently taxed?

Ans: Under the existing provisions, consideration received by a shareholder on buy-back of shares is treated as dividend under section 2(40)(f) of the Income-tax Act, 2025. This is taxed on the applicable rate, i.e. each taxpayer will pay tax on the tax rate that is applicable to him. For eg: a company in new regime will pay tax at 22% while a firm or LLP will pay at 30% (apart from cess and surcharge).

Q.2 Under the present provisions, is there any deduction allowed for the buyback of shares?

Ans: Under the present provisions, buyback is treated as dividend income and no deduction is allowed as per the provisions of section 93(2)(a) of the Income-tax Act, 2025. However, the cost of acquisition of the shares extinguished on buy-back is allowed as a Capital Loss under section 69 of the Income-tax Act, 2025.

Q.3 What change has been made to the tax treatment of consideration received on buy-back of shares by the Finance Bill, 2026?

Ans: It is proposed that the consideration received by a shareholder on buy-back of shares by a company shall be chargeable to tax under the head “Capital gains”.

Q.4 Is there a uniform tax treatment for all taxpayers in respect of buy-back transactions?

Ans: The income from buy-back is treated as capital gains for all taxpayers. Therefore, the cost of acquisition shall be deducted from the buy-back consideration. However, an additional tax is proposed to be collected from taxpayers who are promoters. Within the promoter category, a distinction has been made between promoters that are domestic companies and promoters which are other than domestic companies.

Q.5 What is the tax treatment in the case of promoters which are domestic companies?

Ans: In the case of promoters which are domestic companies, the aggregate tax liability on capital gains arising from buy-back of shares, shall comprise of

i) Tax payable under the capital gains provisions; and

ii) An additional tax.

In a manner that the total tax on buy-back of shares (i.e. aggregate of (i) and (ii)) shall be at the rate of 22 per cent, which is same as the tax rate for domestic companies in the new regime.

Q.6 What is the tax treatment in the case of promoters other than domestic companies?

Ans: In the case of promoters other than domestic companies, the aggregate tax liability on gains arising from buy-back of shares, shall comprise of

i) Tax payable under the capital gains provisions; and

ii) An additional tax.

The additional tax shall be computed in a manner that the total tax on buy-back of shares (i.e. aggregate of (i) and (ii)) shall be at the rate of 30 per cent which is same as the tax rate for firms and LLPs and the highest slab rate for individuals.

Q.7 From which date shall the amended provisions apply?

Ans: These amendments shall take effect from the 1st day of April, 2026 and shall apply in relation to the tax year 2026-27 and subsequent tax years.

II. Rationalisation of Tax Collection at Source rates under section 394(1) of the Income-tax Act, 2025

Q.1 Are the any changes proposed with regard to rates of TCS in Finance Bill, 2026?

Ans: Yes, changes are proposed in various TCS rates. Following are the proposed changes:

| Sl. No | Nature of receipt | Current Rate | Proposed Rate |

|---|---|---|---|

| 1. | Sale of alcoholic liquor for human consumption. | 1%. | 2%. |

| 2. | Sale of tendu leaves. | 5%. | 2%. |

| 3. | Sale of scrap. | 1%. | 2%. |

| 4. | Sale of minerals, being coal or lignite or iron ore. | 1%. | 2%. |

| 5. | Remittance under the Liberalised Remittance Scheme of an amount or aggregate of the amounts exceeding ten lakh rupees— | (a) 5% for purposes of education or medical treatment; (b) 20% for purposes other than education or medical treatment. | (a) 2% for purposes of education or medical treatment; (b) 20% for purposes other than education or medical treatment. |

| 6. | Sale of “overseas tour programme package” including expenses for travel or hotel stay or boarding or lodging or any such similar or related expenditure. | (a) 5% of amount or aggregate of amounts up to ten lakh rupees; (b) 20% of amount or aggregate of amounts exceeding ten lakh rupees. | 2% |

Q.2 Why TCS rates are being rationalized?

Ans: The TCS rates are rationalized with a view to provide uniform rate of TCS to the extent possible.

Q.3 Elaborate the changes made in Finance Bill, 2026 with respect to rate of TCS on remittances?

Ans: At present, TCS at 5% is collected if remittance is for the purposes of education or medical treatment and TCS at the rate of 20% is collected for purposes other than education or medical treatment.

It is proposed to reduce the rate of TCS to 2% for purposes of education and medical treatment. However, there is no change in TCS rate for purposes other than education or medical treatment.

Q.4 What is purpose of reducing TCS rates for remittance for purposes of education or medical treatment

Ans: The rationalization of rates has been done to provide more liquidity to the remitter and minimize locking of funds. In such case the rate has been rationalized only keep track of the transaction

Q.5 Whether any change is proposed in the threshold limit for TCS on remittances?

Ans: No. The threshold limit for applicability of TCS on remittances under the Liberalised Remittance Scheme remains same i.e. Rs. 10 lakhs.

Q.6 Explain the changes in rate of TCS on sale of overseas tour programme packages.

Ans: There are two changes being made ie. (i) Change in rate of TCS; & (ii) removal of threshold. Accordingly –

i) TCS @5% of aggregate amount up to ten lakh rupees and @20% of aggregate amount ten lakh rupees is presently applicable on sale of overseas tour program package. It is proposed to reduce the rate of TCS to 2%.

ii) The threshold limit for TCS on overseas tour programme packages has been removed. TCS @2% will be collected irrespective of the amount paid for overseas tour programme package.

Q.7 From when will these changes be made effective?

Ans: These changes will be effective from 1st April, 2026.

III. Rates of STT (Finance Act (No.2), 2004)

Q.1 What is the current provision for Securities Transaction Tax (STT) on options in securities?

Ans: Under the existing provisions of the Income-tax Act, 2025 and the STT framework introduced by the Finance (No. 2) Act, 2004, STT is levied on transactions in specified securities carried out through recognised stock exchanges. The current rates applicable to options in securities are 0.1 per cent of the option premium on sale of an option and 0.125 per cent of the intrinsic price on sale of an option when exercised.

Q.2 What is the current provision for Securities Transaction Tax (STT) on futures in securities?

Ans: Under the existing provisions and the STT framework introduced by the Finance (No. 2) Act, 2004, the current rate applicable to futures in securities is 0.02 per cent of the traded price on sale of a future

Q.3 What changes have been made by the Finance Act to the rates of Securities Transaction Tax on derivatives transactions?

Ans: The Finance Act provides for a revision in the rates of Securities Transaction Tax applicable to specified derivatives transactions carried out on recognised stock exchanges. The revised rates apply to the sale of options in securities, sale of options in securities where the option is exercised, and sale of futures in securities.

Q.4 What is the revised rate of Securities Transaction Tax on sale of an option in securities?

Ans: The rate of Securities Transaction Tax on the sale of an option in securities has been increased from 0.1 per cent to 0.15 per cent, and the tax shall be computed on the option premium.

Q.5 What is the revised rate of Securities Transaction Tax on sale of an option in securities where the option is exercised?

Ans: The rate of Securities Transaction Tax on the sale of an option in securities where the option is exercised has been increased from 0.125 per cent to 0.15 per cent, and the tax shall be computed on the intrinsic price of the option.

Q.6 What is the revised rate of Securities Transaction Tax on sale of a future in securities?

Ans: The rate of Securities Transaction Tax on the sale of a future in securities has been increased from 0.02 per cent to 0.05 per cent, and the tax shall be computed on the traded price of the future.

Q.7 From which date shall the revised rates of Securities Transaction Tax apply?

Ans: The revised rates shall take effect from the 1st day of April, 2026 and shall apply to derivatives transactions in securities entered into on or after that date.

IV. Clarification regarding Sovereign Gold Bonds (Section 70(1)(x) of the Income

tax Act, 2025)

Q.1 What is the current provision for capital gains on Sovereign Gold Bonds?

Ans: The capital gains arising from redemption of Sovereign Gold Bonds issued by the Reserve Bank of India are exempt under the provisions of section 70(1)(x) of the Income-tax Act, 2025.

Q.2 What amendment is proposed regarding the exemption for capital gains arising from redemption of Sovereign Gold Bonds?

Ans: Section 70(1)(x) of the Income-tax Act, 2025 has been amended to clarify that the exemption from capital gains tax shall be available only where the Sovereign Gold Bond is subscribed to by an individual at the time of original issue and is held continuously until redemption on maturity.

Q.3 Does the exemption apply uniformly to all series of Sovereign Gold Bonds issued by the Reserve Bank of India?

Ans: Yes. The amended provision applies uniformly to all Sovereign Gold Bonds issued by the Reserve Bank of India from time to time, irrespective of the series in which the bonds were issued, subject to fulfilment of the specified conditions.

Q.4 Will the exemption under section 70(1)(x) of the Income-tax Act, 2025 apply to Sovereign Gold Bonds acquired through secondary market transactions?

Ans: No, the exemption shall not apply to Sovereign Gold Bonds acquired through transfer or purchase in the secondary market. The exemption is restricted to bonds subscribed to by an individual at the time of original issue. This was also clarified by the Department of Economic Affairs in its OM dated 06.12.2022.

Q.5 Will this exemption be available in cases of premature redemption of Sovereign Gold Bonds?

Ans: No, the exemption shall apply only where the Sovereign Gold Bond is held continuously until redemption on maturity. Premature redemption, even after completion of the prescribed lock-in period, shall not be eligible for exemption.

Q.6 From which date shall the amended provisions apply?

Ans: The amendment shall take effect from the 1st day of April, 2026 and shall apply in relation to the tax year 2026-27 and subsequent tax years.

Q.7 As a result of this amendment what will be the taxability in respect of redemption of Sovereign Gold Bonds?

Ans: Taxability is as under:

| Sl. no. | Conditions | Taxability |

|---|---|---|

| a) | If purchased at the time of issue and held till maturity: | Exempt |

| b) | If not purchased at the time of issue and held till maturity: | Taxable |

| c) | If purchased at the time of issue and but not held till maturity: | Taxable |

| d) | If neither purchased at the time of issue and nor held till maturity: | Taxable |

V. Rationalisation of Regime for Provident Funds (Schedule XI of the Income-tax Act, 2025)

Q.1 What is the current regime governing Provident Funds under the Income-tax Act?

Ans: Currently, provident funds are governed by Schedule XI of the Income-tax Act, 2025 under which they are recognized and are subject to certain restrictions, including parity-based limits on employer contributions, percentage caps on excess contributions, differentiated limits for employee-shareholders, and investment limits in Government securities, among others. The other sections of the Income-tax Act, 2025 that are applicable to such provident funds include definition of recognized provident fund under section 2(91) of the Income-tax Act, 2025, deduction under section 123 of the Income-tax Act, 2025 and schedule XV of the Income-tax Act, 2025 and exemption under Schedule VII (Table. Sl.No 22) of the Income-tax Act, 2025.

Q.2 What changes are proposed to Schedule XI relating to recognized provident funds under the Income-tax Act, 2025?

Ans: It is proposed to rationalize Schedule XI of the Income-tax Act, 2025 by deleting or amending certain provisions in Parts A and C to align the income-tax framework governing recognized provident funds with the statutory and administrative provisions of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 and the Employees’ Provident Fund Scheme, 1952 and other provisions in the Income-tax Act, 2025.

Q.3 How will employer contributions to recognized provident funds be governed after the proposed amendment?

Ans: The provisions in Schedule XI of the Income-tax Act, 2025 that restrict employer contributions by reference to parity with employee contributions, annual crediting requirements or percentage-of-salary limits are proposed to be removed. Employer contributions shall be governed by the aggregate monetary ceiling of Rs 7.5 Lakhs prescribed under section 17(1)(h) of the Income-tax Act, 2025.

Q.4 What change is proposed regarding recognition of provident funds under the Income-tax Act?

Ans: Recognition under the of the Income-tax Act, 2025 shall be available only to provident funds which have obtained exemption under section 17 of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Schedule XI of the Income-tax Act, 2025 is proposed to be amended to reflect this requirement explicitly.

Q.5 How will the tax treatment of employer contributions in excess of specified limits be determined?

Ans: Employer contributions shall be subject the monetary ceiling prescribed under section 17(1)(h) of the Income-tax Act, 2025. Once this monetary ceiling is crossed, the contributions will be taxed as perquisites. The existing provisions in Schedule XI of the Income-tax Act, 2025 deeming employer contributions as income is proposed to be omitted.

Q.6 Will the distinction for employees who are also shareholders of the employer company continue to apply?

Ans: No separate limits or conditions shall apply to employees who are also shareholders of the employer company. The differentiated limits presently provided in Schedule XI are proposed to be removed, and such employees shall be governed by the same contribution framework as other employees, i.e the limit prescribed in section 17(1)(h) of the Income-tax Act, 2025 and the framework set in place by the EPFO.

Q.7 What change is proposed in relation to investment of provident fund monies in Government securities?

Ans: The rigid statutory ceiling restricting investment in Government securities to fifty per cent is proposed to be removed. Investment norms shall continue to be regulated under the applicable EPF framework and subordinate legislation.

Q.8 From which date shall the amended provisions apply?

Ans: These amendments shall take effect from the 1st day of April, 2026 and shall apply in relation to the tax year 2026-27 and subsequent tax years.

VI. Interest deduction for dividend (Section 93 of the Income-tax Act, 2025)

Q.1 What expenditure is allowed as a deduction against dividend or income from units of Mutual Funds?

Ans: Presently, if any interest expenditure is incurred for earning income from dividends, the expenditure is allowed subject to a certain threshold.

Q.2 What is the threshold for deduction of interest expenditure against dividend or income from units of Mutual Funds?

Ans: Under section 93 of the Income-tax Act, 2025, the interest expenditure is allowed to the extent of twenty per cent of the gross dividend or mutual fund income. For example: If the total income on account of dividend is Rs 1,00,000/- and the interest expense is Rs 25,000/-, the deduction will be allowed to the extent of Rs 20,000/-.

Q.3 What changes are proposed to this provision of deduction of interest expenditure by the Finance Bill 2026?

Ans: It is proposed to amend section 93 of the Income-tax Act, 2025 to provide that no deduction shall be allowed in respect of any interest expenditure incurred for earning dividend income or income from units of mutual funds taxable under the head “Income from other sources”.

Q.4 Can an assessee claim any expenditure apart from interest expenditure against dividend income and income from units of mutual funds?

Ans: No expenditure can be claimed as a deduction against dividend income and income from units of mutual funds.

Q.5 How will dividend income and income from units of mutual funds be computed after the amendment?

Ans: Dividend income and income from units of mutual funds shall be computed without allowing any deduction for interest expenditure, irrespective of any borrowing whether or not claimed to be attributable to such income.

Q.6 Is this deduction available to individuals, after the proposed amendment?

Ans: No, after the proposed amendment, no deduction will be allowed to any assessee, including individuals in respect of such income.

Q.7 From which date shall the amended provisions of section 93 of the Income-tax Act, 2025 apply?

Ans: The amendment shall take effect from the 1st day of April, 2026 and shall apply in relation to the tax year 2026-27 and subsequent tax years.

Q.8 What will be the situation if shares are kept as stock in trade?

Ans: In such a case, the interest expense may have been claimed as deduction in the P&L account. Thus, no additional deduction on this account under section 93 of the Income-tax Act, 2025 can be allowed.

VII. Amendment in Repeal and Saving clause under section 536(2)(h) of the Income-tax

Act, 2025

Q.1 What is the provision of section 536(2)(h) of the Income-tax Act, 2025?

Ans: Section 536(2)(h) of the Income-tax Act, 2025 provides that where deduction has been allowed or any income has not been included in the total income under the repealed Income-tax Act, 1961, on violations of the conditions mentioned in the respective sections of the repealed Act, it will become deemed income under the Income-tax Act, 2025 in the year in which violation takes place.

Q.2 What changes are proposed in section 536(2)(h) of the Income-tax Act, 2025?

Ans: It is proposed that any amount that has been allowed as deduction or which has not been included in the total income under the repealed Income-tax Act, 1961 for any other reason, shall be deemed income of the person, if such amount was to be included in the total income under the repealed Income-tax Act, 1961 for any other reason.

Q.3 Why the aforesaid change is proposed?

Ans: The present provision only covers situations where on violation of conditions mentioned in the respective sections of the repealed Act, the amount will be deemed to be income of the person.

However, it does not cover situations, where as per the provisions of the repealed Act, the amount is required to be added in the total income, even when no conditions are violated.

To ensure that such amounts are deemed to be income of the person under the Income-tax Act, 2025, the aforesaid change is proposed.

Q.4 What is the impact of this amendment?

Ans: This amendment will provide clarity that any amount which had been allowed as deduction or which was included in the total income under the provision of Income-tax Act, 1961, shall be deemed to be the income, if it was required to be added in the total income under the said act, irrespective of violations of conditions or for any other reason.

Q.5 From when the said change be made effective?

Ans: The said change shall be made effective from 1.4.2026.

VIII. Extension of Tonnage Tax Scheme to Inland vessels (Chapter XIII-G of the Income

tax Act, 2025)

Q.1 What is Tonnage Tax Scheme?

Ans: Tonnage Tax Scheme, as provided in the Chapter XIII-G of the Income-tax Act, 2025, is a presumptive tax scheme for shipping companies which allows them to compute their profits on presumptive basis.

Q.2 Who is eligible to avail tonnage tax scheme as per existing provisions of the Income-tax Act, 2025?

Ans: Shipping companies which operate ‘qualifying sea going ships’ registered under the Merchant Shipping Act, 1958, are eligible to avail tonnage tax scheme. Vide Finance Act, 2025, the provisions of this Chapter were extended to inland vessels registered under the Inland Vessels Act, 2021 as well to encourage the inland water transportation in the country.

Q.3 What are the changes proposed vide Finance Bill, 2026 in Chapter XIII-G of the Income-tax Act, 2025?

Ans: Certain amendments are proposed to be made in the Chapter by providing relevant references as per the Inland Vessels Act, 2021 and rules made thereunder.

Q.4 What is the impact of this amendment?

Ans: The amendment will bring the references in the Chapter in line with the provisions of Inland Vessels Act, 2021 and rules made thereunder.

Q.5 From which date will the above amendment be effective?

Ans: The amendments are proposed to be made effective from 1st April, 2026.

IX. Disability pension (Schedule III of the Income-tax Act, 2025)

Q.1 What is the taxability of disability pension for Armed Forces personnel?

Ans: The disability pension received by Armed Forces personnel when invalided out of service due to injury on account of disability attributable/aggravated by service in the armed forces is exempt.

Q.2 What are the provisions under the Income-tax Act, 1961 providing exemption of disability pension for Armed Forces personnel?

Ans: The exemption was first provided under the Income-tax Act, 1922 and has continued through the repeal and saving clause of the Income-tax Act, 1961. Exemption has been administered through notifications, administrative instructions, and clarificatory circulars.

Q.3 What provision has been proposed by the Finance Bill, 2026 in respect of disability pension of Armed Forces personnel?

Ans: It is proposed to amend the Income-tax Act, 2025 to provide an exemption for disability pension received by members of the Armed Forces who have been invalided out of service on account of a bodily disability attributable to, or aggravated by, military, naval or air force service.

Q.4 What components of disability pension are covered under the exemption?

Ans: The exemption applies to both components of disability pension, namely the service element and the disability element, subject to fulfilment of the specified conditions.

Q.5 In which cases shall the exemption for disability pension not be available?

Ans: The exemption shall not be available where the individual has retired on superannuation or otherwise.

Q.6 Does this exemption available for paramilitary forces?

Ans: Yes, this proposed amendment provides for exemption to the paramilitary forces as well.

Q.7 From which date shall the amended provisions apply?

Ans: The exemption shall take effect from the 1st day of April, 2026 and shall apply in relation to the tax year 2026-27 and subsequent tax years.

Q.8 If the exemption is available to the personnel in the Income tax Act, 1961, what is the need to bring such amendment?

Ans:

The exemption under the Income-tax Act, 1961 was provided through repeal and savings clause therein, whereby the exemption provided under the Indian Income tax Act, 1922 and relevant circulars continued to apply. With the imminent repeal of the Income-tax Act, 1961 the provisions therein relevant to disability pension will not apply anymore. Therefore, it is proposed to explicitly provide for exemption for disability pension in the Income-tax Act, 2025. Moreover, the scope for exemption has been increased to include para-military forces as well.

X. Exemption: Income in respect of award/agreement made for compulsory acquisition of land under the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 (RFCTLARR Act). [Schedule III of the Income tax Act, 2025].

Q.1 What are the provisions relating to exemption from income-tax under the provisions of the RFCTLARR Act, 2013?

Ans: Section 96 of the RFCTLARR Act inter alia provides that income-tax shall not levied on any award or agreement made (except those made under section 46) under the said Act.

Q.2 Why is there a requirement to bring such provisions of exemption under the Income-tax Act, 2025 and the RFCTLARR Act, 2013?

Ans: The current provisions of the Income-tax Act, 2025 exempt the capital gains arising to an individual or a Hindu undivided family from transfer of agricultural land by way of compulsory acquisition. However, the RFCTLARR Act does not make any distinction between compensation received for compulsory acquisition of agricultural land and non-agricultural land in the matter of providing exemption from income-tax.

Accordingly, to bring clarity and align the provisions of the two Acts the amendment has been proposed.

Q.3 What amendment has been proposed in the Income-tax Act, 2025 in respect of aforementioned exemption under the RFCTLARR Act, 2013?

Ans: In the proposed amendment, any income of an individual or Hindu undivided family in respect of any award or agreement made on account of compulsory acquisition of any land under the RFCTLARR Act (other than award and agreement made under section 46) is proposed to be exempted irrespective of whether such compulsory acquisition under the said Act is of agricultural or non-agricultural land.

Q.4 The proposed amendment has been made effective from 1.4.2026 (i.e., tax year 2026-27). How would the earlier transaction be dealt with?

Ans: The acquisition of land before 1st April, 2026 (upto financial year 2025-26) shall continue to be exempted as per the clarification given vide CBDT Circular No.36/2016 dated 25 October, 2016.

XI. Advance Pricing Agreements: Section 169 of the Income-tax Act, 2025

Q.1 What is an advance pricing agreement?

Ans: An advance pricing agreement (APA) is a mechanism to provide tax certainty to the taxpayers by determining inter alia the arm’s length price or specifying the manner in which such price is to be determined, in relation to an international transaction to be entered into by that person.

Q.2 What are the provisions of section 169 of the Income-tax Act, 2025 relating to ‘Effect to advance pricing agreement’?

Ans: The provisions of section 169 of the Income-tax Act, 2025 provide inter alia for modification of the return by the person who has entered into APA and taking such return into consideration if any assessment or reassessment proceedings in respect of such tax year in pending.

Q.3 What amendment has been made in the provisions of section 169 of the Income-tax Act, 2025?

Ans: The proposed amendment has enabled furnishing of modified return by the associated enterprise of the person who has entered into APA for the tax years covered by such agreement.

Q.4 What is the rationale for making such amendment?

Ans: APA not only may modify the income of person who has entered into the agreement but also the income of his associated enterprise for the tax years covered under such agreement. This may lead to double taxation of income that is the subject matter of APA in the hands of the associated enterprise. Therefore, to rationalise the existing provision said amendment has been proposed.

XII. Rates of Income-tax

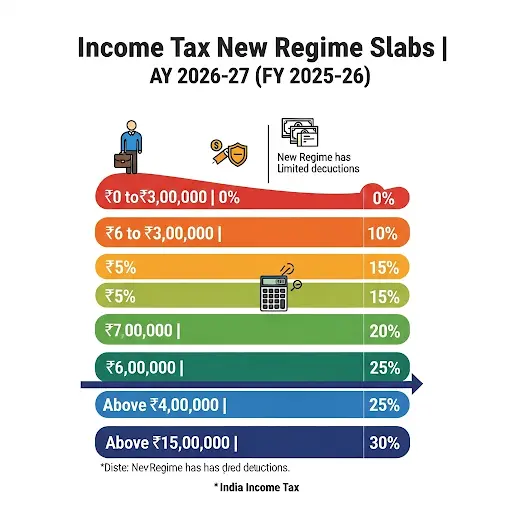

Q.1 What is ‘New Regime’? [Section 115BAC(1A) of the Income-tax Act, 1961 and 202 of the Income-tax Act, 2025]

Ans: New regime provides for concessional tax rates and liberal slabs. However, no deductions are allowed in the new regime (other than those specified in section 115BAC(1A) of the Income-tax Act, 1961 or section 202 of the Income-tax Act, 2025).

Q.2 What are the tax rates in the new tax regime under the current provisions?

Ans: The tax rates in the new tax regime, for assessment year (AY) 2026-27, provided under section 115BAC(1A) of the Income-tax Act, 1961, are as under: –

| Sl. No. | Total income | Rate of tax u/s 115BAC(1A) for AY 2026-27 (%) |

|---|---|---|

| 1 | Up to ₹ 4,00,000 | Nil |

| 2 | From ₹ 4,00,001 to ₹ 8,00,000 | 5 |

| 3 | From ₹ 8,00,001 to Rs.12,00,000 | 10 |

| 4 | From ₹ 12,00,001 to ₹ 16,00,000 | 15 |

| 5 | From ₹ 16,00,001 to ₹ 20,00,000 | 20 |

| 6 | From ₹ 20,00,001 to ₹ 24,00,000 | 25 |

| 7 | Above ₹ 24,00,000 | 30 |

The tax rates in the new tax regime, for tax year (TY) 2026-27 onwards, provided under section 202 of the Income-tax Act, 2025, are as under: –

| Sl. No. | Total income | Rate of tax u/s 202 with effect from TY 2026-27 (%) |

|---|---|---|

| 1 | Up to ₹ 4,00,000 | Nil |

| 2 | From ₹ 4,00,001 to ₹ 8,00,000 | 5 |

| 3 | From ₹ 8,00,001 to Rs.12,00,000 | 10 |

| 4 | From ₹ 12,00,001 to ₹ 16,00,000 | 15 |

| 5 | From ₹ 16,00,001 to ₹ 20,00,000 | 20 |

| 6 | From ₹ 20,00,001 to ₹ 24,00,000 | 25 |

| 7 | Above ₹ 24,00,000 | 30 |

Q.3 To which persons new tax regime is applicable?

Ans: New tax regime under section 115BAC(1A) of the Income-tax Act, 1961 and section 202 of the Income-tax Act, 2025 is applicable to person, being an individual or Hindu undivided family or association of persons otherthanaco−operativesociety, or body of individuals, whether incorporated or not, or an artificial juridical person referred to in section 2(31)(vii) of the Income-tax Act, 1961 or section 2(77)(g) of the Income-tax Act, 2025.

Q.4 What is the maximum total income for which tax liability for individual taxpayers is NIL?

Ans: In the new tax regime, the maximum total income for which tax liability for individual taxpayers is NIL is ₹ 12 lakhs on account of claim of rebate.

Q.5 To claim benefit of NIL tax liability mentioned above, what are the steps required to be taken?

Ans: The benefit of such Nil tax liability mentioned above is available only in the new tax regime. This New tax regime is the default regime. To avail the benefit of rebate allowable under proposed provisions of new tax regime, a return is required to be filed.

Q.6 Is the standard deduction on salary available in the new regime?

Ans: Yes, a standard deduction of ₹ 75,000 is available to a tax payer in the new regime. Therefore, a salaried tax payer will not be required to pay any tax where his income before standard deduction is less than or equal to ₹ 12,75,000.

Q.7 How is the marginal relief available to individuals?

Ans: In the new regime, marginal relief is available to only resident individuals who have income marginally above ₹ 12 lacs. For example, for a person having income of ₹ 12,10,000/-, in the absence of marginal relief, the tax works out to be ₹ 61,500/- (5% of ₹ 4 lacs + 10% of ₹ 4 lac + 15% of ₹ 10 thousand). However, due to marginal relief, the amount of tax to be actually paid is ₹ 10,000/-.

Q.8 How much tax will be paid by a tax payer having income of ₹ 12,10,000? What is marginal relief?

Ans: The tax liability on such tax payer by way of slabs only is ₹ 61,500. However a person having ₹ 12 lac income pays nil tax. By providing marginal relief it has been ensured that the tax payable by a person having income marginally above ₹ 12 lacs is required to pay only marginal amount of tax equal to the amount of income above ₹ 12 lacs so that his carry home is also ₹ 12 lacs. In this case he will be required to pay a tax of ₹ 10,000.

| Income (in ₹) | Tax without Marginal relief (in ₹) | Tax actually payable with marginal relief (in ₹) |

|---|---|---|

| 12,10,000 | 61,500 | 10,000 |

| 12,25,000 | 63,750 | 25,000 |

| 12,50,000 | 67,500 | 50,000 |

| 12,70,588 | 70,588 | 70,588 (No marginal relief) |

Q.9 How the marginal relief is computed?

Ans: The marginal relief is computed in the following manner:–

(i) First the tax as per slab rate is computed on the total income.

For e.g. In the answer given to Q.7 above, tax on the total income of ₹ 12,10,000/- shall be computed in following steps:

| Sl. No. | Amount to be charged (out of total income of ₹ 12,10,000/-) | Tax Amount as per slab rates |

|---|---|---|

| 1. | Initial amount of ₹ 4 lakhs | Nil (being basic exemption) |

| 2. | Tax on subsequent amount of ₹ 4 lakhs (from ₹ 4 lakhs to ₹ 8 lakhs) | ₹ 20,000 (being 5% of ₹ 4 lakhs) |

| 3. | Tax on subsequent amount of ₹ 4 lakhs (from ₹ 8 lakhs to ₹ 12 lakhs) | ₹ 40,000/- (being 10% of ₹ 4 lakhs) |

| 4. | Tax on balance amount of ₹ 10,000/- | ₹ 1500 (being 15% of ₹ 10,000) |

| Aggregate tax liability | ₹ 61,500/- |

(ii) Tax payable on total income of ₹ 12,00,000/- on which rebate is available is Nil.

(iii) Now the tax liability without marginal relief (in this case ₹ 61,500) shall be compared with amount exceeding total income upto which rebate is availabe.(in this case₹10,000,i.e.₹12,10,000–₹12,00,000.)

(iv) The marginal relief shall be computed by deducting the income exceeding ₹ 12,00,000 (i.e. ₹ 10,000) from total tax liability determined in this case (i.e. ₹ 61,500) as tabulated above.

(v) Therefore, in the above case marginal relief is ₹ 51,500 (61,500/- 10,000/- = 51,500/-) which is allowed.

(vi) Tax payable is therefore ₹ 10,000 ₹61,500–₹51,500.

Q.10 What is the maximum amount of rebate available to any tax payer?

Ans: The maximum rebate available is ₹ 60,000 which is there for a tax payer having income of ₹ 12 lacs on which tax is payable as per the new regime slabs.

Q.11 What is the total income till which marginal relief is admissible?

Ans: The total income till which marginal relief is available is ₹ 12,70,588/-.

Q.12 Whether special income having special rate such as capital gains, lottery etc. also be eligible for rebate?

Ans: Rebate is not available on income from capital gains or lotteries or any other income on which special rate has been provided in the Act. It is available only on the tax payable as per slabs under section 115BAC(1A) of the Income-tax Act, 1961 or section 202 of the Income-tax Act, 2025.

Q.13 What is the difference between rebate and marginal relief?

Ans: Rebate is the deduction from tax which is available to tax payers having income upto ₹ 12 Lakhs in the new regime. Marginal relief ensures that taxpayers having income marginally higher than ₹ 12 Lakhs do not pay tax more than the income in excess of ₹ 12 Lakhs.

Q.14 What are the tax rates for the individuals in the old tax regime?

Ans: The income-tax slabs in the old tax regime (i.e. whose income is not chargeable to tax under section 115BAC(1A) of the Income-tax Act, 1961 or section 202 of the Income-tax Act, 2025) has been tabulated below:–

Old Tax Scheme

| Income-Slab (in ₹) | Statutory Tax Rate (FY 2025-26 / AY 2026-27) |

|---|

| ≤ 2.5 lakhs | 0% |

| > 2.5 lakhs – 5 lakhs | 5% |

| > 5 lakhs – 10 lakhs | 20% |

| > 10 lakhs | 30% |

Q.15 Whether standard deduction is available in old regime?

Ans: Standard deduction of ₹ 50,000 is available in old regime.

You May Also Like

- Budget 2026 Key Tax Highlights: Income Tax, GST, TDS & STT

- Budget 2026: Classification Of Income Tax FAQs & Key Themes

- Budget 2026: FAQs On Income Tax Penalty & Prosecution

- Budget 2026 Corporate Tax Rationalisation FAQs Explained

Sources and References

The information presented on this page is based on official clarifications and FAQs issued by the Income Tax Department in connection with the Finance Bill, 2026 and the proposed provisions of the Income-tax Act, 2025 and allied laws.

Key reference materials include:

- Finance Bill, 2026 and Explanatory Memorandum

- Official FAQs and press clarifications issued by the Income Tax Department

The FAQs reproduced on this page are presented in their official form, without interpretation or modification, to ensure accuracy and legislative fidelity.

Disclaimer: The FAQs reproduced in this article are based on the clarifications issued in relation to Budget 2026–27. They are presented verbatim for informational purposes only and should not be construed as legal or tax advice.